Understanding the Economic Impact of U.S.-China Trade Friction

Understanding the Economic Impact of U.S.-China Trade Friction

Recent weeks have seen an unprecedented escalation in trade friction between the United States and China, with both nations implementing substantial tariff increases. Currently, the U.S. has imposed 145% tariffs on Chinese imports, while China has responded with 125% tariffs on American goods. This rapidly changing situation continues to influence financial markets globally. While such international tensions often create market uncertainty, examining historical precedents reveals that markets have successfully navigated similar challenges before. For investors focused on long-term goals, understanding the fundamental economic relationship between these two global powers can provide valuable context amid the headlines.

The spotlight is now on U.S.-China economic relations

While tariffs against all trading partners have recently dominated financial news, the 90-day pause has shifted attention specifically to the U.S.-China relationship. The core issue extends beyond simple trade policy disagreements. Current tensions reflect a "multipolar" global order where the U.S. and China represent the world's two largest economies, each wielding significant global influence. This marks a multi-decade transition from the "unipolar" world that emerged after the Cold War when the U.S. stood as the sole major superpower. This evolution naturally creates both new challenges and opportunities for each nation.

While predicting the trade dispute's trajectory over coming months remains difficult, maintaining perspective is increasingly crucial for long-term investors. The economies of the U.S. and China remain deeply interconnected through trade relationships, financial systems, and global supply chains.

