The Ultimate Guide to Understanding Legacy Insurance Plans

The Ultimate Guide to Understanding Legacy Insurance Plans

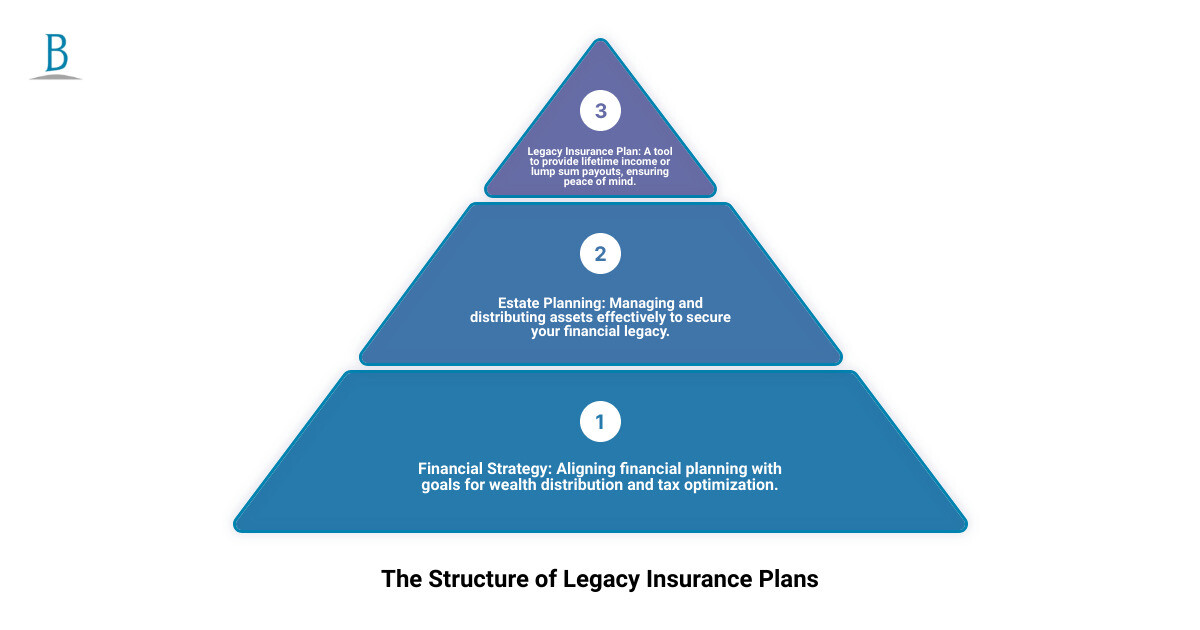

When it comes to securing your financial future and ensuring your loved ones are taken care of, understanding legacy insurance plans is crucial. You’re in the right place if you’re looking for a quick guide on what these plans entail and how they fit into broader estate planning and financial strategies.

Quick Snapshot:

- Legacy Insurance Plans: Financial tools designed to provide peace of mind by securing a financial legacy for your loved ones.

- Estate Planning: A critical component that works hand-in-hand with legacy insurance to manage and distribute your assets.

- Financial Strategy: Ensuring that your financial planning aligns with your goals for wealth distribution and tax optimization.

Legacy insurance plans are not just about leaving behind financial resources; they are about crafting a strategy that reflects your values, secures your financial independence, and optimizes your tax situation. These plans are key to establishing a comprehensive safety net that supports your vision of the legacy you wish to leave behind. Whether you’re seeking to provide for your family’s future, contribute to charitable causes, or ensure that your financial affairs are in order, understanding how legacy insurance integrates with estate planning and your broader financial strategy is the first step.

In this guide, we’ll dive deeper into what legacy insurance plans are, their importance in your overall financial planning, and how they can be tailored to meet your specific needs and goals. Let’s embark on this journey towards securing a meaningful and lasting legacy.

What is a Legacy Insurance Plan?

When we talk about securing our family’s future, a legacy insurance plan stands out as a powerful tool. But what exactly is it? In simple terms, it’s a type of insurance designed to provide financial security and benefits to your loved ones after you’re gone. Let’s break down the key components that make legacy insurance plans an essential part of your financial strategy.

Lifetime Income

One of the standout features of a legacy insurance plan is its ability to provide lifetime income to your beneficiaries. This means that after you pass away, your family or chosen beneficiaries can receive a steady stream of income. This is incredibly valuable, ensuring they have financial support for their daily needs, education, or even retirement.

