Top 5 Flat Fee Financial Advisors - Ultimate 2024 Guide

Top 5 Flat Fee Financial Advisors - Ultimate 2024 Guide

Finding the right flat fee financial advisors can be a game-changer for those looking to optimize their financial situation without the worry of escalating costs tied to asset size. If you’re seeking a transparent, cost-effective way to manage your finances, flat fee advisors offer a straightforward solution. These professionals charge a set fee for their services, allowing for easier budgeting and eliminating the percentage-of-assets cost model that can disproportionately affect those with larger investment portfolios.

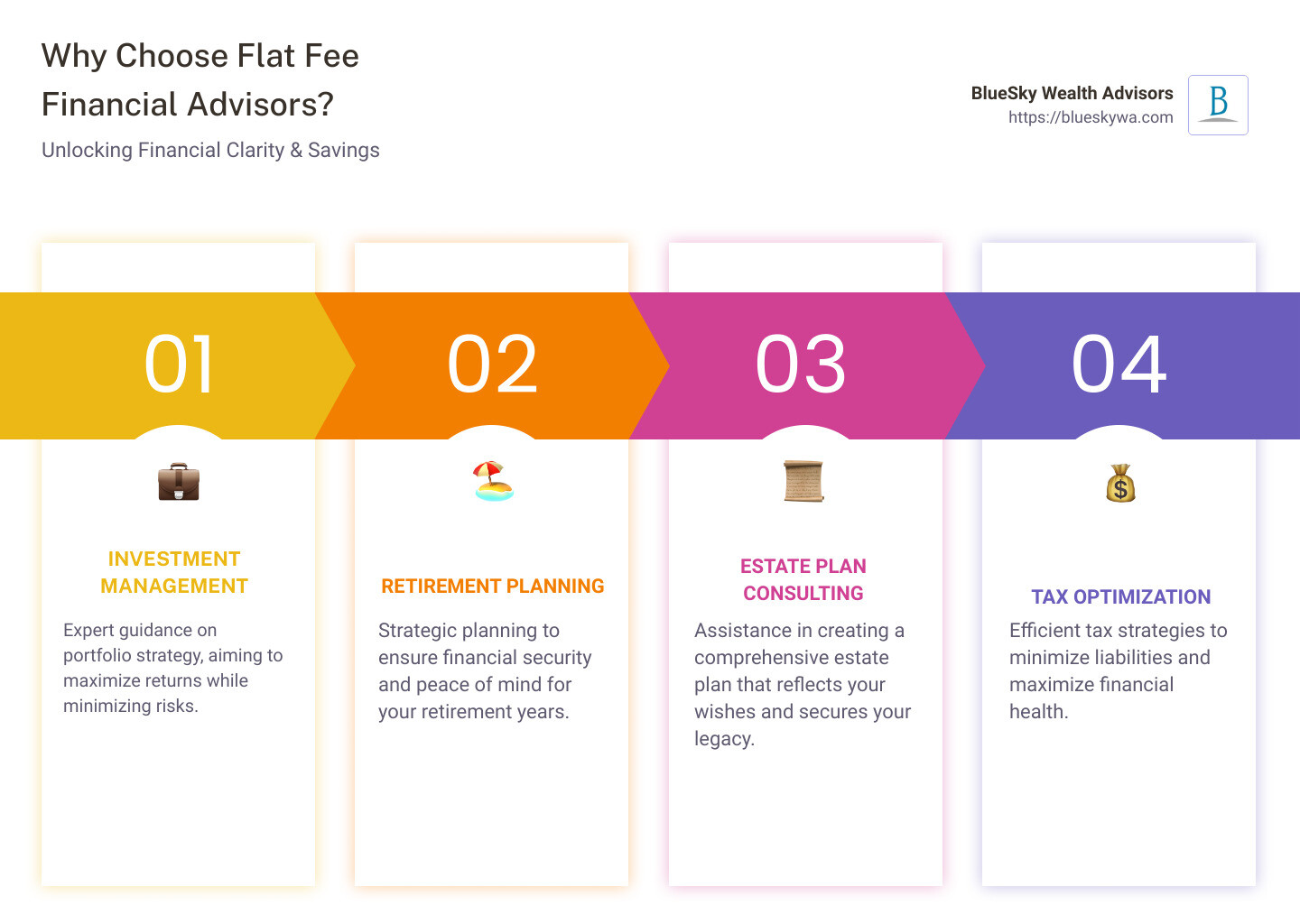

Flat fee financial advisors provide a range of services including investment management, retirement planning, estate planning, and more, all under a transparent pricing structure. This approach not only simplifies the complex world of financial advice but aligns your financial goals with the advisor’s incentives, ensuring your interests are always put first.

Whether you’re looking to secure financial independence, optimize your tax situation, or establish a meaningful legacy, flat fee financial advisors could be the ideal partners in navigating your financial journey efficiently.

Why Choose Flat Fee Financial Advisors?

When it comes to managing your finances, clarity, simplicity, and cost are key. That’s where flat fee financial advisors come into play, offering a model that stands out for its transparency, cost-effectiveness, and simplicity. Let’s break down these three critical reasons to choose flat fee advisors for your financial planning needs.

Transparency

With flat fee advisors, what you see is what you get. There are no hidden fees, no complex percentage calculations based on your assets, and no surprises when you receive your bill. This model promotes an environment of trust, as you know upfront exactly how much you’re paying for the services you receive. This straightforward approach removes any potential conflicts of interest, ensuring that the advice you receive is aimed solely at benefiting you, not increasing the advisor’s fees.

Cost-Effectiveness

One of the most appealing aspects of flat fee financial advisors is their cost-effectiveness. Unlike traditional percentage-based models, where fees increase as your portfolio grows, flat fees remain constant regardless of how much money you have under management. This can lead to substantial savings over time, especially for individuals with larger portfolios. Moreover, this model encourages efficiency and prioritizes your financial growth, as advisors are motivated to provide the best possible service within the agreed-upon fee.

