Understanding the Impact of America's Growing National Debt

Understanding the Impact of America's Growing National Debt

The U.S. Treasury reports that the national debt is nearing $36 trillion, sparking widespread discussion among market participants and economic experts. Since 2001, this figure has seen consistent annual increases, expanding to almost four times its pre-2008 financial crisis level. These developments continue to fuel ongoing discussions about fiscal policy, including debates over deficit spending, debt ceiling limits, and government funding measures.

Following the recent election cycle, public discourse has turned to incoming administration appointments and policy directions. Understanding the implications of this expanding debt burden, and its relationship to economic and market dynamics, has become increasingly crucial. What perspective should investors maintain regarding government fiscal policy?

Federal debt levels have seen substantial increases since the financial crisis

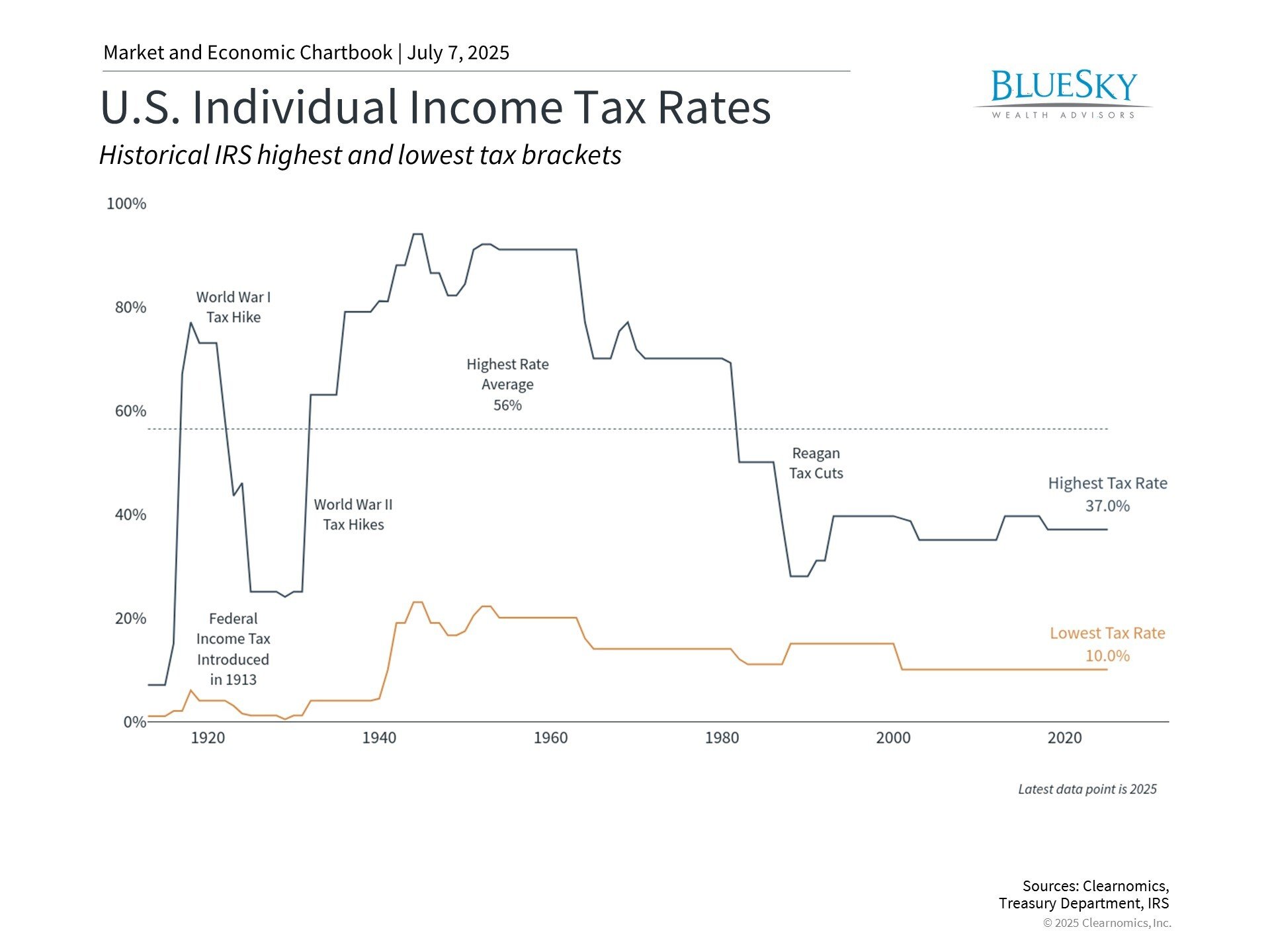

When examining complex economic issues like national debt, it's essential to differentiate between civic concerns and investment considerations. Many individuals maintain strong positions on fiscal policy and taxation as citizens and taxpayers, particularly regarding future generations. This topic will likely resurface when debt ceiling discussions resume in January 2025.

