Top 5 Capital Gains Tax Reduction Strategies for 2023

Top 5 Capital Gains Tax Reduction Strategies for 2023

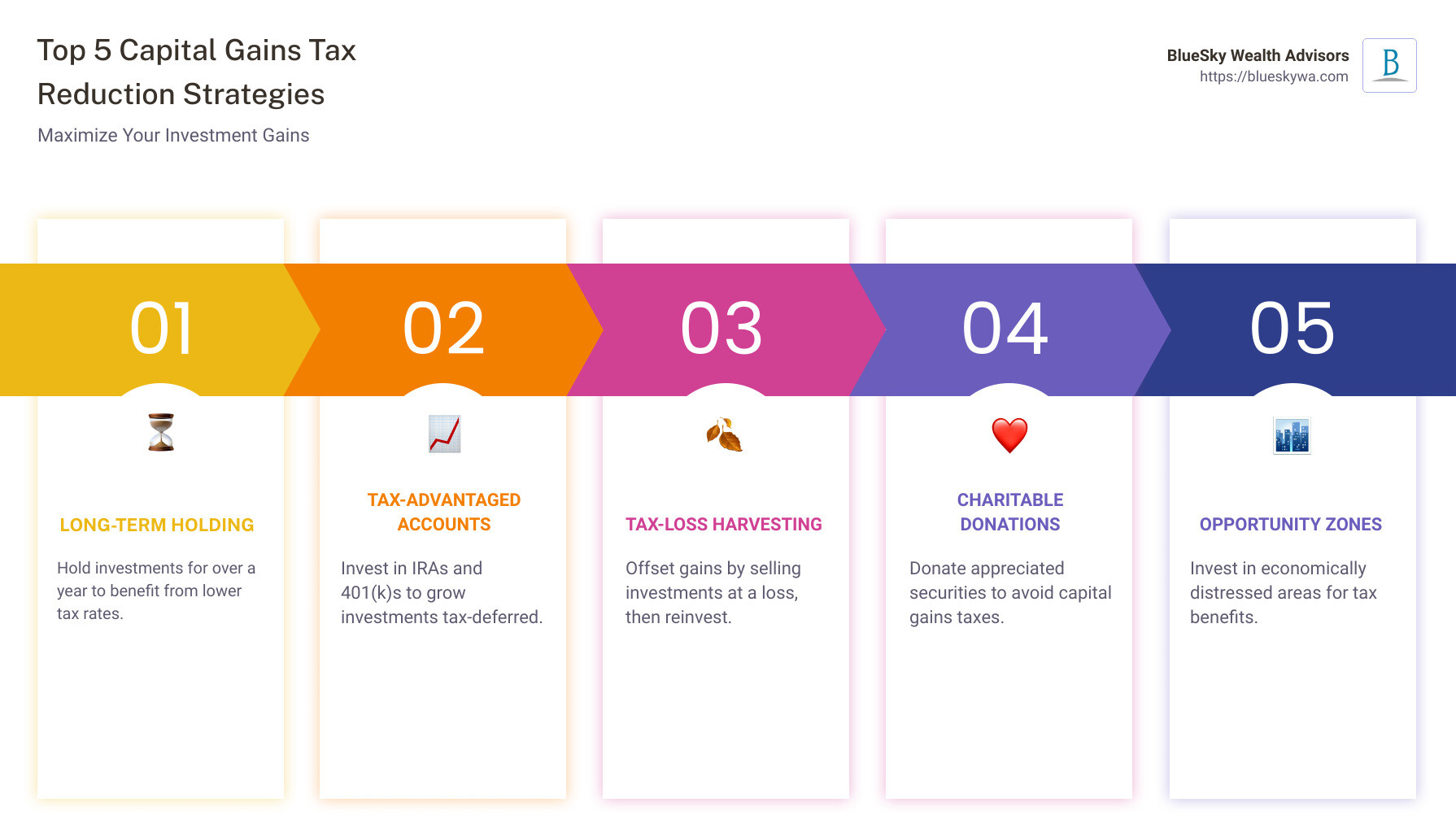

When searching for capital gains tax reduction strategies, it’s crucial to understand how employing certain tactics can significantly lower your tax obligations. Briefly, here are some effective methods:

- Hold onto investments for longer than a year to benefit from lower long-term capital gains tax rates.

- Invest in tax-advantaged accounts like IRAs and 401(k)s.

- Practice tax-loss harvesting to offset capital gains with any investment losses.

- Consider making charitable donations of appreciated securities to avoid capital gains taxes.

- Explore investing in opportunity zones for deferred and potentially reduced tax on prior gains.

