What Fed Rate Cuts And Disinflation Mean For Long-Term Investors

What Fed Rate Cuts And Disinflation Mean For Long-Term Investors

Markets continue to be driven by artificial intelligence stocks and the timing of the Fed’s first rate cut. Beyond the day-to-day swings, these drivers reflect important trends in innovation, productivity, and the health of the economy. They are also the result of the pandemic-era easy money policies and fiscal stimulus measures that led to booms in the tech sector and rapid price increases. As the dust settles on the inflationary episode of the past few years, what should investors do to maintain perspective in their portfolios?

Inflation is improving, albeit at a slower pace

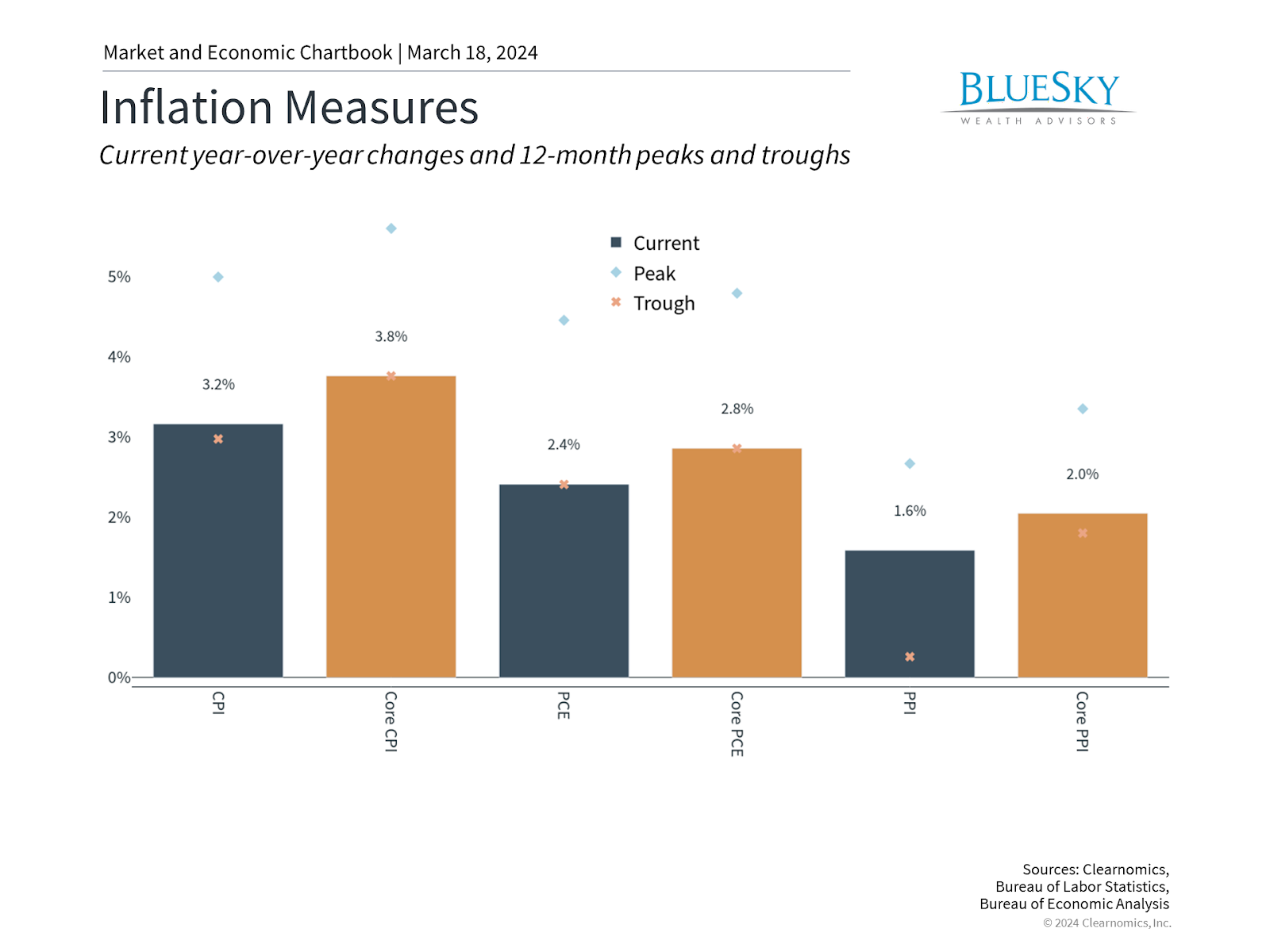

While economists and historians will no doubt spend the next decade documenting the many causes and policy decisions that drove the worst inflation in 40 years, it is clear that the various supply and demand shocks are fading. Some prices remain stubborn, such as those for the important category of shelter (i.e., the cost of rent and mortgages), but most measures have improved significantly. This sets the stage for the widely-anticipated Fed rate cuts later this year.

