How Market Uncertainty and Fed Independence Disputes Impact Bond Investors

How Market Uncertainty and Fed Independence Disputes Impact Bond Investors

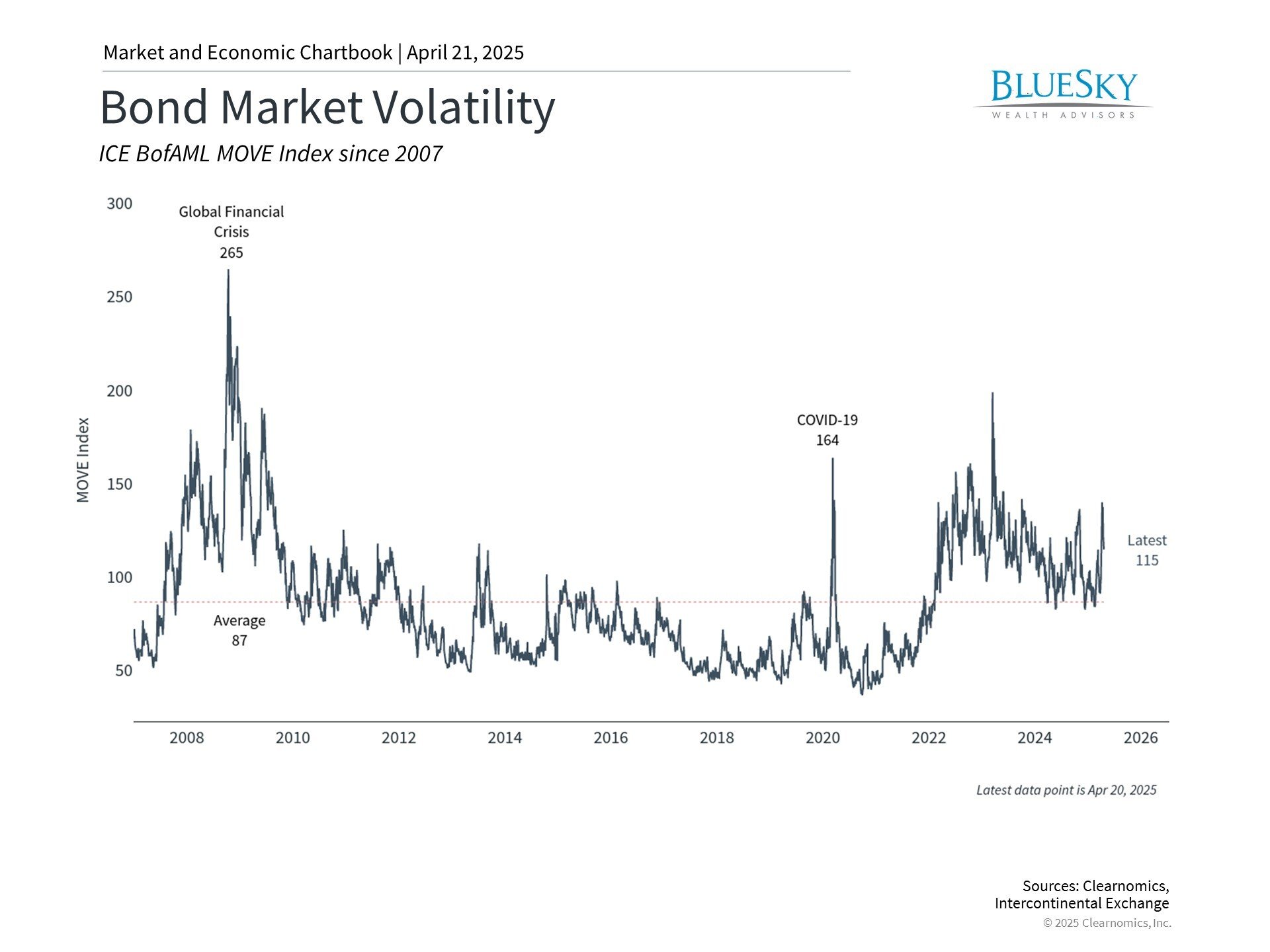

Increased uncertainty has triggered fluctuations in bond markets, similar to what we've witnessed in equities. These movements, influenced by tariff policies and tensions between the White House and Federal Reserve, have elevated interest rates and bond yields. Although short-term volatility often produces unexpected outcomes, it's essential to recognize that such periods occur regularly throughout market cycles, even if each instance has unique catalysts. For investors who depend on bond portfolios for income generation, today's environment presents a mix of challenges and possibilities for their long-term financial strategies.