Tax efficiency in investments isn’t just about saving money—it’s about maximizing how much of your investment gains you get to keep. This principle guides everything from the choice of the investment vehicle to the timing of the sale of assets. With the right strategies, investors can significantly reduce their capital gains tax, allowing their wealth to grow more rapidly and sustainably.

In the changing landscape of investment, being tax-savvy is not just an option, but a necessity for financial success and stability.

Understanding Capital Gains Tax

When you sell something for more than you spent to buy it, the profit you make is called a capital gain. The IRS wants a piece of that profit in the form of capital gains tax. But not all capital gains are taxed the same way or at the same rate. Let’s break it down into bite-sized pieces.

Short-Term vs. Long-Term

First off, the IRS divides capital gains into two categories: short-term and long-term. This classification hinges on how long you held the asset before selling it.

Short-term capital gains are profits from assets you’ve owned for one year or less. These gains are taxed like regular income. That means the tax rate could be as high as 37%, depending on your income.

Long-term capital gains come from assets you’ve held for more than one year. These are taxed at lower rates: 0%, 15%, or 20%, again depending on your income.

Simply put, holding onto assets for longer can significantly reduce your tax bill.

Federal Rates

The rate at which your long-term gains are taxed depends on your taxable income. For example, in 2024, single filers with an income up to $44,625 may not owe any tax on their long-term capital gains. But if you’re earning more, you might fall into the 15% or even 20% tax bracket for these gains.

Real Estate Exclusions

Now, if you’re selling your house, there’s some good news. The IRS offers a primary residence exclusion. If you’ve lived in your home for at least two out of the last five years before selling it, you might not have to pay tax on some or all of the profit. Single filers can exclude up to $250,000 of the gain from their income, and married couples filing jointly can exclude up to $500,000.

But, if you’re dealing with rental properties, the rules change. Selling a rental property for a profit can lead to a capital gains tax bill. However, there are strategies, like Section 1031 exchanges, that allow you to defer these taxes by reinvesting the proceeds into another rental property under specific conditions.

Understanding these key points about capital gains tax can help you make more informed decisions about when to sell assets and how to plan for potential tax implications. Whether you’re dealing with stocks, bonds, real estate, or other investments, being aware of these rules can save you money and avoid surprises come tax time. Holding assets longer, taking advantage of retirement accounts, and understanding exclusions can all play a part in reducing your capital gains tax burden.

Capital Gains Tax Reduction Strategies

Investing smartly isn’t just about picking the right assets; it’s also about managing your taxes effectively. Let’s dive into some strategies that can help you keep more of your investment gains in your pocket and less in Uncle Sam’s.

Hold Onto Taxable Assets for the Long Term

Why? Long-term rates are lower than short-term rates. If you hold an asset for more than a year, you benefit from these reduced rates. Plus, your assets have more time to appreciate in value. It’s a win-win!

How it works: Let’s say you buy some shares. Instead of selling them after a few months, you wait for over a year. By doing this, you’ll pay a lower tax rate on any gains from those shares. This approach encourages patience and long-term thinking in your investment strategy.

Invest in Tax-Deferred Retirement Plans

What are they? IRAs, 401(k)s, and Roth IRAs. These accounts offer tax advantages that can help you grow your savings more efficiently.

Benefits: Traditional IRAs and 401(k)s allow you to defer taxes until you withdraw the money, typically in retirement when you might be in a lower tax bracket. Roth IRAs, on the other hand, are funded with after-tax money, which means your withdrawals, including gains, are tax-free in retirement.

Utilize Tax-Loss Harvesting

What is it? A strategy to offset your gains with losses. If some investments have lost value, you can sell them to “harvest” those losses. You can then use these losses to offset taxable gains from other investments.

Carry Forward: If your losses exceed your gains, you can carry forward the unused losses to future years to offset future gains. This can be a powerful tool in years when your investments perform well.

Donate Appreciated Investments to Charity

Why? You get a charitable deduction and avoid paying capital gains tax on the donated assets.

How it works: Suppose you have stocks that have increased in value. By donating these stocks directly to a charity, you avoid paying capital gains tax on the appreciation. Plus, you can deduct the fair market value of the stocks on your tax return, reducing your taxable income.

In Summary:

– Hold assets for more than a year to enjoy lower long-term capital gains tax rates.

– Invest in tax-deferred accounts like IRAs and 401(k)s to defer taxes and potentially reduce your tax burden in retirement.

– Use tax-loss harvesting to offset gains with losses, reducing your overall tax liability.

– Donate appreciated investments to charity to avoid capital gains tax and receive a tax deduction.

By incorporating these strategies into your investment plan, you can significantly reduce your capital gains tax bill, allowing your investments to grow more efficiently. The key to successful tax planning is to think long-term and make decisions that align with your overall financial goals.