Simplicity

The simplicity of the flat fee model cannot be overstated. It’s easy to understand and budget for, as you pay a straightforward fee for a defined set of services. This eliminates the need to decode complex fee structures or calculate percentages of assets under management (AUM), making it easier for you to focus on what truly matters: your financial goals and how to achieve them.

By choosing flat fee financial advisors, you’re opting for a model that values transparency, promotes cost savings, and simplifies the financial advisory process. This approach aligns the advisor’s interests with your own, fostering a partnership that’s built on trust and mutual respect. Whether you’re planning for retirement, saving for college, or looking to optimize your investment strategy, flat fee advisors offer a clear, straightforward path to achieving your financial objectives.

Keep these benefits in mind. They underscore why so many individuals are turning to flat fee financial advisors as their trusted partners in navigating the complexities of personal finance.

Types of Flat Fee Arrangements

When you’re exploring flat fee financial advisors, you’ll find there are several ways they can structure their fees. This flexibility allows you to choose an arrangement that best fits your financial situation and goals. Let’s break down the different types of flat fee arrangements you might encounter.

Investment Management

In this arrangement, you pay a fixed fee for ongoing investment management services. This fee is not based on the size of your investment portfolio but is a set rate agreed upon between you and your advisor. For example, this could look like paying $6,000 per year, billed quarterly, for comprehensive investment oversight. This model is perfect for those who want continuous, proactive management of their investments without worrying about the fee scaling with their account balance.

One-Time

For those who need targeted advice or a specific financial plan, one-time fees can be an excellent option. This could be for a retirement projection, a detailed financial plan, or a one-time meeting to discuss a particular financial concern. The fee is agreed upon upfront and is paid for the completion of the project. This arrangement suits individuals looking for expert guidance on a particular issue without the need for ongoing management.