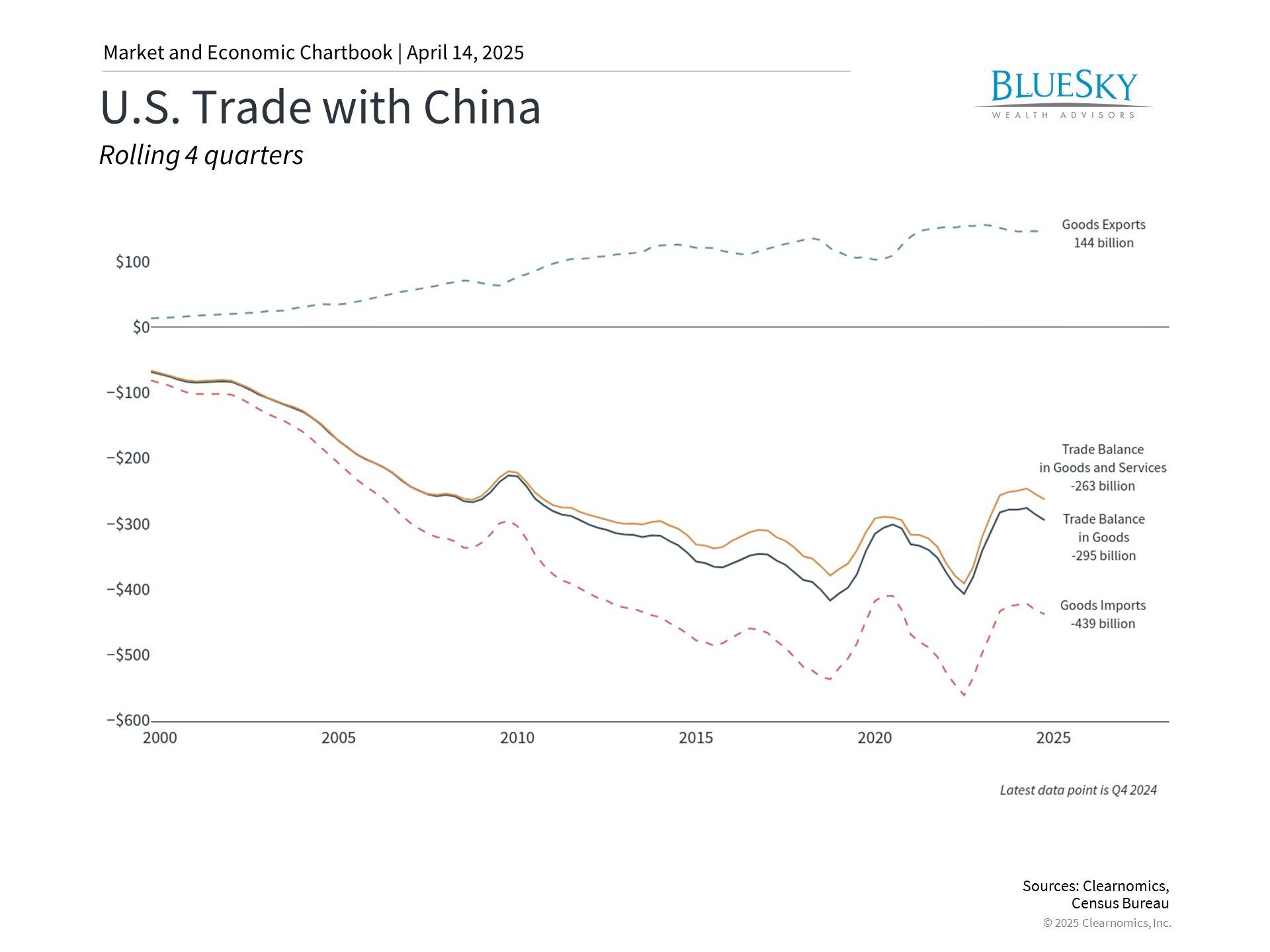

What distinguishes the current situation from previous trade tensions is both the scale of the tariffs and the broader geopolitical context. As illustrated in the accompanying chart, the U.S. maintains a substantial trade deficit with China. Tariff levels exceeding 100% effectively mean the price of goods crossing either border would more than double, assuming all other factors remain constant. This increases consumer prices, elevates business costs, and potentially slows economic activity. Concerns about accelerating inflation and deteriorating profit margins have triggered market volatility recently, with notable changes appearing in consumer surveys and corporate earnings forecasts.

Financial markets have also expressed concern about how far the White House might extend a trade confrontation with China. Since tariffs at current levels likely cannot be maintained indefinitely, they probably represent a negotiating stance by the administration. Evidence supporting this view includes the 90-day suspension of tariffs above 10% (except for China) and exemptions for technology products, suggesting the White House's primary goal remains securing agreements.