Real Estate and Capital Gains Tax

Real estate investments bring their own set of opportunities and challenges when it comes to capital gains tax. Two of the most powerful tools at your disposal are the Primary Residence Exclusion and the 1031 Exchange. Let’s break down how these can work for you.

Utilizing the Primary Residence Exclusion

Imagine selling your home and keeping a big chunk of the profit without having to pay a penny in capital gains tax. Sounds too good to be true? Well, it’s not. The IRS offers a $250,000 exclusion on the capital gains from the sale of your primary residence if you’re single, and $500,000 for married couples filing jointly. Here’s what you need to know:

- The house must be your primary residence. You need to have lived there for at least two of the last five years.

- You can use this exclusion every two years. This means you could potentially move, sell, and profit tax-free every couple of years if you plan carefully.

This exclusion is a straightforward way for many homeowners to reduce or even eliminate their capital gains tax on real estate.

Leveraging a 1031 Exchange for Rental Properties

Now, let’s talk about how to defer taxes through a 1031 Exchange. This strategy is like a magic trick for real estate investors, allowing you to sell a property, buy another, and defer paying capital gains taxes on the sale. Here’s the gist:

- Defer taxes indefinitely. By rolling the proceeds from one investment property into another, you can defer paying capital gains taxes for as long as you keep exchanging.

- Investment growth. This strategy allows your investment to grow tax-deferred, potentially increasing your returns over time.

- Specific rules apply. You must identify the new property within 45 days and close within 180 days. Plus, the properties must be “like-kind,” meaning they’re both investment properties.

Using a 1031 Exchange can be a bit complex, but it’s a powerful way to grow your real estate portfolio while deferring taxes. It’s like continually passing the tax bill down the road while your investments grow.

Rental Property Strategies:

For those with rental properties, the capital gains tax treatment is different from your primary residence. However, strategies like depreciation recapture and 1031 exchanges can significantly impact your tax situation.

- Depreciation recapture can increase your tax bill when selling a rental, but planning and using a 1031 exchange can offset this.

- Consider converting a rental property into your primary residence for at least two years before selling to take advantage of the primary residence exclusion.

By understanding and utilizing these strategies, real estate investors can significantly reduce their tax liability and increase their investment growth. Whether it’s leveraging the primary residence exclusion or deferring taxes through a 1031 exchange, there are several ways to navigate the complexities of real estate and capital gains tax to your advantage.

As we move into the next section, we’ll explore advanced capital gains tax planning techniques that can further optimize your investment strategy and potentially lead to even greater tax savings.

Advanced Capital Gains Tax Planning Techniques

Investing in Opportunity Zones

Opportunity Zones are a powerful tool for investors looking to defer and potentially reduce their capital gains taxes. Created to spur economic development in underserved communities, these zones offer unique tax benefits for investors. By reinvesting capital gains into Qualified Opportunity Funds (QOFs), investors can defer taxes on those gains until 2026 or until they sell their opportunity zone investment, whichever comes first.

- Defer Taxes: Initially, you can defer paying capital gains taxes by investing in a QOF within 180 days of selling your asset. This can provide a significant temporary relief from immediate tax liabilities.

- Reduce Taxes: If the investment in the QOF is held for at least five years, investors receive a 10% exclusion on the deferred gain. Holding it for seven years increases this exclusion to 15%.

- Economic Development: Beyond tax benefits, your investment contributes to revitalizing economically distressed areas, potentially leading to job creation and improved local economies.

Choosing Growth Stocks and Index Funds

For long-term investors, growth stocks and index funds offer pathways to minimize capital gains taxes while benefiting from market appreciation.

- Long-Term Growth: Growth stocks, typically companies expected to grow sales and earnings at a faster rate than the market average, can offer substantial returns over time. While they might not pay dividends (which are taxable), their value can increase significantly. By holding these stocks for more than a year, investors qualify for the lower long-term capital gains tax rates.

- Diversification: Index funds, which track a market index like the S&P 500, offer a diversified portfolio in a single investment. This diversification can reduce risk while still providing the opportunity for growth. Plus, index funds tend to have lower turnover rates, which means fewer taxable events, helping investors keep more of their returns.

- Tax Efficiency: Both growth stocks and index funds can be more tax-efficient compared to other investment vehicles. Index funds, for example, typically generate fewer capital gains distributions than actively managed funds, making them an attractive option for tax-conscious investors.

By incorporating these advanced capital gains tax planning techniques into your investment strategy, you can potentially defer, reduce, or even avoid certain taxes, all while supporting economic development and achieving long-term growth. The key to successful tax planning is a proactive approach and, when necessary, consulting with financial advisors to tailor strategies to your unique financial situation.