Ongoing

Ongoing fees are for individuals who seek continuous financial planning and advice beyond just investment management. This could be billed annually, quarterly, or monthly and often represents a long-term relationship with your advisor. You might choose this option if you value having a professional monitor your financial health and guide you through life’s financial decisions. It’s a partnership where you can end the agreement if your needs change, but it’s designed for those who see the value in long-term financial guidance.

Combination

Some advisors offer a combination of the services above for a flat annual rate. This hybrid model can provide the best of both worlds: ongoing investment management plus periodic financial planning and advice. It’s tailored to those who need comprehensive financial oversight and specific planning services without the variability of asset-based fees.

Choosing the Right Flat Fee Arrangement

Selecting the right flat fee arrangement comes down to understanding your financial needs and goals. Whether you’re looking for someone to manage your investments, need a one-time financial plan, or want a long-standing advisor relationship, there’s a flat fee model that can work for you. The transparency and predictability of these arrangements make them a compelling choice for anyone looking to take control of their financial future.

The best financial advisor is one who understands your goals, communicates clearly, and aligns their services with your needs. As we transition into evaluating flat fee financial advisors, keep these arrangements in mind and consider which structure aligns best with your financial journey.

Benefits of Opting for a Flat Fee Model

When you’re deciding how to manage your money, knowing the benefits of a flat fee model can help you make an informed choice. Let’s break down why a flat fee could be the right move for your financial planning.

Predictability

With a flat fee, you know exactly what you’re paying upfront. No surprises, no hidden costs. This predictability makes budgeting easier, as you can plan your finances without worrying about fluctuating advisory fees.

Reduced Conflicts of Interest

A flat fee means your advisor isn’t motivated by commissions. This reduces the chance they’ll push products you don’t need. Your goals stay front and center, leading to advice that’s in your best interest.

Market Movements

Your fees don’t balloon just because the market does well. Similarly, they don’t shrink if the market takes a dip. This means your advisor is focused on your long-term strategy, not short-term gains or losses.

Fee-Only

A flat fee structure is often part of a fee-only model. This means your advisor isn’t earning commissions from selling products. It’s a transparent way to ensure their advice is unbiased and focused on your needs.

Easy to Track

With a flat fee, you can easily keep tabs on what you’re paying for advisory services. There’s no need for complex calculations based on asset values or transactions. This simplicity makes it straightforward to assess the value you’re getting from your advisor.

In conclusion, opting for a flat fee model with your financial advisor offers a host of benefits. From predictable costs to unbiased advice, it’s a structure designed to put your interests first. Keep these advantages in mind to find an advisor who can best support your financial journey.

How to Evaluate Flat Fee Financial Advisors

Evaluating flat fee financial advisors isn’t just about finding someone who charges a straightforward fee. It’s about ensuring they’re the right fit for your financial needs and goals. Let’s break down the key factors you should consider: experience, services offered, client testimonials, and fee structure.

Experience

Look for advisors with a proven track record. How long have they been in the industry? Do they have experience with clients in situations similar to yours? The complexity of your financial needs often requires someone with a deep understanding and extensive experience.

Services Offered

Not all financial advisors offer the same services. Some might specialize in retirement planning, while others might focus on investment management or tax planning. Make sure the advisor you’re considering offers the services that match your financial goals.

Client Testimonials

What do their clients say about them? Positive feedback from clients can give you insight into what it’s like to work with the advisor. Look for testimonials that speak to the advisor’s professionalism, expertise, and the quality of their advice.

Fee Structure

Understanding an advisor’s fee structure is crucial. A true flat fee model should be transparent and straightforward, with no hidden costs. Ensure the fee aligns with the services provided and that it fits within your budget.

The goal is to find an advisor who not only fits your financial situation but also one whom you can trust and feel comfortable working with over the long term. Take your time, do your research, and don’t hesitate to ask questions during your search for the right flat fee financial advisor.

In the next section, we’ll dive into some frequently asked questions about flat fee financial advisors to help you further understand this model and how it can benefit your financial planning strategy.

Frequently Asked Questions about Flat Fee Financial Advisors

When considering flat fee financial advisors, you might have a few questions on your mind. Let’s tackle some of the most common queries to give you a clearer picture.

