Warren Buffett's Timeless Investment Principles for Current Markets

Warren Buffett's Timeless Investment Principles for Current Markets

Investment success often hinges on three fundamental attributes: patience, discipline, and long-term thinking. Warren Buffett, who recently announced his retirement after leading Berkshire Hathaway for five decades, exemplifies these qualities better than perhaps any investor in history. His departure provides us an opportunity to examine investment strategies that have not only withstood numerous market cycles but remain particularly relevant in today's environment.

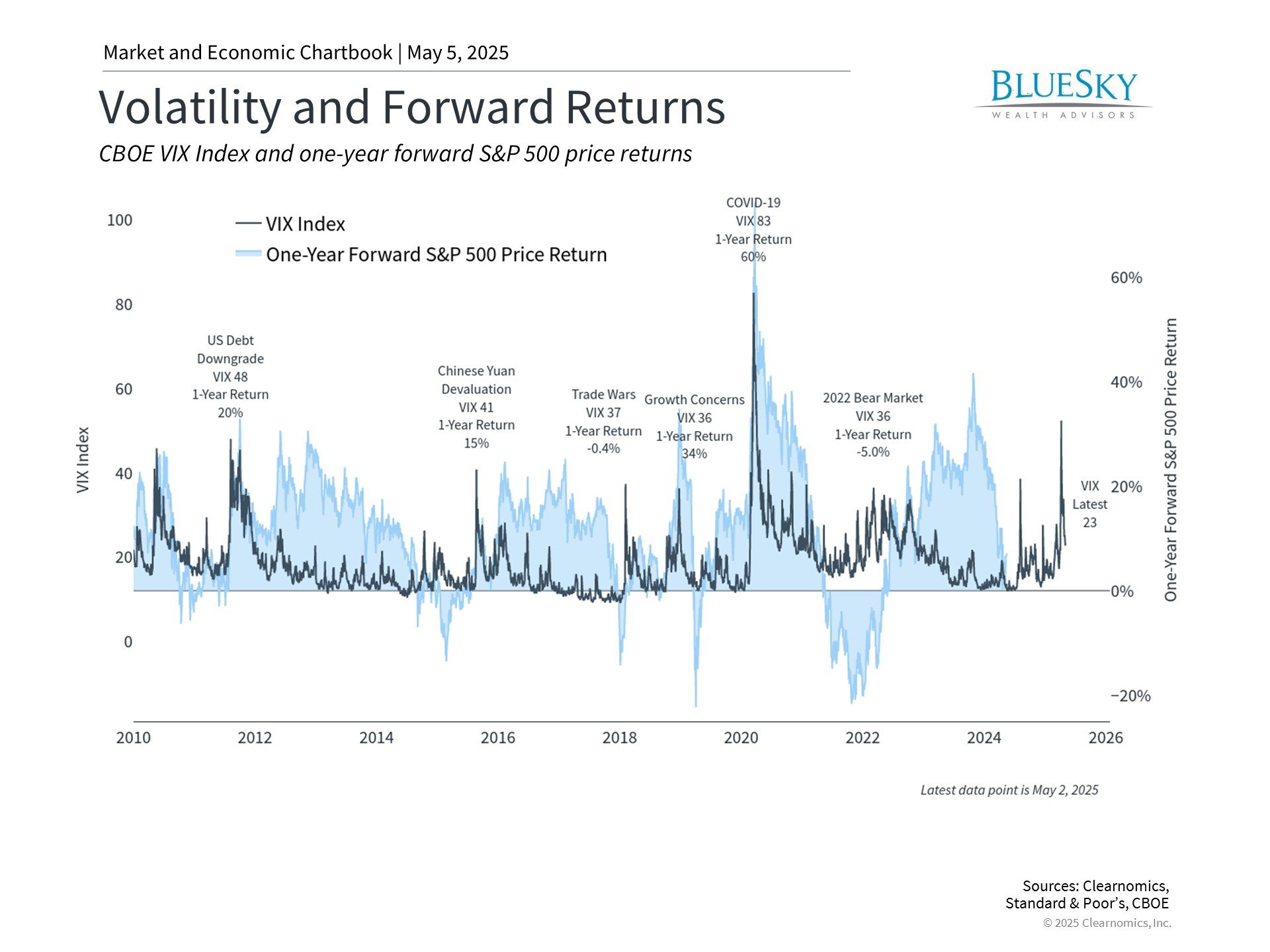

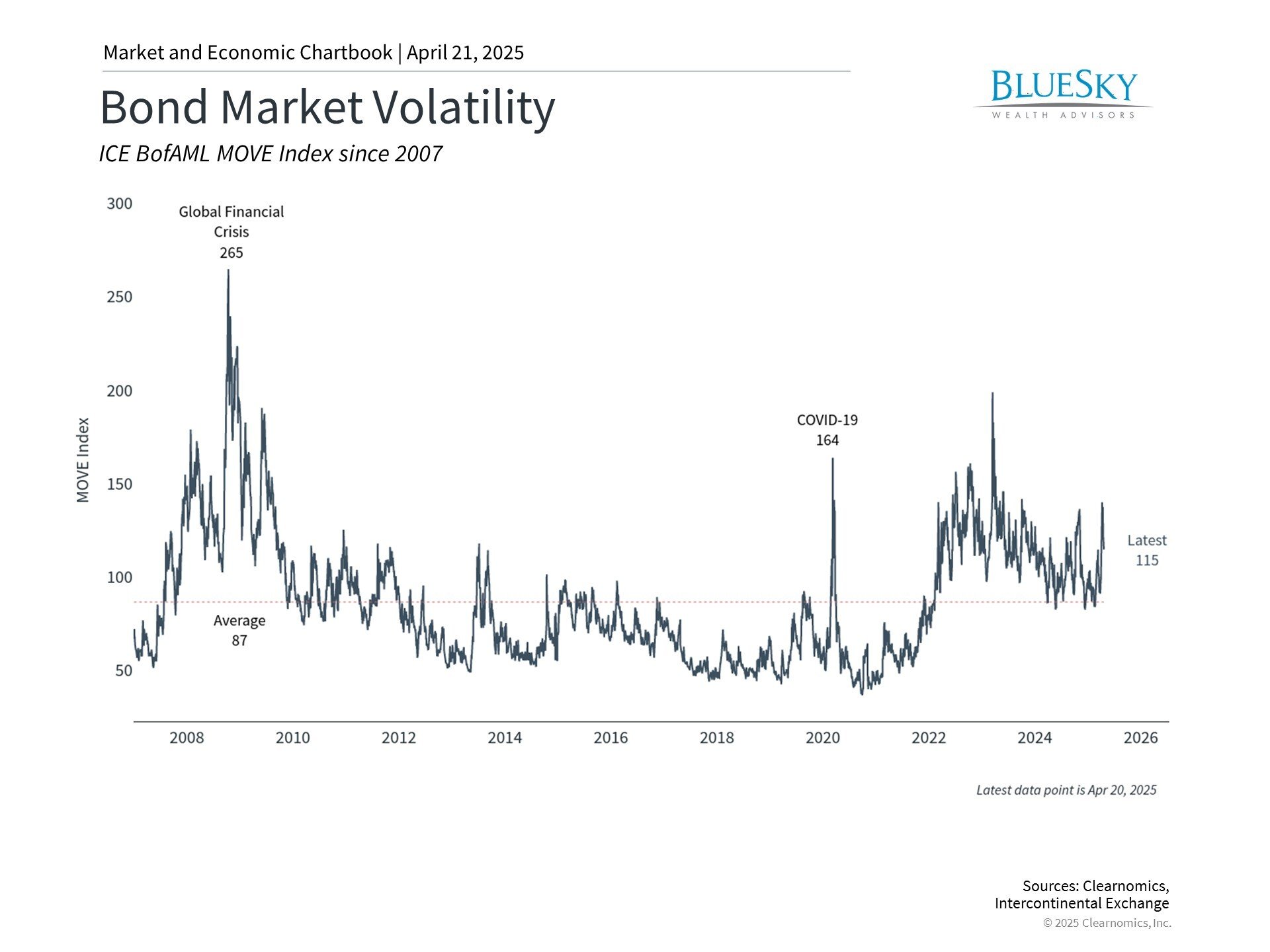

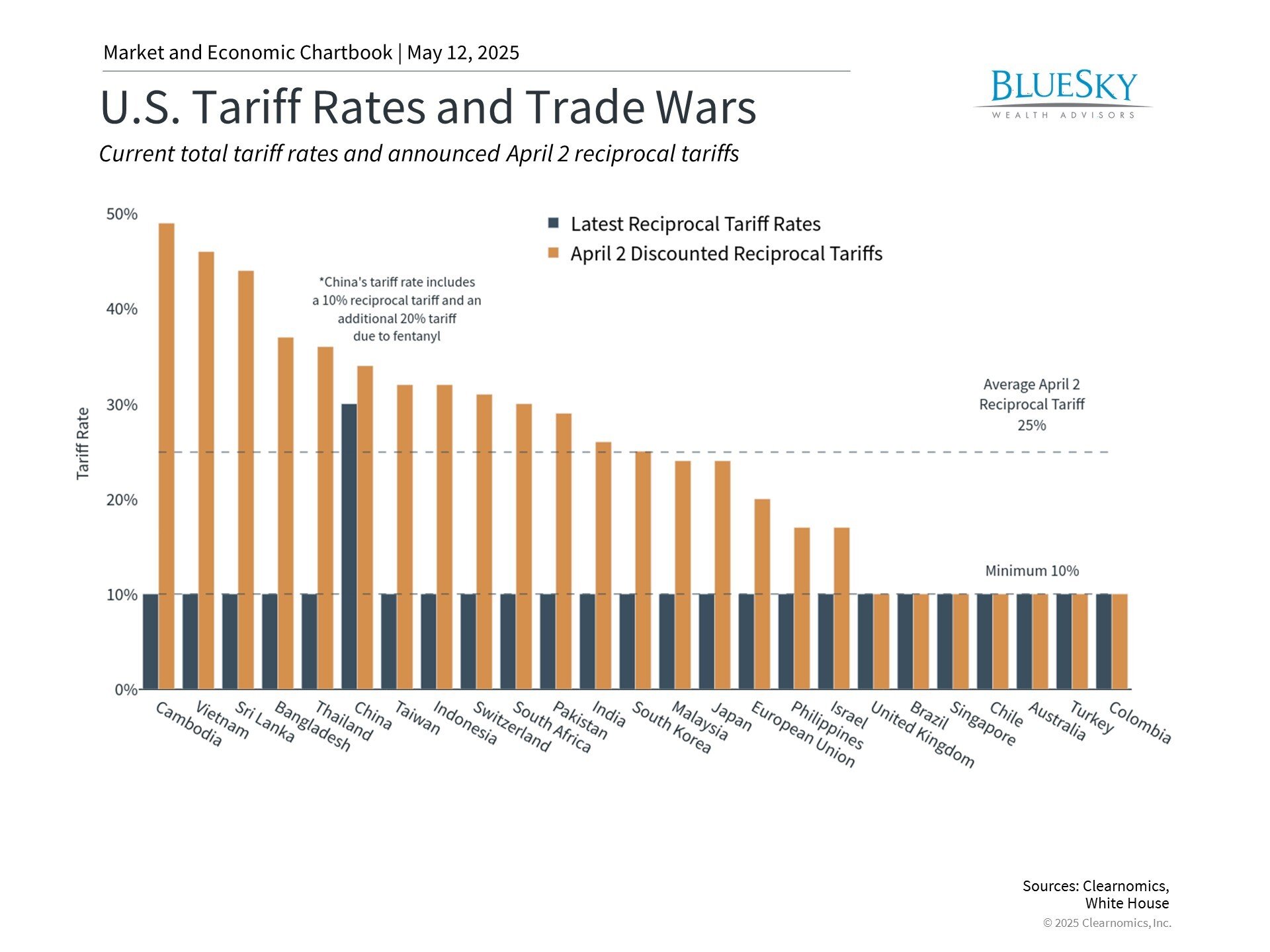

One of Buffett's most frequently cited pieces of wisdom advises investors to "be fearful when others are greedy, and greedy when others are fearful." While stable markets feel more comfortable, genuine opportunities typically emerge during periods of uncertainty. The market volatility we experienced in April—driven by concerns about tariffs, inflation, and interest rate policies—illustrates this principle perfectly. Investors who maintained perspective on their overall portfolio strategy rather than reacting to headlines have likely positioned themselves advantageously for future growth.