Bond volatility has been pronounced recently

A fundamental principle of diversification relies on the traditionally low correlation between stocks and bonds. Generally, when one asset class moves in one direction, the other tends to move differently. This relationship exists because stocks typically flourish during economic strength while bonds have historically provided stability during uncertain economic conditions. Combining these asset classes with others can create a more balanced portfolio that reduces overall volatility, enhancing the probability of meeting financial objectives.

What's occurring in bond markets now and why should investors care? Occasionally, financial market volatility creates temporary exceptions to historical correlation patterns. Bond volatility specifically emerges when markets adapt to significant economic or policy shifts, such as current developments regarding tariffs and questions about Federal Reserve independence. Regarding tariffs, bond investors must balance two potentially conflicting scenarios: trade restrictions might increase consumer prices, creating inflation (typically negative for bonds), while potentially decelerating economic growth (usually positive for bonds).

Furthermore, concerns about market liquidity, potential outflows from U.S. assets, and technical market factors have contributed to recent fluctuations. The U.S. dollar has weakened alongside bonds, which is unusual since higher bond yields normally attract international capital. The chart illustrates that bond market volatility has remained elevated not just in recent weeks but throughout the past three years.

While various events surround bond market movements, they fundamentally reflect heightened policy uncertainty. Bond valuations depend heavily not just on future interest rate trajectories and economic conditions, but also on the predictability of these factors. Recent government actions regarding trade have complicated planning for both businesses and households, similarly making it challenging to forecast economic variables in coming months or years. This includes Federal Reserve policy direction, further complicated by headlines about President Trump and Chair Powell. Consequently, bond price fluctuations alongside stocks are understandable in this context.

Bonds continue providing portfolio stability despite volatility

Context remains important when assessing market conditions. Currently, the 10-year Treasury yield stands around 4.3% – comfortably within its trading range over the past two years. Generally, interest rates are higher than many analysts anticipated at the beginning of the year.

Nevertheless, most bond sectors continue showing positive year-to-date performance, including the U.S. Aggregate Bond Index, Treasurys, and investment grade corporate bonds. High yield bonds, which correlate closely with equity markets, have experienced only slight negative returns.

These performance patterns demonstrate that corporate bond investors are distinguishing between higher and lower quality issuers amid ongoing economic uncertainty. Corporate bond spreads, which measure additional yield compared to Treasurys, provide insight into this dynamic. Investment-grade spreads remain relatively narrow, while high-yield spreads have expanded considerably. However, current spreads remain significantly tighter than during previous financial stress periods such as 2008, 2020, and 2022.

Municipal bonds have also experienced heightened volatility recently. The municipal bond ratio, which compares municipal yields to Treasury yields, increased following tariff announcements and remains above historical averages. This elevated ratio indicates that municipal bonds offer greater relative value compared to Treasurys, particularly for investors in higher tax brackets or high-tax states.

Current bond yields provide compelling income opportunities

Regardless of near-term bond price movements, yields remain attractive compared to historical levels over the past two decades, creating income opportunities across fixed income markets. Investment grade corporate bonds currently offer average yields of 5.3%, notably higher than their 3.8% average since 2009.

The investment case for bonds appears favorable since the Federal Reserve is anticipated to implement additional rate cuts later this year, regardless of how White House disputes evolve. For income-focused investors, current yield levels are compelling across numerous fixed income sectors and can support portfolio stability during continued market uncertainty.

The bottom line? Financial markets continue to react to policy uncertainty. Despite recent bond market volatility, attractive yields and generally positive returns support long-term investors in achieving their financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.