Are Financial Advisors Worth the 1% Fee?

The answer depends on what you’re getting for that 1%. If your advisor offers comprehensive services like investment advice, tax planning, estate planning, and more, then yes, the 1% fee can be worth it. However, as your assets grow, a flat fee model could save you a significant amount of money. For instance, if you’re managing a $3 million portfolio, a 1% fee would cost you $30,000 a year. In contrast, a flat fee arrangement might cost significantly less, potentially saving you $15,000 to $20,000 annually.

Is a 1% Management Fee High?

In asset management, a 1% fee is pretty standard, especially for portfolios under $1 million. But, as we’ve discussed, the more assets you have, the more you’ll feel the pinch of that 1% fee. It’s essential to consider the value you’re receiving in return. Are you getting personalized, comprehensive financial advice or just basic investment management? For larger portfolios, a flat fee model often makes more financial sense and can feel more equitable.

What is a Flat Fee Financial Model?

A flat fee financial model is a pricing structure where you pay a fixed amount for your financial advisor’s services, regardless of the size of your assets. This fee is usually set annually and covers a range of services, making it easier to budget and understand what you’re paying for. The model promotes transparency and can reduce conflicts of interest, as your advisor’s compensation is not tied to the amount of money you have invested. It’s particularly appealing for individuals with larger asset bases, as it can lead to substantial savings over the traditional percentage-based fee models.

The key to a successful financial advisory relationship is finding a fee structure that aligns with your financial goals, needs, and the complexity of your financial situation. Flat fee financial advisors can offer a compelling alternative for those seeking straightforward, transparent pricing and a focus on comprehensive financial planning.

Consider how a flat fee model aligns with your financial goals and whether it could offer the simplicity and cost-effectiveness you’re looking for in managing your wealth.

Conclusion

At BlueSky Wealth Advisors, we believe in the power of simplicity, transparency, and integrity when it comes to managing your finances. Our commitment to these principles is why we advocate for and practice a flat fee financial advisory model. This model not only aligns with our values but also serves the best interests of our clients, providing a clear, straightforward approach to financial planning and investment management.

Choosing a flat fee financial advisor like us means you’re opting for a partnership where your success is the priority, not the size of your portfolio. Our fees are based on the complexity of your financial situation and the services you need, not on how much money you have. This approach eliminates many of the conflicts of interest inherent in percentage-based or commission-driven models and ensures our advice is always aimed at achieving your financial goals.

Why BlueSky?

Transparency: With our flat fee model, you’ll always know exactly what you’re paying for. There are no hidden fees or surprises.

Simplicity: Finances can be complex, but understanding what you pay your advisor shouldn’t be. Our clear fee structure simplifies this aspect, allowing you to focus on what matters.

Alignment: Our interests are aligned with yours. Since our fee doesn’t fluctuate with the size of your assets, our focus remains on providing the best advice to meet your financial objectives.

Expertise: Our team of seasoned professionals is dedicated to offering tailored financial solutions. We bring years of experience and a commitment to excellence to the table, ensuring that you’re in good hands.

Comprehensive Services: From retirement planning to tax strategies and estate planning, we offer a wide range of services designed to cover all aspects of your financial life.

At BlueSky Wealth Advisors, we’re more than just your financial advisors; we’re your partners in achieving financial independence. We understand that each client’s needs are unique, and we’re committed to providing personalized service that respects your individual goals and circumstances.

Choosing the right financial advisor is a crucial step toward securing your financial future. If you’re looking for a transparent, straightforward, and effective approach to financial planning and investment management, consider the flat fee model offered by BlueSky Wealth Advisors. Let us help you navigate the complexities of the financial world with confidence and clarity.

We invite you to reach out to us, learn more about our services, and see how we can help you achieve your financial dreams. Together, we can build a plan that not only meets your immediate needs but also lays the foundation for lasting wealth and security.

BlueSky Wealth Advisors – Simplifying success, one flat fee at a time.