The latest Consumer Price Index report, for instance, showed that prices rose 3.2% on a year-over-year basis in February. This represents a slight uptick from the prior month due to an increase in energy prices. Energy drove the Producer Price Index higher as well, although both the headline and core measures are both still at or below 2%. Core CPI came in at 3.8% but excluding the shelter component results in a year-over-year growth rate of only 2.2%.

These data points are consistent with consumer price inflation that is heading back toward 2%, although it will take some time. In any case, these figures represent the best-case scenario that investors could have hoped for less than two years ago. Still, the Fed has been careful to not declare victory too soon. This is wise since headline inflation is strongly correlated with energy prices which are subject to unforeseen global events such as the war in Ukraine or the two OPEC oil shocks of the 1970s.

Although many parallels have been drawn to the inflationary shocks of the 1970s and early 1980s, the policy response and economic outcome could not be more different. In the 1970s, the Fed switched direction multiple times as it grappled with the concept of “stagflation,” or the idea that inflation could rise even as demand was weak. Fortunately, perhaps because that period was studied so extensively by current policymakers, stagflation has been avoided this time around.

The money supply has stabilized

Perhaps most relevant for investors today is that disinflation then made way for “the Great Moderation” beginning in the mid-1980s. During this time, business cycles grew longer, inflation was subdued, unemployment fell, and markets performed well. While this is only one historical example, it does suggest that falling inflation and a return to more normal monetary policy will likely be positive for the economy and markets.