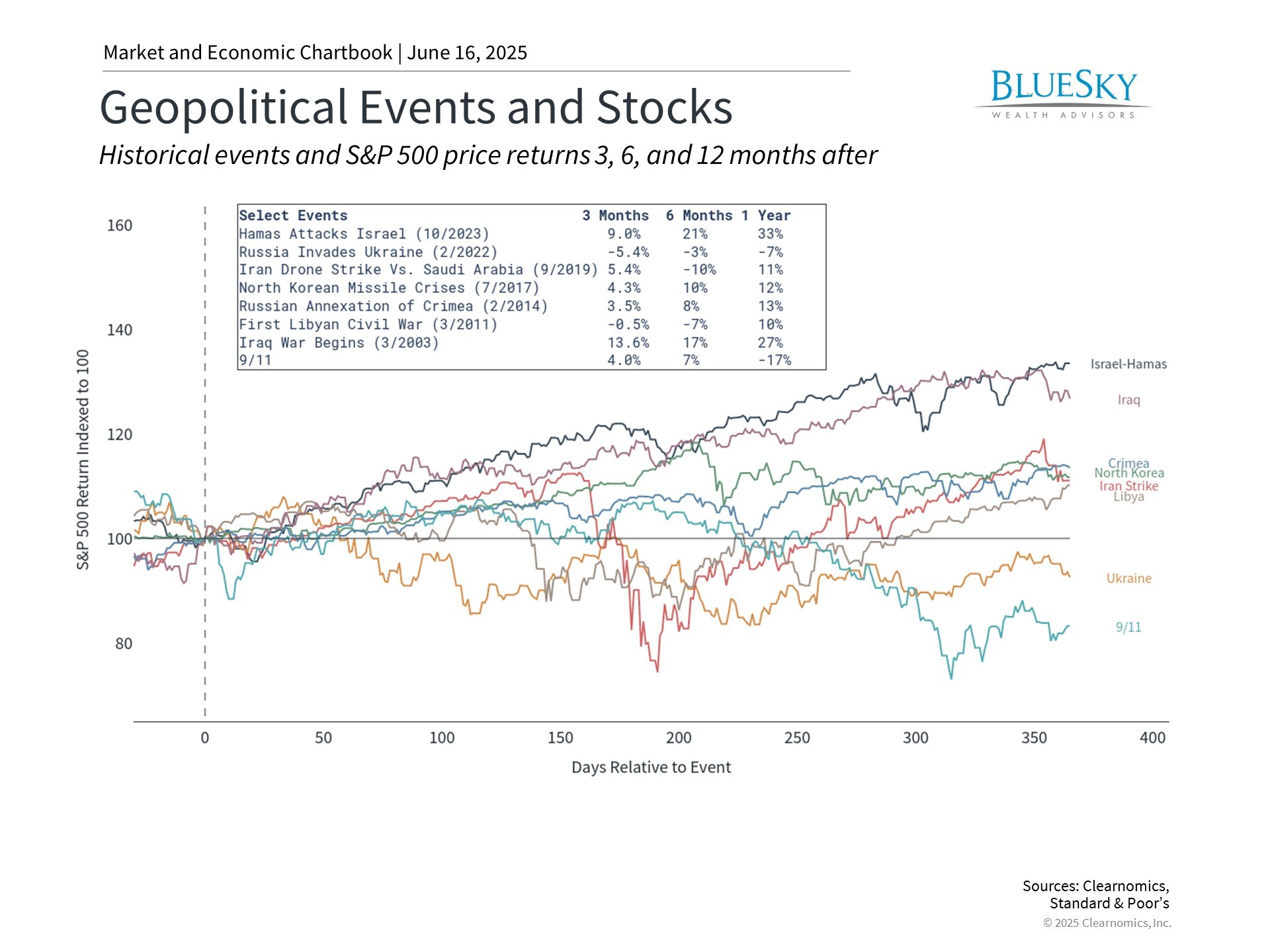

However, these considerations should be viewed separately from the debt's economic and market implications. While acknowledging the significance of federal debt levels, it's worth noting that markets have demonstrated resilience across recent economic cycles. Long-term financial planning should take precedence over reactive portfolio adjustments.