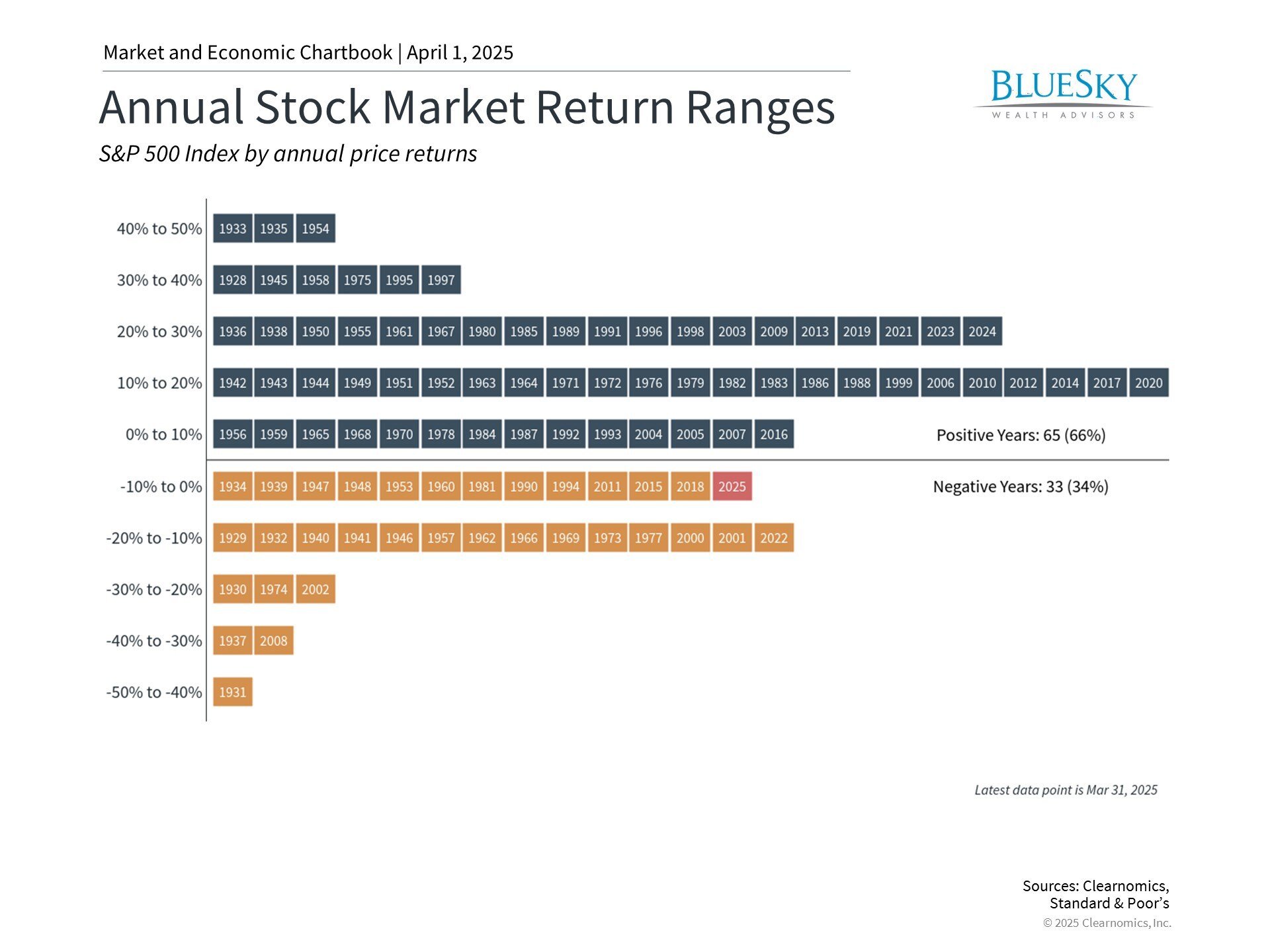

The tariffs implemented during 2018 and 2019 provide historical context for how markets and businesses might adapt as circumstances evolve. Many companies demonstrated adaptability by reconfiguring supply chains, identifying alternative suppliers, or absorbing portions of the increased costs. Despite market difficulties in 2018, performance improved in 2019 and again during the post-pandemic recovery period. The broader application of current tariffs creates greater challenges for companies this time, yet the significant market rally following the announcement of the 90-day pause demonstrates markets can recover when conditions improve.