Lump Sum Payout

In addition to or instead of lifetime income, many legacy insurance plans offer a lump sum payout. This is a one-time payment made to your beneficiaries upon your death. It can be used to cover immediate expenses like funeral costs, settle debts, or as they see fit to secure their financial future. The flexibility of a lump sum payout allows your loved ones to make choices that best suit their needs.

Generational Wealth

A key goal for many when considering a legacy insurance plan is the creation and preservation of generational wealth. This isn’t just about leaving behind money. It’s about providing a foundation upon which future generations can build. Whether it’s helping to pay for education, contributing to the purchase of a home, or supporting entrepreneurial endeavors, a legacy insurance plan can be a stepping stone to long-term financial stability for your family.

Understanding these components helps highlight why a legacy insurance plan is more than just a policy; it’s a commitment to the well-being of your loved ones after you’re gone. With the help of a financial advisor, like those at BlueSky Wealth Advisors, you can tailor a plan that aligns with your wishes and provides peace of mind knowing your family’s future is secure.

In the next section, we’ll explore the importance of legacy planning in insurance, emphasizing how it benefits not just the next of kin but can have lasting impacts for generations to come.

The Importance of Legacy Planning in Insurance

When we talk about legacy planning in insurance, we’re diving into a world that’s much more than just numbers and policies. It’s about people—your loved ones, your next of kin, and the generations that will follow. Here’s why it’s so crucial:

Asset Bequeathal: This isn’t just about leaving money behind; it’s about ensuring your assets serve your family’s needs and dreams after you’re gone. Whether it’s a home, savings, or a cherished family heirloom, how you pass these on can significantly impact your family’s future.

Loved Ones: For those closest to you, your legacy plan is a final act of love and care. It’s your way of saying, “I’ve got you covered,” even when you’re not around. This reassurance can provide immense peace of mind to your family during difficult times.

Next of Kin: Specifically, your direct descendants or closest relatives. These individuals stand to benefit the most directly from your legacy planning. It’s about making their path smoother, perhaps helping them with education costs, home purchases, or starting their own businesses.

Financial Advisor: Here’s where the human touch comes in. A good financial advisor, like those at BlueSky Wealth Advisors, can be your guide, helping you navigate the complexities of legacy planning. They’re the ones who can tailor a plan that fits your unique family situation and future aspirations.

Hal Campbell’s story with Legacy Assurance illustrates the power of effective legacy planning. He and his family found peace of mind through comprehensive estate planning, ensuring all necessary documentation and legal assistance were in place for a reasonable price. This is the kind of security and preparedness legacy planning aims to provide.

Kim Flock’s experience further underscores the importance of legacy planning. After her parents worked with Legacy to outline their final wishes, Kim found guidance and support in managing their estate, a testament to the plan’s effectiveness in easing the burden on loved ones during trying times.

Why It Matters:

Generational Impact: Your legacy plan can influence not just your children but grandchildren and beyond. It’s about setting up a foundation that can support educational pursuits, entrepreneurial ventures, or charitable endeavors across multiple generations.

Personal Values: Through your legacy plan, you have the opportunity to pass on more than assets—you can impart values, traditions, and a sense of responsibility to your next of kin.

Avoiding Conflicts: A well-thought-out plan can prevent potential disputes among family members, ensuring your assets are distributed according to your wishes and reducing the risk of misunderstandings.

In Conclusion:

Legacy planning in insurance isn’t a one-time task but a crucial part of your ongoing relationship with your finances and your family’s future. With the guidance of a skilled financial advisor, you can craft a legacy that supports your loved ones for generations to come, ensuring that your final wishes are respected and fulfilled. It’s about leaving a lasting mark, not just in wealth but in values and care for those you hold dear.

In the next section, we’ll tackle some common misconceptions about legacy insurance plans, shedding light on the truths to help you make informed decisions for your family’s future.

Key Components of Legacy Planning

When we talk about legacy planning, we’re diving into a world that’s much broader than just deciding who gets what. It’s about setting up a future that reflects your values, cares for your loved ones, and even supports causes close to your heart. Let’s break it down into simpler parts: Estate planning, Tangible assets, Intangible items, and Charitable giving.

Estate Planning

At its core, estate planning is about preparing for the future. It involves making decisions today about what will happen to your things after you’re gone. This includes who will inherit your assets, how your affairs will be managed if you can’t do it yourself, and even who will take care of your children. It’s a way to reduce stress and uncertainty for your loved ones during a difficult time.

