Balancing Risk and Opportunity in Today's Market Environment

Balancing Risk and Opportunity in Today's Market Environment

Global financial markets have been roiled by escalating trade tensions, with concerns over reciprocal tariffs between major economies, particularly involving China, stoking recession fears. This uncertainty has triggered market declines worldwide and prompted investors to seek refuge in safer assets, leading to rising bond prices and falling yields.

Strategic portfolio construction is crucial in uncertain times

Much like athletics, successful investing requires both defensive and offensive strategies. The defensive aspect involves structuring a portfolio to weather various market conditions. Given the inevitability of market volatility and unexpected events, maintaining strong defensive positioning is essential.

Conversely, offensive strategies seek to capitalize on market opportunities as they arise. Though market uncertainty can be unsettling, these periods often present attractive entry points for long-term investors. The key is finding the right balance between protection and opportunity in a portfolio aligned with your financial objectives.

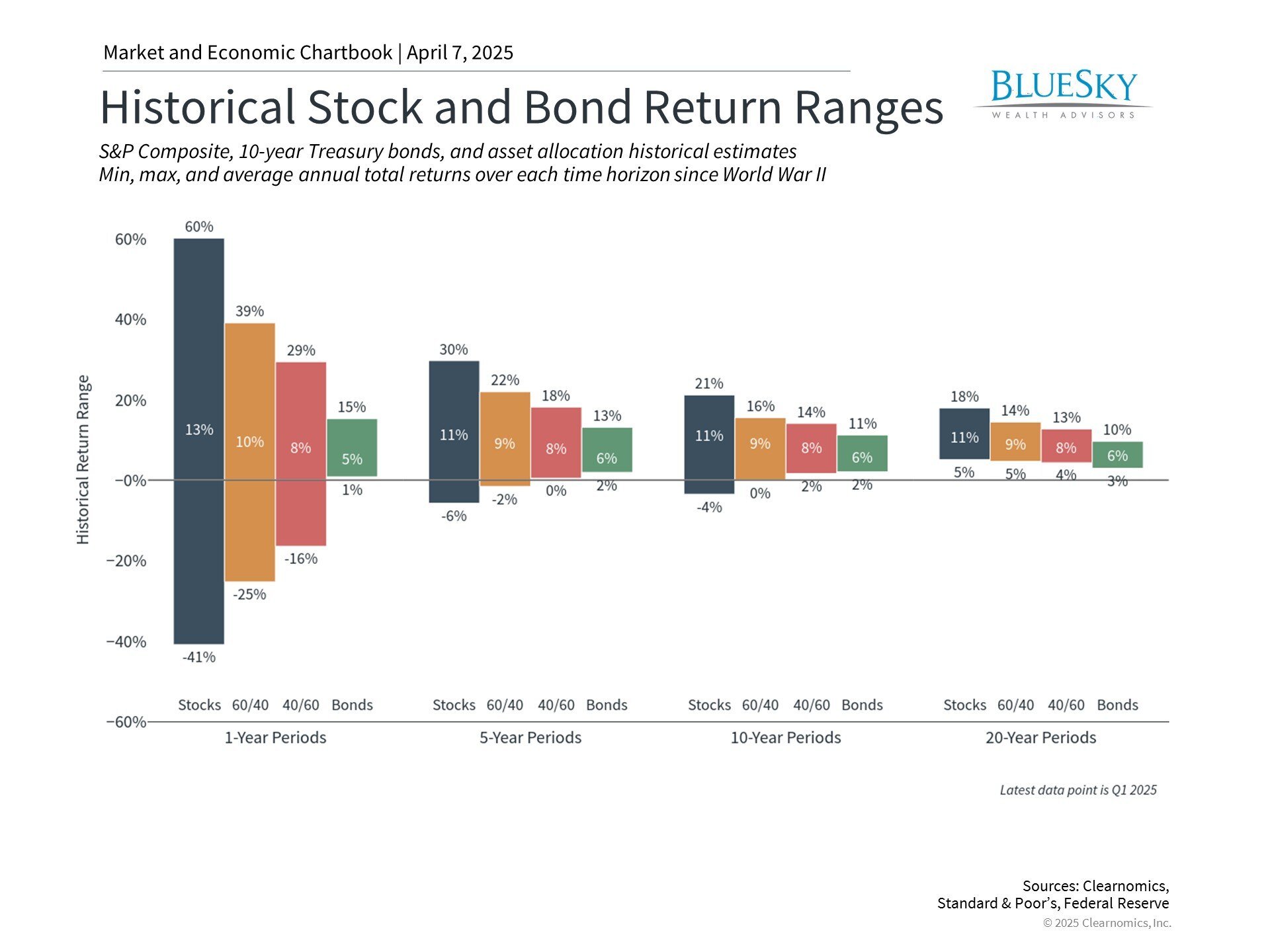

The power of diversification and long-term investing is illustrated in the accompanying chart, which shows historical performance ranges across different asset types and time periods. The data reveals significant variation in single-year stock market returns, from a 60% gain in 1983 following stagflation concerns to a 41% decline during the 2008 financial crisis.

Expanding beyond stocks and lengthening time horizons demonstrates the benefits of diversification. While a balanced portfolio may limit maximum potential returns, it also reduces risk exposure. This year's market performance provides a clear example - while the S&P 500 has fallen 13%, a portfolio with 60% stocks and 40% bonds has only declined 4.6%.

The primary objective isn't maximizing returns at any cost, but rather optimizing the probability of achieving specific financial goals. A well-diversified portfolio typically experiences less extreme outcomes, enabling more reliable financial planning.

Time horizon also significantly impacts investment outcomes. Since World War II, no 20-year period has produced negative average annual returns for these asset types and portfolio combinations. Many diversified portfolios show similar results over 10-year periods. While past performance doesn't guarantee future results, this highlights the advantages of maintaining a long-term perspective.

Market volatility can create potential opportunities