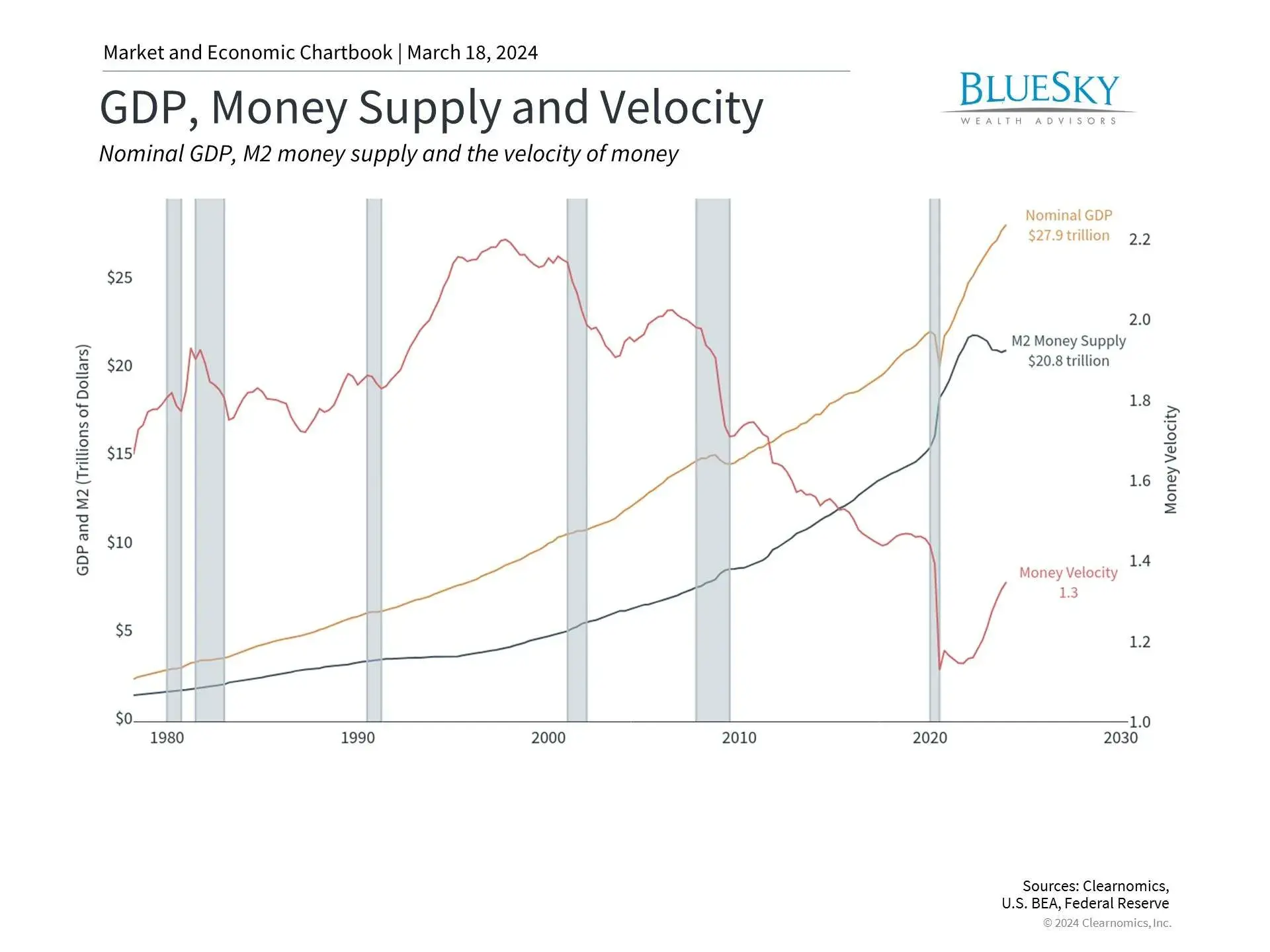

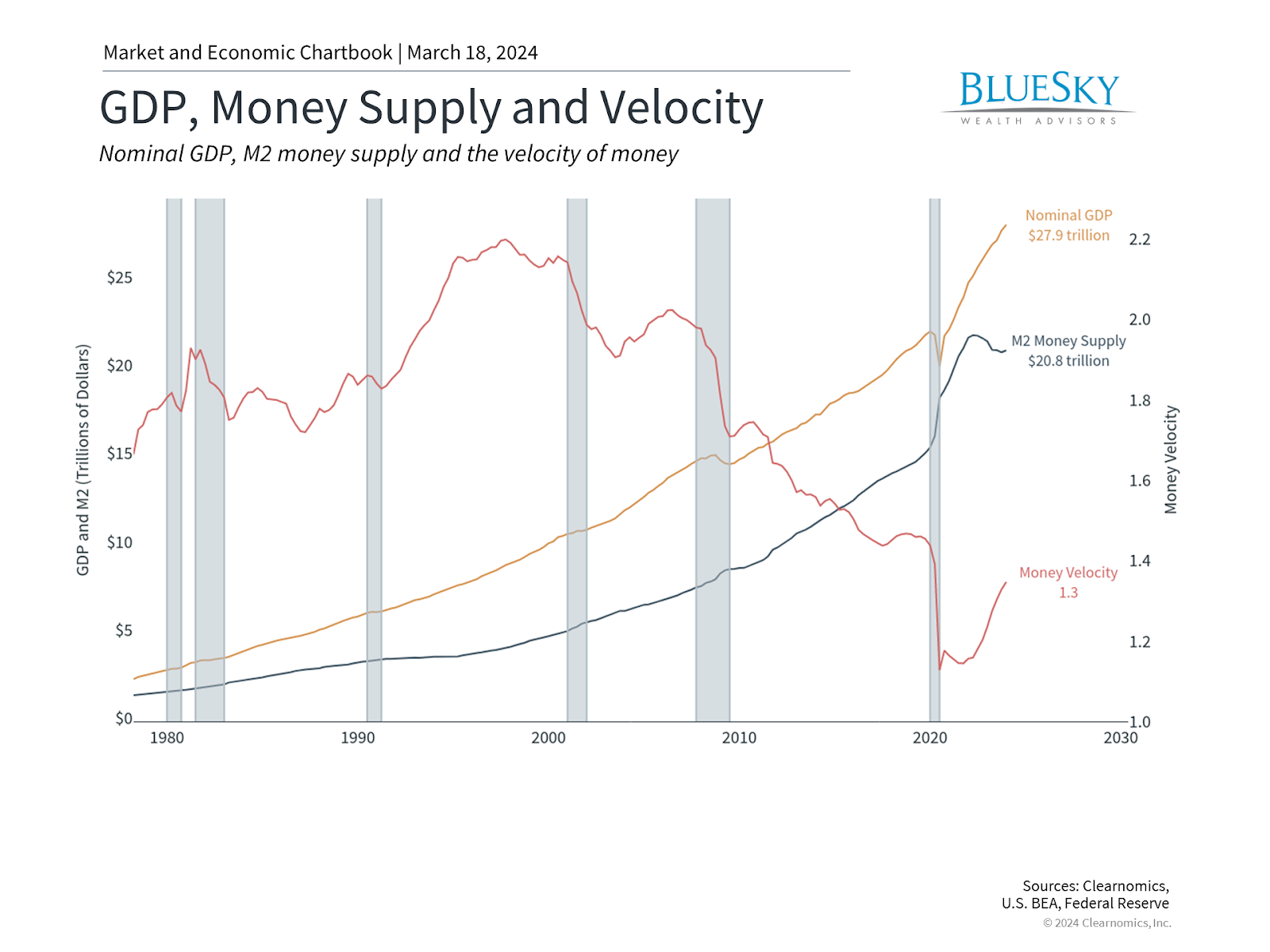

One concern among investors has been the supply of money, reflecting the famous quote by the economist Milton Friedman that “inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Whether or not this view, known as “monetarism,” is right is a subject of debate among economists. Either way, the accompanying chart shows that the money supply has shrunk relative to its post-pandemic peak. This reflects monetary tightening by the Fed, including the shrinking of the Fed’s balance sheet at a pace of around $1.1 trillion per year.