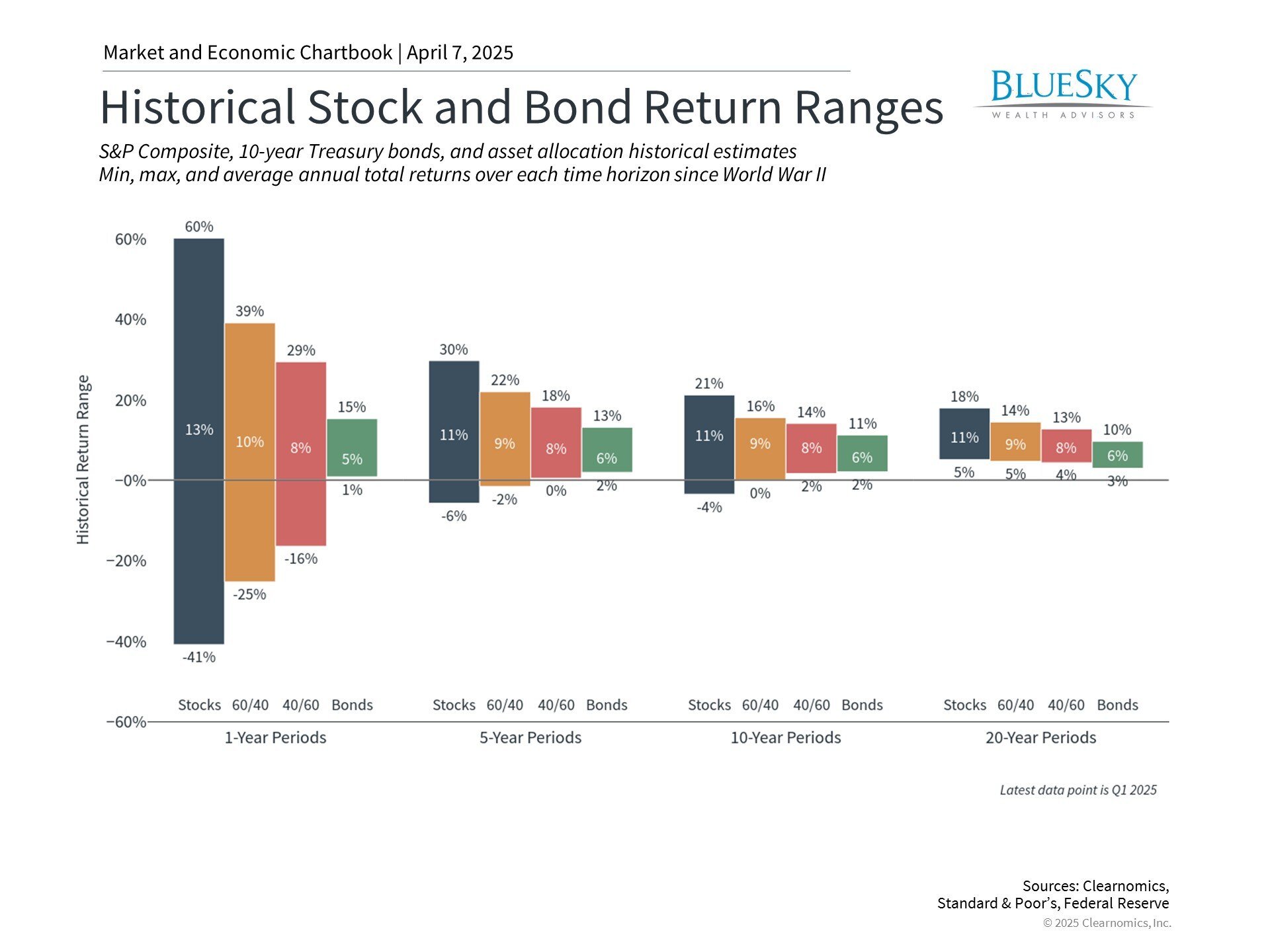

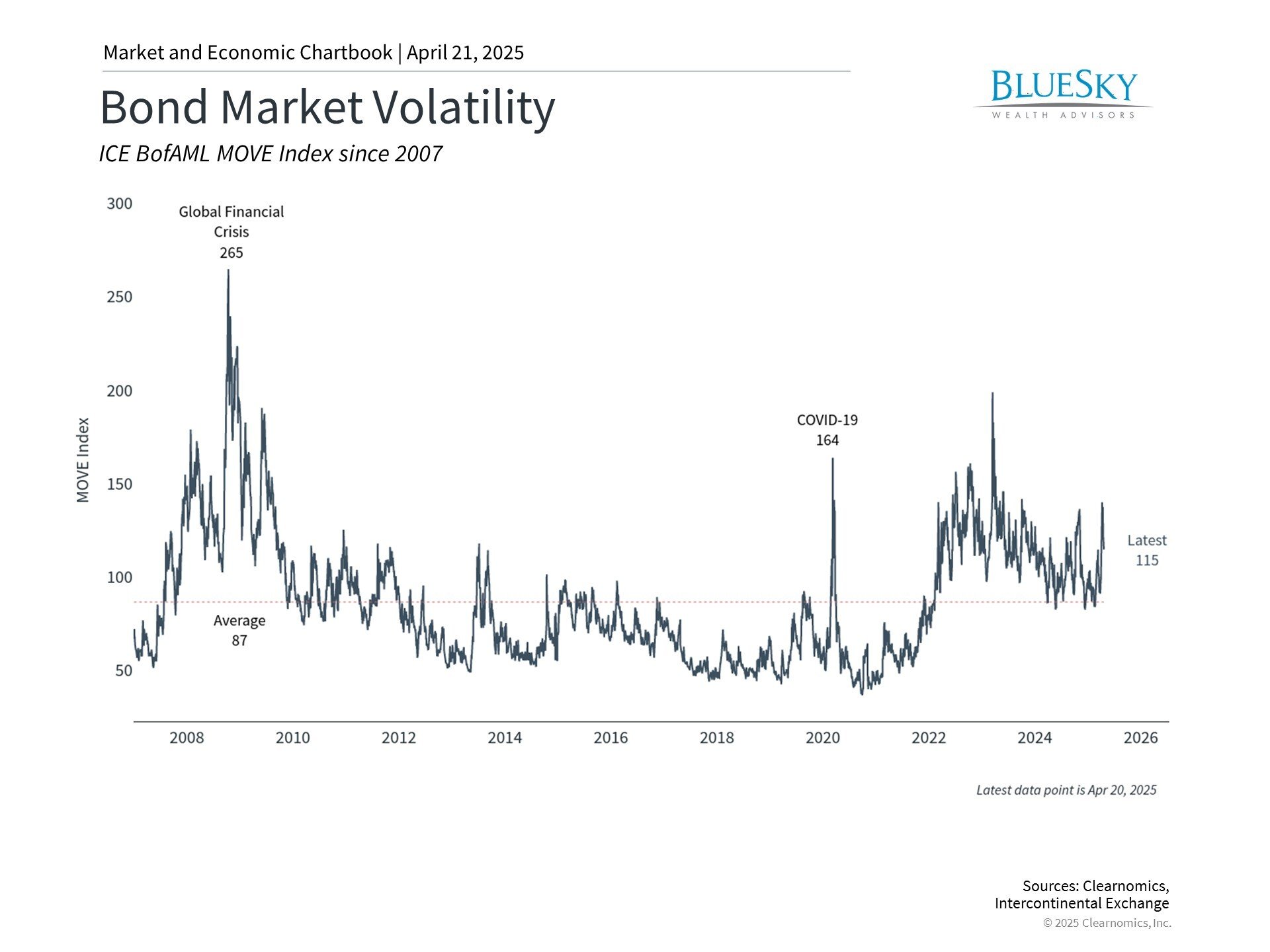

For investors with extended time horizons, challenging market environments often create potential opportunities. Valuations have become considerably more attractive compared to just a few months ago, both across the broader market and in sectors like Information Technology and Communication Services that drove the recent bull market. While rising interest rates have contributed to bond market volatility, they also provide investors with enhanced opportunities to generate portfolio income.

China faces numerous economic headwinds

While considerable attention has focused on the U.S. response to trade tensions, China confronts its own set of economic challenges. These include ongoing concerns about real estate market instability and financial system vulnerabilities that could affect its capacity to withstand trade pressures. China's economic recovery following the pandemic has been inconsistent, with GDP growth decelerating to 5.4% year-over-year in late 2024, according to official Chinese government data. Numerous economists have already reduced their growth forecasts for 2025 below the government's target of 5%.

Chinese leadership is reportedly considering additional stimulus measures. These would supplement significant stimulus initiatives implemented last year, including a 5-year, 10 trillion-yuan package supporting local government debt issues, commitments to increase budget deficits, interest rate reductions, lower bank reserve requirements, and various measures to stabilize the real estate market.

In recent days, the People's Bank of China has permitted the yuan to weaken, potentially offsetting tariff impacts, including setting its currency peg at the weakest level since September 2023. Currency devaluation can enhance export competitiveness by making goods less expensive for international buyers. However, this approach carries risks including potential capital outflows, particularly concerning for China as it could further destabilize its financial system. Such actions may also be interpreted by the White House as attempts to circumvent tariff effects.

