Consumer Debt Patterns in Today's Dual-Track Economy

Consumer Debt Patterns in Today's Dual-Track Economy

When examining economic indicators, consumer financial health serves as a critical barometer. With consumer expenditures accounting for approximately 70% of total economic activity, the steady flow of purchases has been a key factor in the economy's better-than-expected performance in recent years. Yet, emerging signs of consumer weakness have sparked recession concerns among market participants.

Media reports highlight escalating debt levels and increasing payment delinquencies amid inflation concerns and growth deceleration. Simultaneously, economic data indicates robust consumer balance sheets, unprecedented household net worth, and sustainable monthly payment obligations. This seeming paradox has left investors questioning which narrative accurately reflects reality and whether fundamental weaknesses are developing.

The explanation can be found in what economists describe as a "dual-track economy," where financial circumstances differ significantly across consumer segments based on factors such as income brackets, wealth distribution, credit ratings, and other variables.

While the financial difficulties facing substantial portions of the population deserve serious attention, it's essential to distinguish between impacts on individual households and consequences for financial markets and investment portfolios. Consumer health metrics should be considered within a comprehensive framework that incorporates savings patterns, debt service ratios, and aggregate net worth. This more complete perspective helps explain why financial markets have demonstrated resilience despite these challenges.

Payment delinquencies show an upward trend

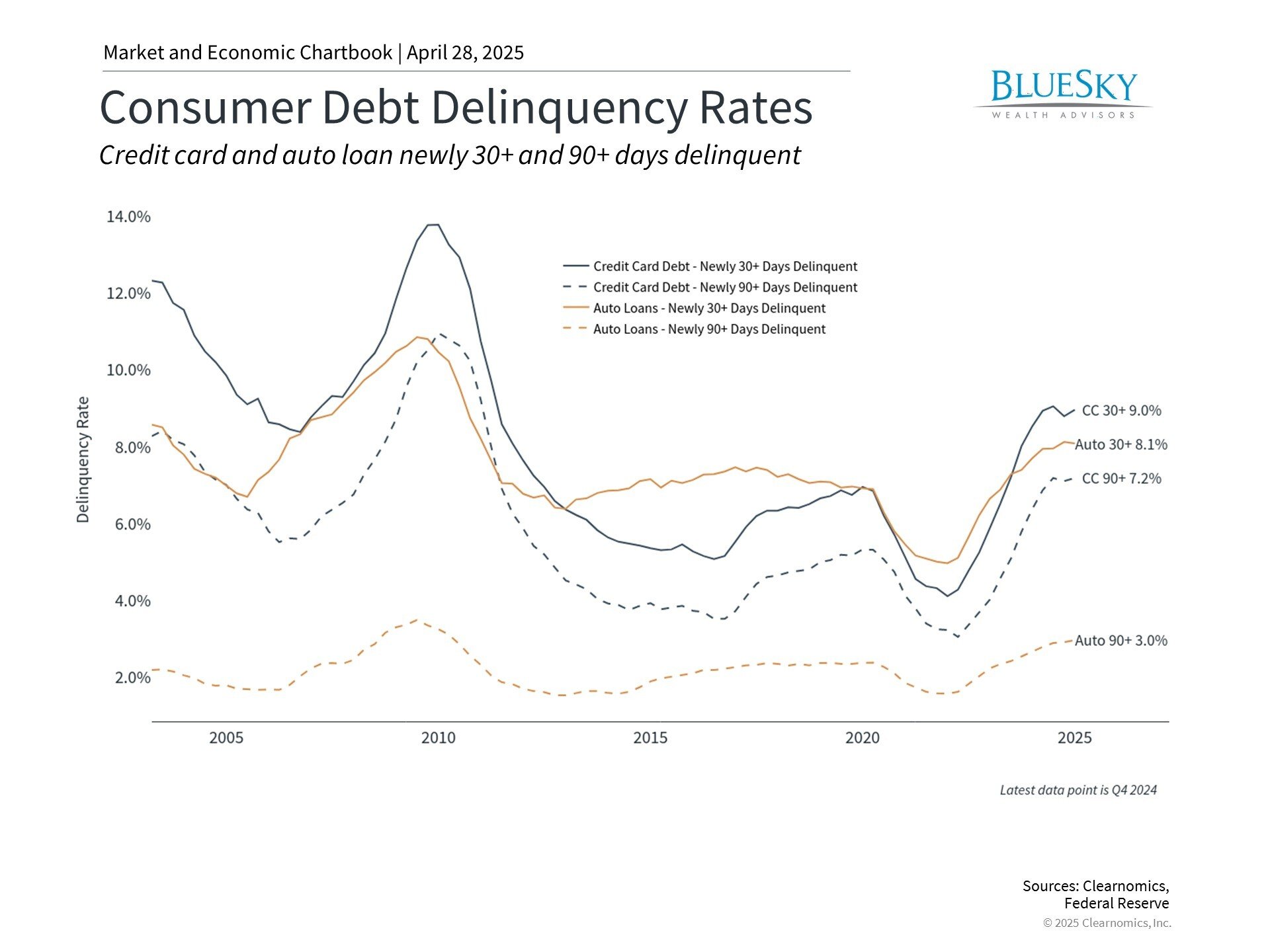

Among the most scrutinized indicators of consumer financial pressure is the delinquency rate across various loan categories. Delinquencies occur when consumers fail to make timely debt payments, which may happen for numerous reasons. During the past two years, both credit card and auto loan delinquencies have risen notably, as illustrated in the accompanying chart.

Delinquencies are categorized according to the duration of payment delays. Early-stage delinquency begins at 30 days past due, with increasing severity at 60 and 90+ days. The emergence of new delinquencies is particularly significant as it identifies consumers who have recently begun experiencing payment difficulties. The increase in 90+ day delinquencies for credit card accounts indicates that some consumers are facing persistent financial challenges.

Auto loan delinquencies provide especially valuable insight because consumers typically prioritize these payments even during periods of financial constraint. This prioritization stems from the essential nature of vehicle ownership for commuting and daily activities. This pattern was particularly evident during the housing crisis when many homeowners held mortgages that exceeded their property values.

Delinquency patterns differ substantially across credit tiers