Although the market has recovered much of its earlier declines this year, valuations remain more attractive than they were in January. These conditions create potential advantages for disciplined investors who can leverage improved entry points and long-term market trends. Following Buffett's example of looking beyond short-term fluctuations has historically benefited those who maintain focus on their investment goals. Several key Buffett principles can provide guidance through current market conditions.

Recent volatility has created more attractive valuations

"Whether we're talking about stocks or socks, I like buying quality merchandise when it is marked down." - Warren Buffett, 2018 Berkshire Hathaway annual letter

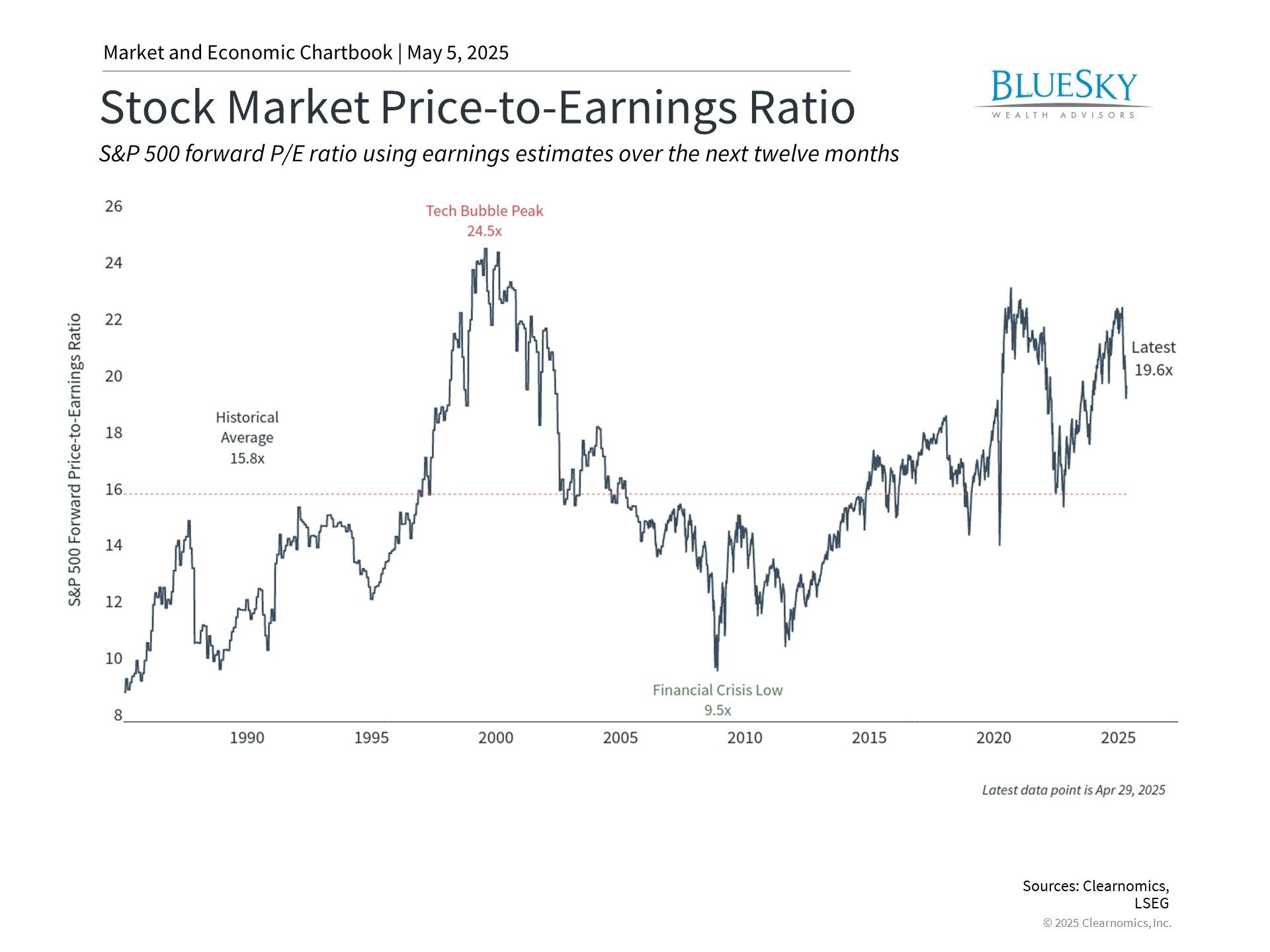

Finding undervalued companies represents a cornerstone of Buffett's investment philosophy. While market valuations approached historic highs earlier this year, the recent correction combined with consistent earnings growth has brought valuations to more reasonable levels. The S&P 500's price-to-earnings ratio now stands just under 20x, aligning with its 10-year average. This valuation adjustment, triggered by concerns about tariffs and economic uncertainty, may represent a window of opportunity for investors.