The VIX index, commonly called the market's "fear gauge," tends to spike during periods of market stress. These peaks coincide with sharp market declines, as seen in 2008 and 2020, when investor sentiment reaches extreme levels of pessimism.

The chart also displays subsequent 12-month S&P 500 returns. While no single-year outcome is guaranteed, history suggests that significant opportunities often emerge during periods of peak market fear. This pattern exemplifies Warren Buffett's famous advice to "be fearful when others are greedy, and greedy when others are fearful."

This is particularly relevant when markets face liquidity rather than solvency issues. Liquidity-driven selloffs occur when leveraged investors are forced to liquidate positions, potentially creating disconnects between asset prices and fundamental values. These situations can present opportunities for patient investors.

However, this shouldn't be interpreted as an endorsement of market timing. Even elevated VIX readings don't guarantee immediate market recoveries. Instead, investors should consider this within their broader portfolio strategy. Market declines often coincide with improved valuations, potentially warranting selective increases in exposure to affected assets, depending on individual circumstances.

Market conditions have created more favorable valuations

Bonds have demonstrated their portfolio diversification benefits this year as falling interest rates have helped offset declines in other assets. This illustrates bonds' typically lower volatility and tendency to move inversely to stocks - the "zig when stocks zag" phenomenon that makes them valuable portfolio components.

Current market conditions have improved valuations following several years of strong equity returns. While the impact of tariffs on earnings remains uncertain, the S&P 500's price-to-earnings ratio has decreased to 20.7x. Information Technology, Communication Services, and Consumer Discretionary sectors have experienced particularly notable multiple compression.

Traditional safe-haven assets like gold have shown mixed performance recently. Despite reaching record highs earlier this year and delivering double-digit returns over the past twelve months, gold prices have retreated amid broader commodity market weakness. This underscores the importance of maintaining a diversified portfolio rather than relying on any single asset class.

The bottom line? Successfully navigating market uncertainty requires both defensive positioning and the ability to capitalize on opportunities. A well-constructed portfolio that balances both elements remains the most effective approach to achieving long-term financial objectives.