What accounts for increasing delinquencies and the disparities among loan types? Recent analysis reveals these trends are primarily driven by variations in credit quality. Credit profiles typically range from subprime (individuals with less favorable credit histories) to prime (those with stronger credit records). Prime borrowers generally represent lower default risk, while subprime loans typically carry higher interest rates reflecting elevated non-payment risk.

Current statistics indicate that the overall increase in auto loan delinquencies is heavily concentrated among lower credit score borrowers. The accompanying chart demonstrates that delinquency rate disparities between subprime and prime borrowers are pronounced both in absolute terms and compared to historical averages. Similar patterns are evident in credit card delinquency data.

This distribution also explains why major financial institutions haven't expressed broader concerns regarding consumer financial stability. During recent financial reports, banking executives highlighted the continued durability of their consumer portfolios. This resilience persists despite tariff concerns, lackluster consumer sentiment, heightened inflation apprehensions, and other economic uncertainties.

Debt service requirements remain within sustainable parameters

Realistically, debt levels typically increase over time in parallel with economic expansion. To accurately evaluate consumer financial health, debt must be assessed relative to income and savings capacity. Currently, the ratio of consumer debt payments to household income stands at 5.5%. While this figure is approaching its long-term average, it remains comparatively low from a historical perspective. This suggests that the typical consumer maintains a healthy capacity to manage monthly payment obligations.

Similarly, household savings rates have found equilibrium in recent months, with Americans currently saving about 4.6% of their earnings, though this falls below the historical average of 6.2%. Additionally, U.S. household net worth continues to hover near all-time highs despite market fluctuations and economic uncertainties in recent years. Collectively, these factors establish a robust foundation for many consumers' financial stability.

It's crucial to recognize that these aggregate measures can obscure significant disparities across demographic and economic segments. The challenges confronting subprime borrowers in this "dual-track economy" represent a genuine and concerning development. Nevertheless, from macroeconomic and market perspectives, broader indicators of consumer financial health remain positive.

What are the implications for investors? Despite tariffs and market volatility contributing to elevated inflation and recession concerns, overall consumer trends remain resilient. This presents a positive outlook for investors with portfolios structured to withstand temporary market fluctuations as markets adjust to economic and policy uncertainties.

The bottom line? The dual-track economy explains why aggregate consumer metrics appear healthy despite isolated pockets of financial distress. For investors, maintaining focus on long-term trends is essential for staying invested and achieving financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.