Over extended time horizons, valuation metrics provide the most reliable indicator of market attractiveness. Daily and monthly market movements often respond to headlines, specific corporate developments, and geopolitical events, but these factors typically diminish in importance over time. When examining performance across years or decades, what truly matters is the underlying growth trajectory and whether investors initially paid a fair price for their investments.

Valuations effectively measure whether investors receive appropriate value for their investment capital—considering factors like earnings, book value, cash flow, and dividends. Acquiring assets at attractive valuations typically enhances the probability of stronger future returns, while investing during periods of market exuberance often leads to more modest long-term outcomes. This relationship explains why valuations have consistently shown strong correlation with long-term portfolio performance.

It's critical to understand that valuations should not be used as timing mechanisms for making binary investment decisions. Instead, they represent valuable information for constructing appropriate portfolios. Assessing current valuation levels helps identify potential opportunities and establish realistic expectations throughout market cycles.

Corporate earnings continue showing strong growth

"Focus on the future productivity of the asset you are considering. If you don't feel comfortable making a rough estimate of the asset's future earnings, just forget it and move on." - Warren Buffett, 2013 Berkshire Hathaway annual letter

Beyond more favorable pricing, improving valuations also reflect the steady progression of corporate earnings. With over three-quarters of S&P 500 companies having released their first-quarter results, earnings have grown by an impressive 12.8%, according to FactSet data. This substantially exceeds the 7.2% growth rate anticipated at the start of earnings season. Several sectors have driven this positive surprise, particularly Communication Services, Financials, Healthcare, and Information Technology, which continue expanding their profit margins.