The chart above, which indexes major currencies to a value of 100 from two years ago, illustrates recent currency market volatility. Beyond the yuan's movements, the U.S. dollar index has declined to the lower end of its three-year range. This contradicts some expectations since, theoretically, tariffs typically reduce imports, decreasing demand for foreign currency and consequently strengthening the domestic currency.

U.S. government debt remains predominantly domestically held

Some investors express concern that China's ownership of U.S. Treasury securities provides excessive leverage over the American economy. Questions have emerged about whether recent bond market movements reflect selling by countries like China. While difficult to confirm definitively, government data shows that China's Treasury holdings represent approximately 2.1% of total U.S. government debt. Importantly, most Treasury securities remain domestically held by U.S. individuals, corporations, and various federal, state, and local government entities.

If China were to substantially reduce its Treasury holdings, this might cause temporary market volatility and briefly increase U.S. interest rates. However, China and other nations maintain U.S. Treasuries, dollar reserves, and other foreign assets for a crucial reason: financial stability. The U.S. dollar and Treasury securities have consistently maintained their "safe haven" status even during periods of uncertainty. This pattern has persisted over recent years despite inflation concerns, budget challenges, U.S. debt downgrades, and various other issues.

The bottom line? Despite intensifying U.S.-China trade tensions creating market uncertainty, historical evidence demonstrates the long-term resilience of financial markets. Maintaining a diversified portfolio aligned with your long-term financial objectives remains the most effective strategy for navigating evolving global economic conditions.