As we’ve explored these advanced techniques, it’s clear that with the right knowledge and strategies, investors can navigate the complexities of capital gains tax. Whether it’s through investing in opportunity zones, choosing growth stocks, or diversifying with index funds, there are several ways to optimize your investment returns while minimizing tax liabilities.

Moving forward, we’ll address some frequently asked questions about capital gains tax to further clarify how you can leverage these strategies effectively.

Frequently Asked Questions about Capital Gains Tax

What Determines My Capital Gains Tax Rate?

Your capital gains tax rate is determined by a few key factors:

- How long you’ve held the asset: If you’ve held an asset for more than a year, it’s considered a long-term capital gain and is taxed at a lower rate. Assets held for less than a year fall into the short-term category and are taxed at your ordinary income tax rate.

- Your taxable income: Your income level influences which tax bracket you fall into, and consequently, your capital gains tax rate. Generally, higher income results in a higher tax rate on long-term capital gains.

- Type of asset: Different assets might have different tax implications. For example, real estate and collectibles can be subject to different rules.

How Can I Use Real Estate to Reduce My Capital Gains Tax?

Real estate offers unique opportunities for reducing capital gains tax:

- Primary Residence Exclusion: If you sell your primary residence, you may exclude up to $250,000 of the gain from your income ($500,000 for married couples filing jointly), provided you’ve lived in the home for at least two of the five years before the sale.

- 1031 Exchange: This strategy allows you to defer paying capital gains taxes by reinvesting the proceeds from the sale of investment property into a similar property. It’s a powerful tool for real estate investors looking to grow their portfolio without the immediate tax hit.

- Depreciation: For rental properties, depreciation can offset income, potentially reducing your taxable income and thus, your capital gains tax liability when you sell.

Are There Limits to Tax-Loss Harvesting?

Yes, there are several important considerations:

- $3,000 Deduction Limit: You can use capital losses to offset capital gains plus up to $3,000 ($1,500 if married filing separately) of other income. Any additional losses can be carried forward to future tax years.

- Wash Sale Rule: The IRS prohibits claiming a tax deduction for a security sold in a wash sale. A wash sale occurs if you sell a security at a loss and then repurchase the same security, or one substantially identical, within 30 days before or after the sale.

- Matched to Specific Types of Income: Long-term losses must first offset long-term gains, and short-term losses must offset short-term gains. Any remaining losses can then be applied to other types of income within the limits mentioned above.

Navigating the complexities of capital gains tax can seem daunting, but understanding these strategies and rules can significantly impact your tax liabilities and investment growth. Whether through strategic asset holding, investing in tax-advantaged accounts, or smart real estate decisions, there are numerous ways to manage your capital gains tax effectively. Always consider consulting with a tax professional or financial advisor, like those at BlueSky Wealth Advisors, to tailor strategies to your unique financial situation.

Conclusion

At BlueSky Wealth Advisors, we’re committed to helping you navigate the complexities of capital gains tax with proactive tax strategies and personalized financial solutions. We understand that each investor’s situation is unique, and there’s no one-size-fits-all approach to tax reduction. That’s why we focus on creating tailored strategies that align with your financial goals and help you minimize your tax liabilities.

Proactive Tax Strategies

Our approach to reducing capital gains tax revolves around proactive planning and strategic decision-making. We believe in staying ahead of the curve by leveraging tax-loss harvesting, investing in tax-advantaged retirement plans, and considering the timing of asset sales to optimize tax outcomes. By adopting these strategies, we aim to enhance your investment growth while minimizing tax impact.

Personalized Financial Solutions

Our team at BlueSky Wealth Advisors takes the time to understand your financial landscape, goals, and aspirations. This deep understanding allows us to craft personalized financial solutions that not only aim to reduce your capital gains tax but also support your overall financial well-being. Whether you’re an individual investor, a family planning for the future, or someone interested in exploring the opportunities in opportunity zones, we’re here to guide you every step of the way.

We believe in building lasting relationships with our clients, providing them with the insights and support needed to make informed financial decisions. Our commitment to excellence, integrity, and transparency is the foundation of our advisory services.

Let’s Embark on Your Financial Journey Together

Reducing capital gains tax is just one aspect of a comprehensive financial strategy. At BlueSky Wealth Advisors, we’re ready to assist you in exploring a broad spectrum of tax planning and investment opportunities tailored to your unique situation. Our expertise in both traditional and digital assets positions us to offer you a wide range of solutions designed to enhance your financial independence and success.

Discover how our proactive tax strategies and personalized financial solutions can help you achieve your financial goals. Explore our services and learn more about our approach to tax planning at BlueSky Wealth Advisors. Together, we can turn your financial aspirations into reality, ensuring a legacy that lasts for generations to come.