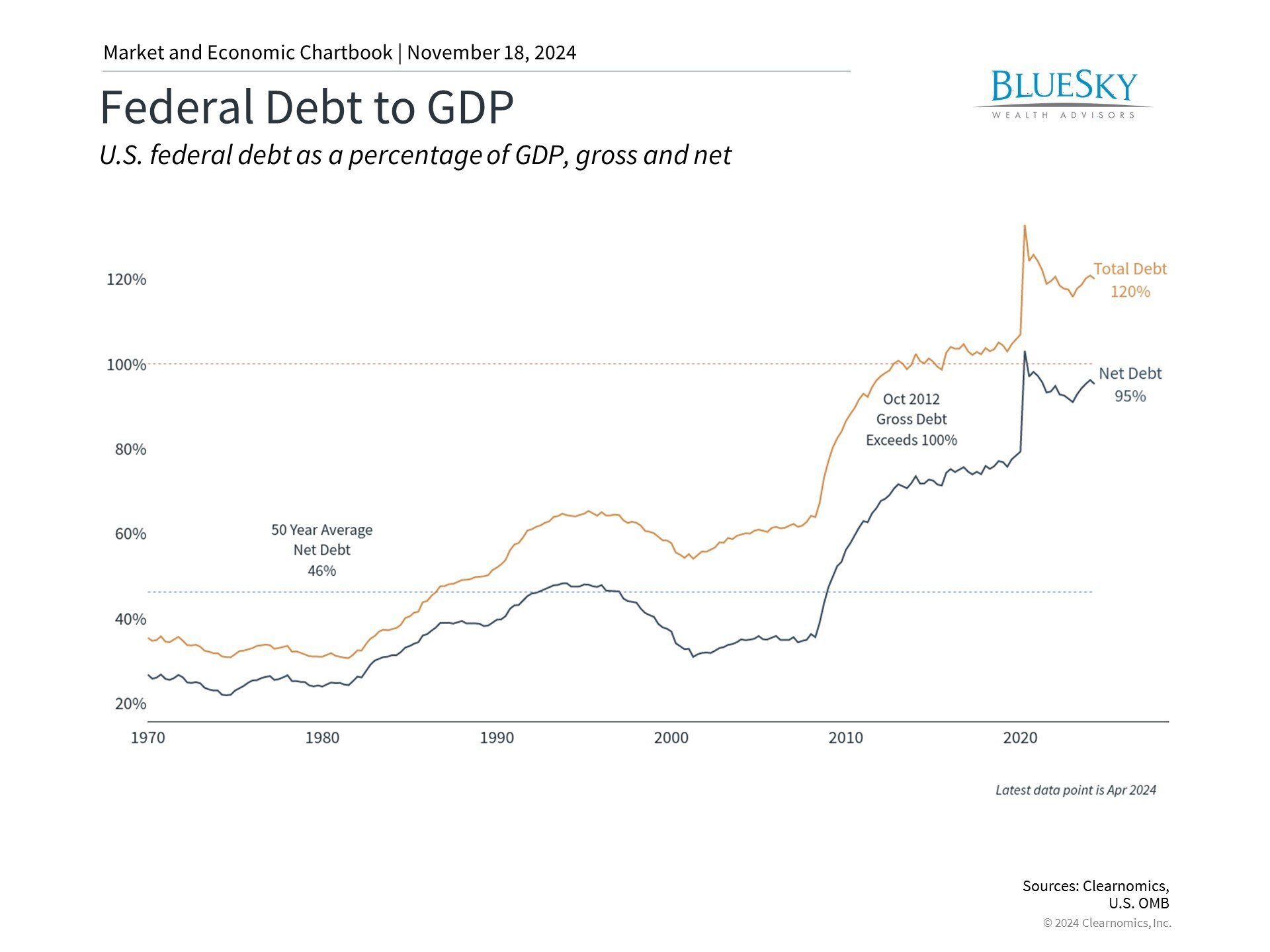

Evaluating debt relative to economic output provides more context than absolute figures. While debt has grown considerably, the economy has doubled since 2008. Currently, total national debt represents 120% of GDP, though excluding intragovernmental holdings reduces this figure to 95%. This elevated level largely reflects pandemic-related fiscal measures.

The sustainable debt threshold remains unclear. Japan provides an example of a developed nation managing debt exceeding 200% of GDP for 15 years, recently surpassing 250%. However, Japan's circumstances differ due to its high household savings rate offsetting government borrowing. America's more diverse economy, favorable demographics, and the dollar's global role create distinct conditions.

Annual budget shortfalls continue to increase total federal debt

What drives debt expansion? Budget deficits occur when expenditures exceed tax revenues, including personal, corporate, and social insurance collections. While additional revenue sources like tariffs exist, they represent minimal contributions, typically below 2% of total receipts.

Despite natural revenue growth from economic expansion, government spending has outpaced income across both mandatory programs like Social Security and discretionary categories including defense and education.

Treasury security issuance finances these shortfalls, with various investors, institutions, and foreign entities providing necessary funding.

Current deficits around 6% of GDP, while significant, aren't unprecedented. Historical patterns show temporary deficit increases during economic challenges and conflicts, typically moderating during recovery periods, even if complete balance remains elusive.

Rising interest costs amplify the debt challenge

Deficit spending persists without significant political focus from either major party. Balanced budgets haven't occurred since the Clinton era, following the Nixon administration's achievement. Projections indicate annual interest expenses could reach $1.71 trillion within a decade.

Approximately two-thirds of federal debt is domestically held by government entities and citizens. Foreign ownership comprises the remainder, with China's share declining to 2.2%. Some worry about reduced Treasury demand affecting refinancing capabilities, potentially driving rates higher or weakening dollar dominance. These concerns extend to America's global economic position.

Despite long-standing economist warnings and emerging alternatives like cryptocurrencies and gold, such scenarios appear distant. During global uncertainty, U.S. assets remain preferred safe havens. The 2011 fiscal cliff crisis demonstrated this when Treasury demand increased despite a Standard & Poor's downgrade.