Tangible Assets

These are the things you can touch and see, like your house, car, and bank accounts. Planning for these assets means deciding who gets them and when. It’s not just about the big stuff, either. Sometimes, smaller items with sentimental value can have a big impact on your family.

Intangible Items

This part often gets overlooked, but it’s just as important. Intangible items include your values, life lessons, and family history. Sharing these with your loved ones can be part of your legacy, too. For example, writing letters or recording videos about important life lessons can be a powerful gift to leave behind.

Charitable Giving

For many, leaving a mark on the world means supporting causes that matter to them. Through charitable giving, you can set up donations that will continue to support your favorite charities after you’re gone. This not only helps the organizations but can also provide tax benefits for your estate and heirs.

It’s important to remember that legacy planning isn’t a one-size-fits-all deal. It’s deeply personal and should reflect what’s most important to you. In the next section, we’ll address some common misconceptions about legacy insurance plans, helping you see the bigger picture and make choices that align with your goals and values.

Common Misconceptions about Legacy Insurance Plans

When it comes to securing your financial future and that of your loved ones, understanding the ins and outs of legacy insurance plans is crucial. However, several misconceptions can muddy the waters, making it challenging to make informed choices. Let’s clear up some of these misunderstandings.

Term vs. Whole Life

A common point of confusion lies in distinguishing between term and whole life insurance policies.

- Term insurance is like renting a house. You pay for protection over a set period, and if you outlive the term, the coverage ends without any return on the premiums paid.

- Whole life insurance, on the other hand, is akin to buying a home. It offers lifelong coverage and includes a cash value component that grows over time, acting as a form of savings or investment.

Both types serve different needs, but when it comes to a legacy insurance plan, whole life insurance is often more relevant because it provides a permanent solution.

Coverage Duration

Another misconception is that once you’ve purchased a legacy insurance plan, you’re set for life, with no need to revisit your policy. The truth is, as your life evolves, so too should your coverage. Marriages, births, and even changes in financial goals can all impact your insurance needs. Regular check-ins with your financial advisor ensure that your legacy plan keeps pace with your life’s changes.

Benefit Realization

Many people mistakenly believe that the benefits of a legacy insurance plan are only realized upon their passing. While it’s true that the primary purpose is to provide for your loved ones after you’re gone, there are also living benefits. For example, the cash value in a whole life policy can be borrowed against for emergencies, retirement income, or even funding a child’s education.

Remember:

- Term insurance is temporary and without a savings component.

- Whole life insurance offers lifelong coverage and a cash value that grows over time.

- Regular reviews of your policy are essential as your life and needs change.

- Legacy insurance plans offer both death benefits for your heirs and living benefits for you.

Keep these clarifications in mind. Understanding the true nature of legacy insurance plans can empower you to make decisions that best serve your long-term goals and provide for your loved ones. Next, we’ll explore how to choose the right legacy insurance plan for your unique situation, with insights from BlueSky Wealth Advisors.

How to Choose the Right Legacy Insurance Plan

Choosing the right legacy insurance plan is a crucial step in securing your family’s financial future. It’s not just about picking any insurance; it’s about finding the perfect fit for your unique needs and goals. Let’s break this down into simple, easy-to-follow steps, incorporating insights from BlueSky Wealth Advisors.

Policy Comparison

Think of shopping for the right legacy insurance plan like looking for a new house. You wouldn’t buy the first one you see. You’d compare, right? Here’s how to do it:

- Features: Look at what each plan offers. Some might have benefits like accelerated death benefits or cash value growth.

- Costs: How much are the premiums? Are there any additional fees?

- Company Reputation: Choose a company that’s financially stable and has good customer service.

Financial Needs Analysis

This is where you sit down and get real with your finances. It’s like making a budget but for your future. Ask yourself:

- How much coverage do I need? This depends on your debts, income, and what you want to leave behind.

- What can I afford to pay in premiums? Don’t stretch yourself too thin.

- How long will I need coverage? This helps you decide between term or whole life policies.

Future Goals

Your legacy insurance plan should align with your future goals. Think about:

- Family Needs: How much financial support will your family need in your absence?

- Wealth Transfer: Do you want to leave a lump sum or provide a steady income?

- Charitable Giving: If you’re passionate about a cause, consider how your plan can support it.

BlueSky Wealth Advisors

Working with a financial advisor from BlueSky Wealth Advisors can make this process much easier. They can help you:

- Understand Your Options: They’ll break down the complex insurance jargon into simple terms.