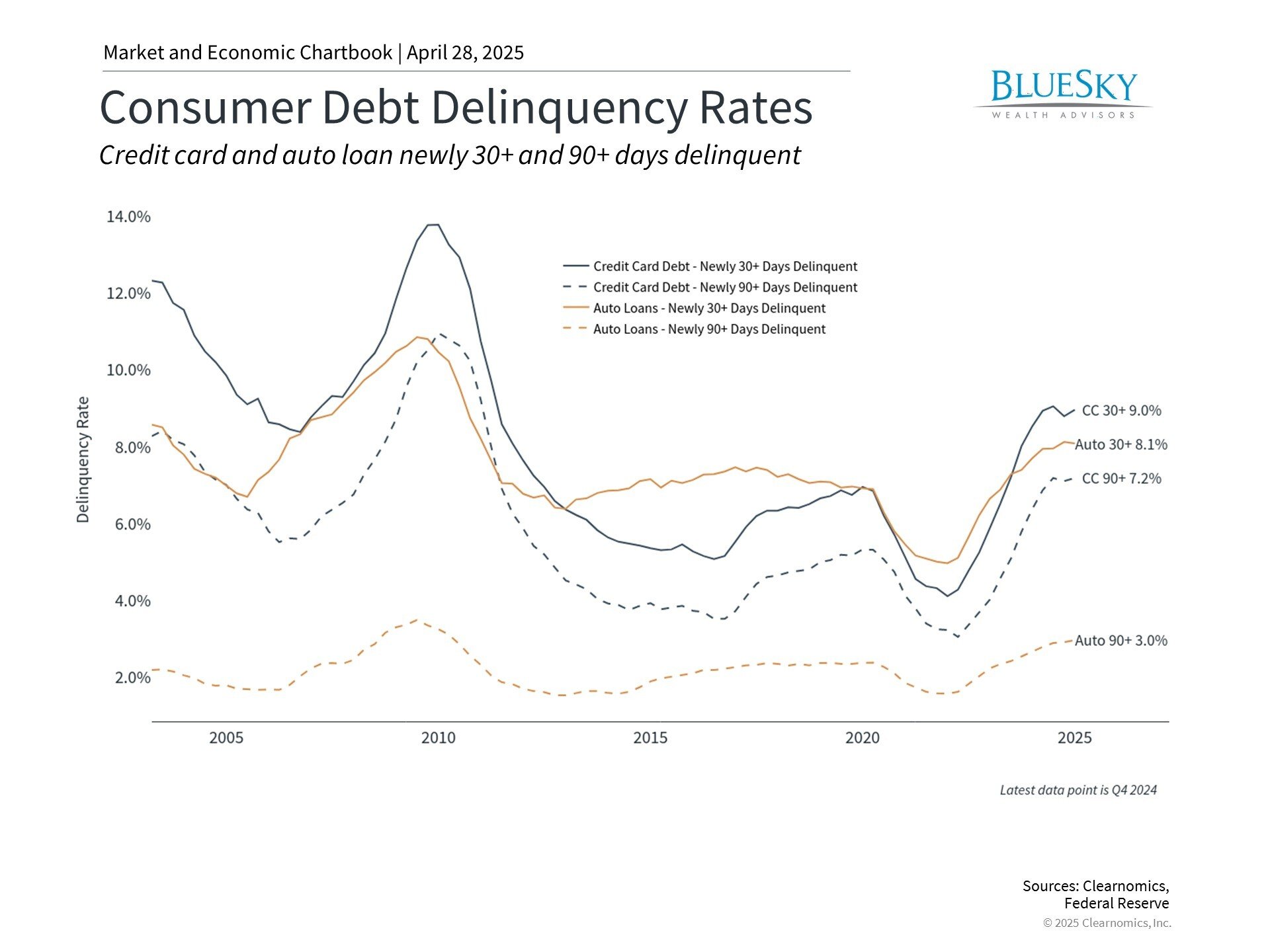

Meanwhile, Consumer Discretionary and Consumer Staples sectors have demonstrated comparative weakness, exceeding their sales targets at lower rates. This aligns with survey evidence suggesting consumers have become increasingly cautious about spending as they prioritize essential purchases amid ongoing inflation concerns.

Looking beyond the figures, earnings calls have revealed important insights into corporate strategies during current conditions. Three prominent themes have emerged from these discussions.

First, numerous companies have adopted a cautious approach regarding potential tariff impacts. Given the limited clarity, some organizations have temporarily suspended earnings guidance, while others have incorporated initial tariff estimates into their projections.

Second, despite near-term uncertainties, commitments to capital investments remain robust, especially in technology sectors. Major tech companies have sustained or enhanced their capital expenditure plans for 2025, particularly for infrastructure supporting artificial intelligence. This suggests management teams maintain confidence in long-term growth prospects.

Third, companies across diverse industries are implementing strategic transformations to adapt to technological advances, evolving consumer preferences, and economic shifts. These strategic adjustments, though sometimes challenging initially, position organizations to better navigate uncertainty and capitalize on emerging opportunities.

Dividend growth provides portfolio support

"It's not good news when any company cuts its dividend dramatically" - Warren Buffett, 2023 Berkshire Hathaway annual meeting

Although Berkshire Hathaway rarely distributes dividends, Buffett has consistently benefited from the earnings and dividend-generating capabilities of his portfolio companies. His mentor, Benjamin Graham, emphasized dividends' importance as indicators of financial health in "The Intelligent Investor." While investors typically concentrate on stock price movements, dividends have historically contributed significantly to long-term investment returns.

Despite ongoing market uncertainty, dividends have maintained their upward trajectory, enhancing total returns for stock market investors. The accompanying chart illustrates that many sectors maintain healthy dividend yields, with numerous sectors offering yields near their 10-year averages.

For investors relying on portfolios for income generation, dividends provide an essential yield source. Companies typically resist reducing dividends except during periods of significant financial stress. Dividends also serve as important indicators of underlying corporate financial health because, unlike accounting figures, dividend payments require actual cash disbursement. The continued growth in dividend distributions suggests corporate leadership maintains confidence despite short-term market uncertainties.

The bottom line? Warren Buffett's career demonstrates that navigating uncertainty requires a patient, long-term investment approach. This wisdom remains especially valuable in today's market environment as fundamental indicators continue to improve.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.