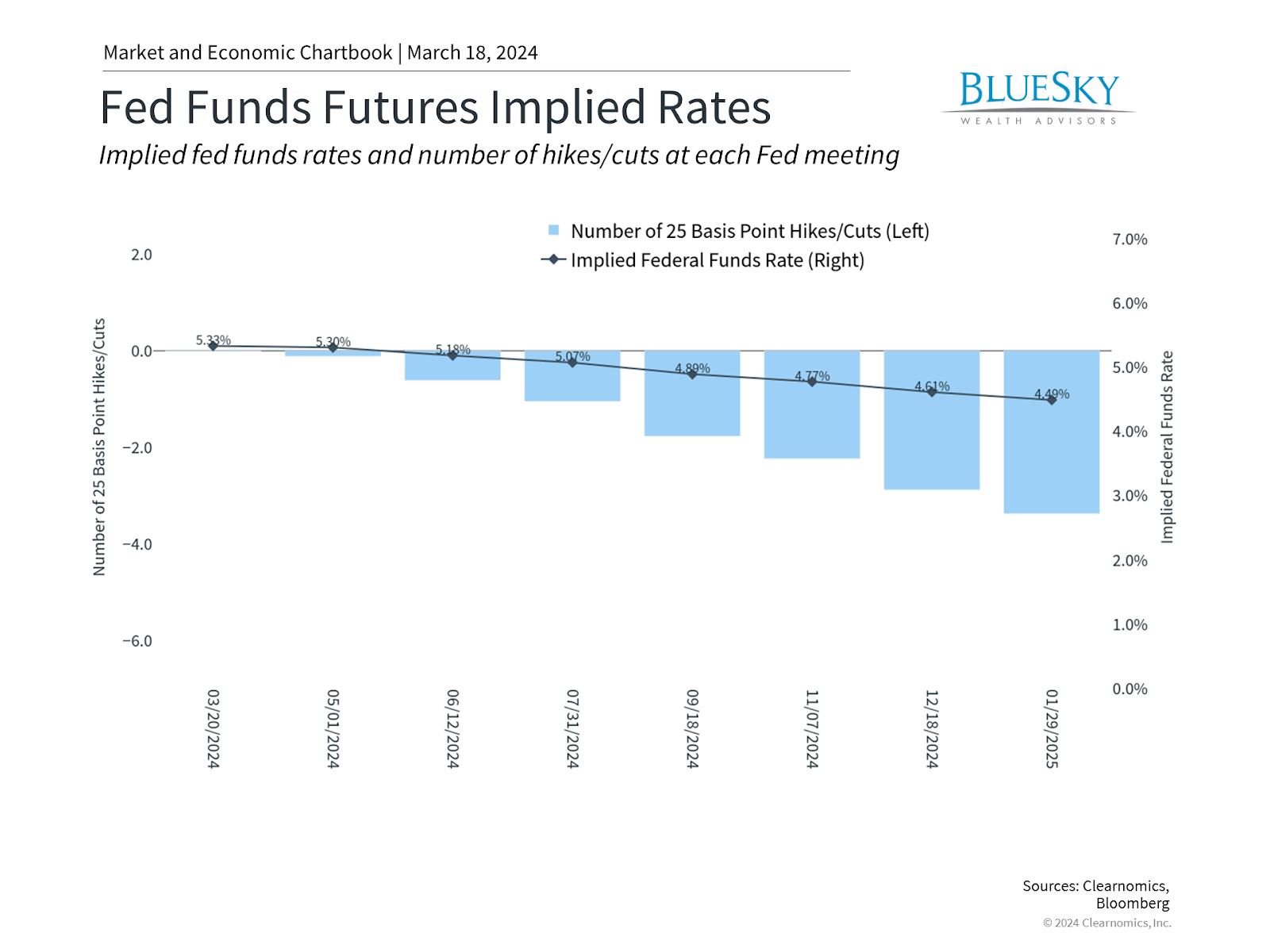

Markets expect the first rate cut to occur in the summer

Thus, daily market swings continue to be driven by changing expectations for the economy and Fed rate cuts. Recent volatility has been the result of the market shifting to a first cut occurring in June or July rather than in March. For long-term investors, whether this takes place today or a few months out should be immaterial given the broader historical context. What matters is the underlying trend of improving inflation and steady economic growth. A return to more normal monetary policy should also help interest rates to stabilize, resulting in a more attractive financial market environment.

The bottom line? Investors should continue to focus on broad economic trends and historical perspectives rather than on day-to-day market swings in specific stocks.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.