- Analyze Your Financial Situation: They can do a deep dive into your finances to determine how much coverage you need.

- Align Your Plan with Your Goals: They’ll ensure your legacy insurance plan fits your long-term objectives.

Choosing the right legacy insurance plan is about more than just securing financial support for your loved ones; it’s about peace of mind for you and those you care about. By carefully comparing policies, conducting a thorough financial needs analysis, considering your future goals, and consulting with experts like BlueSky Wealth Advisors, you can find a plan that not only meets your needs but also reflects the legacy you wish to leave behind.

Keep these steps in mind, the goal is to secure a plan that offers comfort and assurance to both you and your loved ones. Next, we’ll answer some frequently asked questions about legacy insurance plans to help clarify any remaining uncertainties.

Frequently Asked Questions about Legacy Insurance Plans

Navigating insurance can be like trying to find your way through a thick fog. But don’t worry, we’re here to shine a light on legacy insurance plans. Let’s tackle some of the most common questions you might have.

What distinguishes Legacy Insurance from other types of plans?

Legacy insurance plans stand out because they’re not just about the here and now; they’re about the future. Think of them as a bridge connecting your financial wishes today with the well-being of your family tomorrow. Unlike term insurance, which is like renting coverage for a certain period, legacy insurance is more like owning a home that you can pass down. It provides:

- Lifetime income to ensure your loved ones are taken care of, even long after you’re gone.

- A lump sum payout that can support generational wealth, helping your family maintain or improve their lifestyle.

- The ability to pass on wealth across generations, making it a cornerstone of estate planning.

How does legacy planning benefit future generations?

Imagine planting a tree today that your grandchildren will one day enjoy in the shade of. That’s the essence of how legacy planning benefits future generations. It’s about setting up a financial safety net that:

– Protects your family from financial hardships in case of unexpected events.

– Supports educational and life goals, making dreams more attainable for your children and grandchildren.

– Preserves family wealth, reducing the impact of taxes and legal fees on your estate.

Can legacy insurance plans be customized for individual needs?

Absolutely! One size fits all? Not in our book. Legacy insurance plans can be tailored to fit the unique tapestry of your life and wishes. Whether you’re looking to support a cause close to your heart through charitable giving, ensure your family business stays in the family, or simply provide for your loved ones, there’s a way to customize your plan. BlueSky Wealth Advisors specializes in understanding your vision and crafting a plan that aligns with your values and goals.

As we peel back the layers of legacy insurance plans, it becomes clear that they’re about much more than just money. They’re a reflection of your values, dreams, and the legacy you wish to leave behind. With the right guidance and a personalized plan, you can provide peace of mind for yourself and a brighter future for your loved ones.

Conclusion

When we talk about legacy insurance plans, we’re really talking about peace of mind and comprehensive planning. It’s about knowing that your loved ones will be taken care of and that your values and dreams will live on. At BlueSky Wealth Advisors, we understand the importance of building a legacy that endures.

Peace of mind comes from knowing that no matter what happens, your family will be financially secure. This isn’t just about money; it’s about the comfort and security that comes with it. It’s about knowing that your children and grandchildren will have the resources they need to thrive, even when you’re not there to provide for them directly.

Comprehensive planning is key to achieving this peace of mind. It’s not enough to simply purchase a policy and hope for the best. Your legacy plan needs to be a part of a bigger financial strategy that takes into account your entire estate, your financial goals, and the needs of your loved ones. This is where we come in. At BlueSky Wealth Advisors, we don’t just look at one piece of the puzzle. We consider all aspects of your financial life to create a holistic plan that aligns with your values and goals.

We invite you to explore our estate planning services and start a conversation about how we can help you build a legacy that endures. Whether you’re looking to provide for your family, support charitable causes, or simply ensure that your wishes are carried out, we can help you craft a plan that meets your needs.

Your legacy is a gift to the future. With the right planning and support, you can ensure that this gift is meaningful, impactful, and enduring. Let us help you secure a legacy that is cherished for generations to come. Join us at BlueSky Wealth Advisors and let’s create a plan that not only meets your financial goals but also reflects the mark you wish to leave on the world.

In the end, it’s not just about the assets you leave behind; it’s about the memories, the values, and the love that defines your legacy. At BlueSky Wealth Advisors, we’re honored to be part of your journey, helping you to secure a future that your loved ones will treasure.