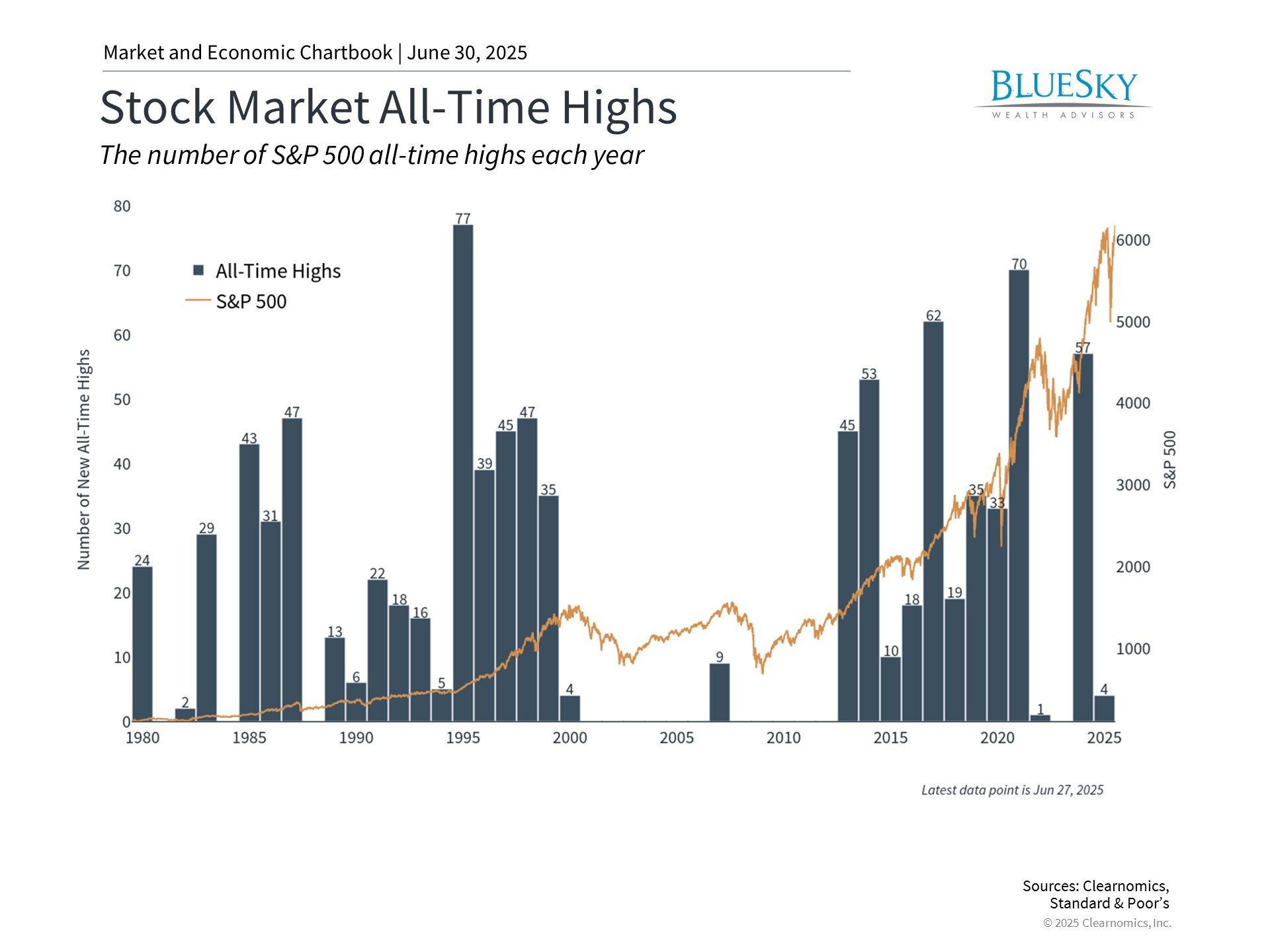

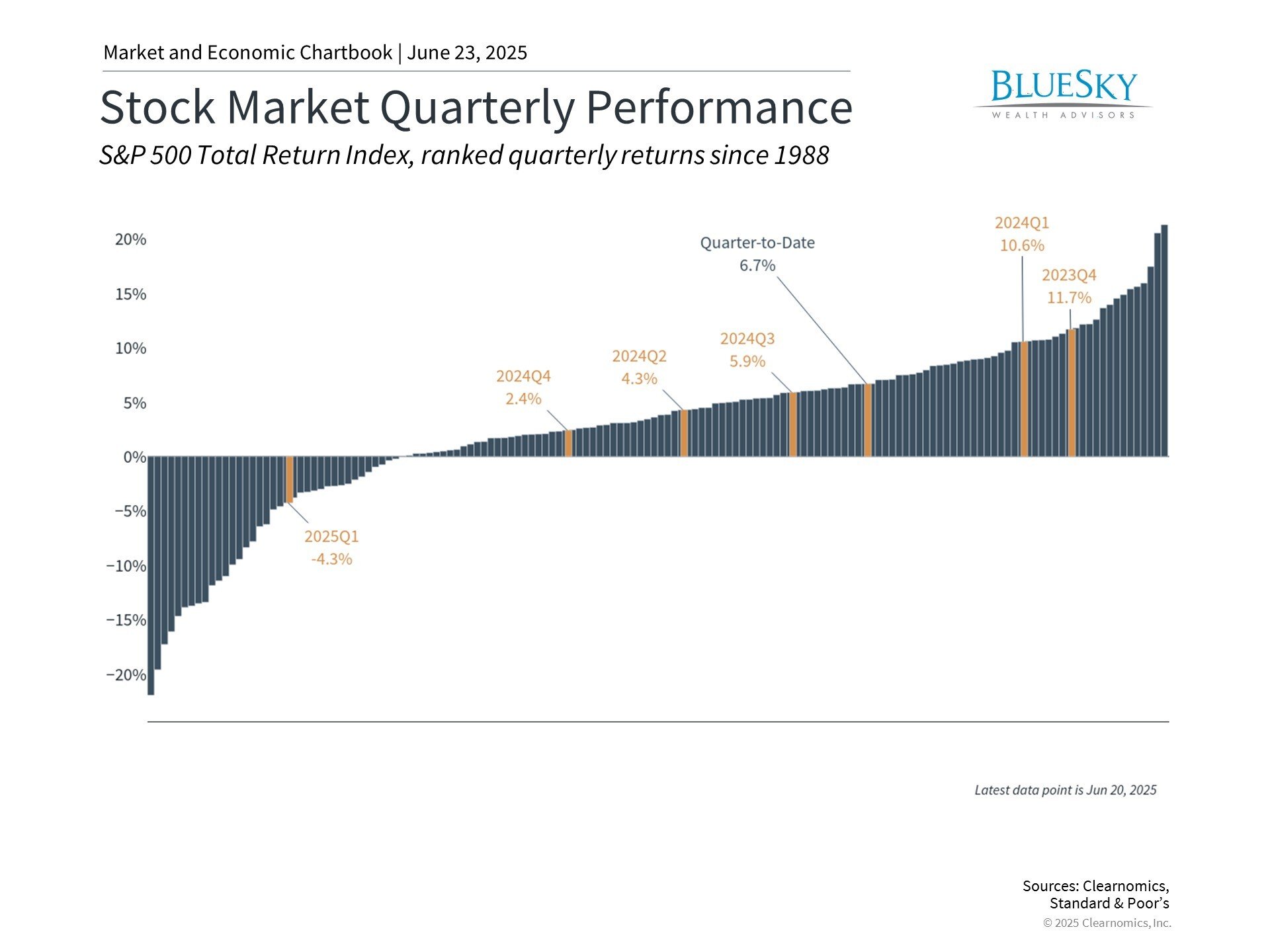

Notably, markets have demonstrated resilience regardless of debt levels and tax policies over the past century. Counterintuitively, periods of highest deficits, typically during crises requiring emergency spending, have often presented attractive investment opportunities. While this observation doesn't constitute an investment strategy, it emphasizes the importance of maintaining long-term perspective.

The bottom line? While the national debt presents legitimate economic concerns, investors should separate personal views from investment decisions. Maintaining focus on long-term financial objectives remains paramount.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.