Trade Progress Between U.S. and China: What Investors Should Know

Trade Progress Between U.S. and China: What Investors Should Know

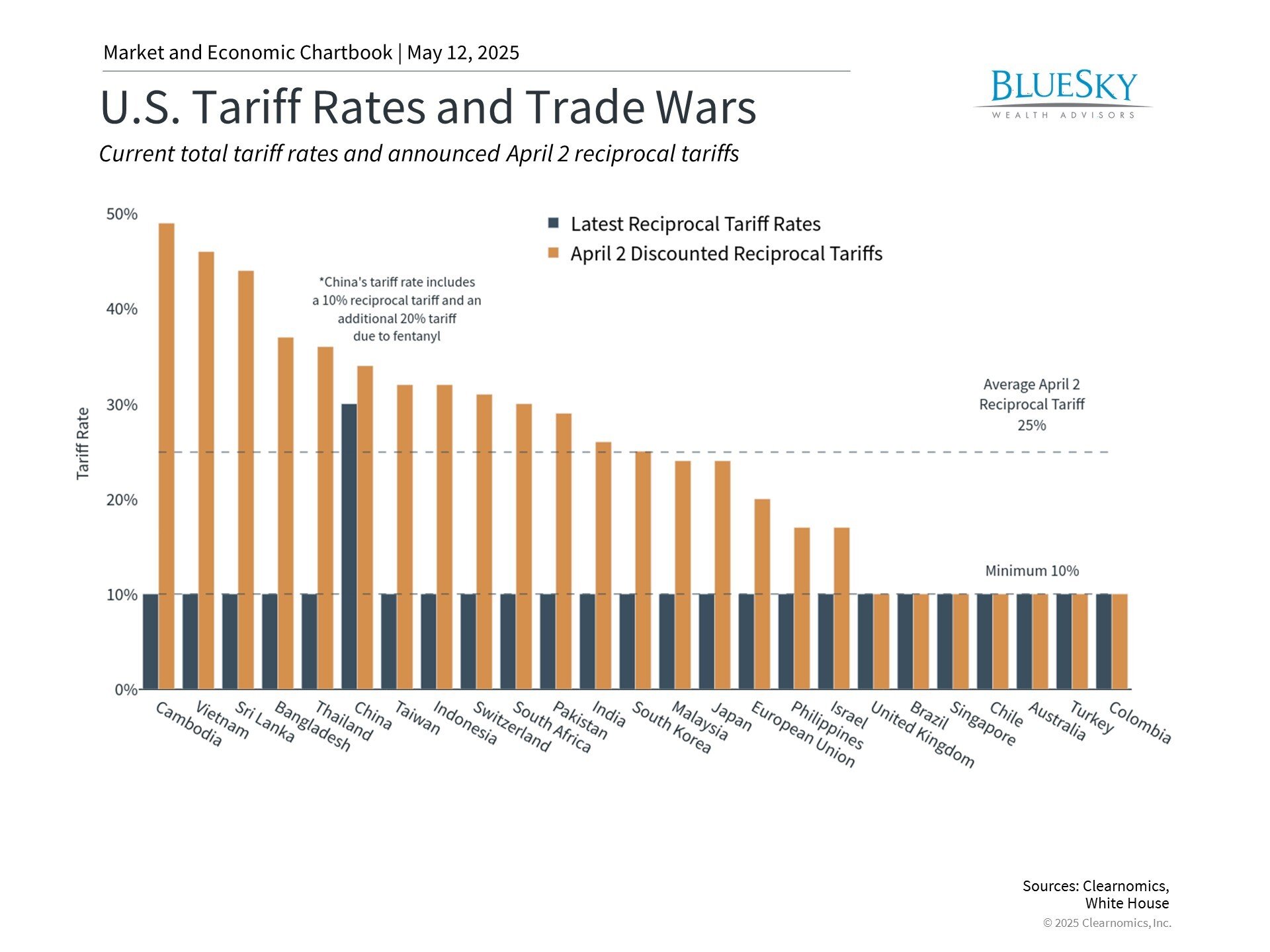

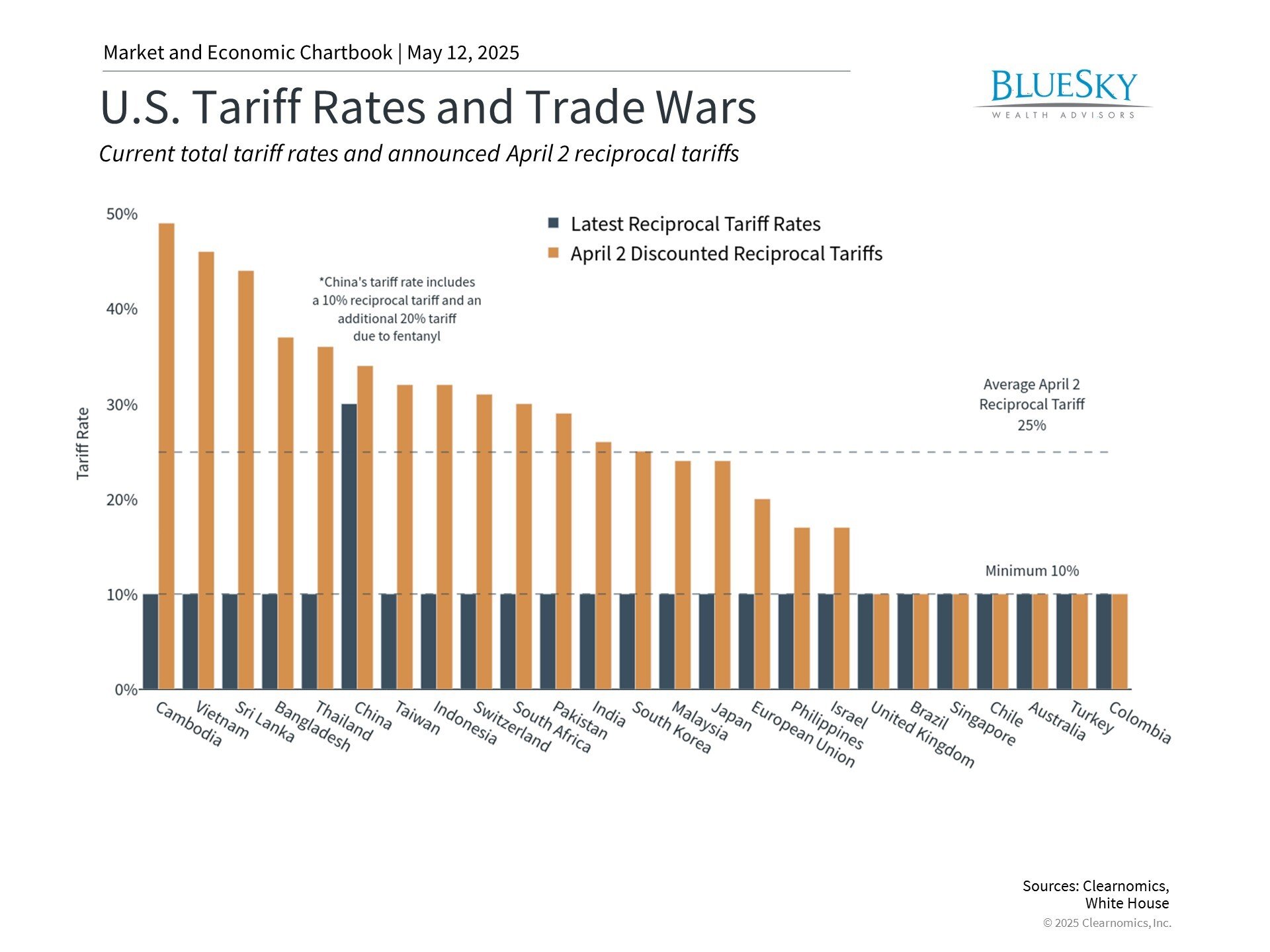

The recently announced trade arrangement between the United States and China has significantly reduced many of the tariffs that caused financial market turbulence beginning in April. Under this 90-day agreement, U.S. tariff rates on Chinese products have decreased from 145% to 30%, while China's rates on American goods have been lowered to 10%. Combined with tariff suspensions affecting other trading partners and a newly established trade agreement with the United Kingdom, financial markets are increasingly optimistic that an extended trade conflict may be avoided. How should long-term investors interpret this evolving market situation?

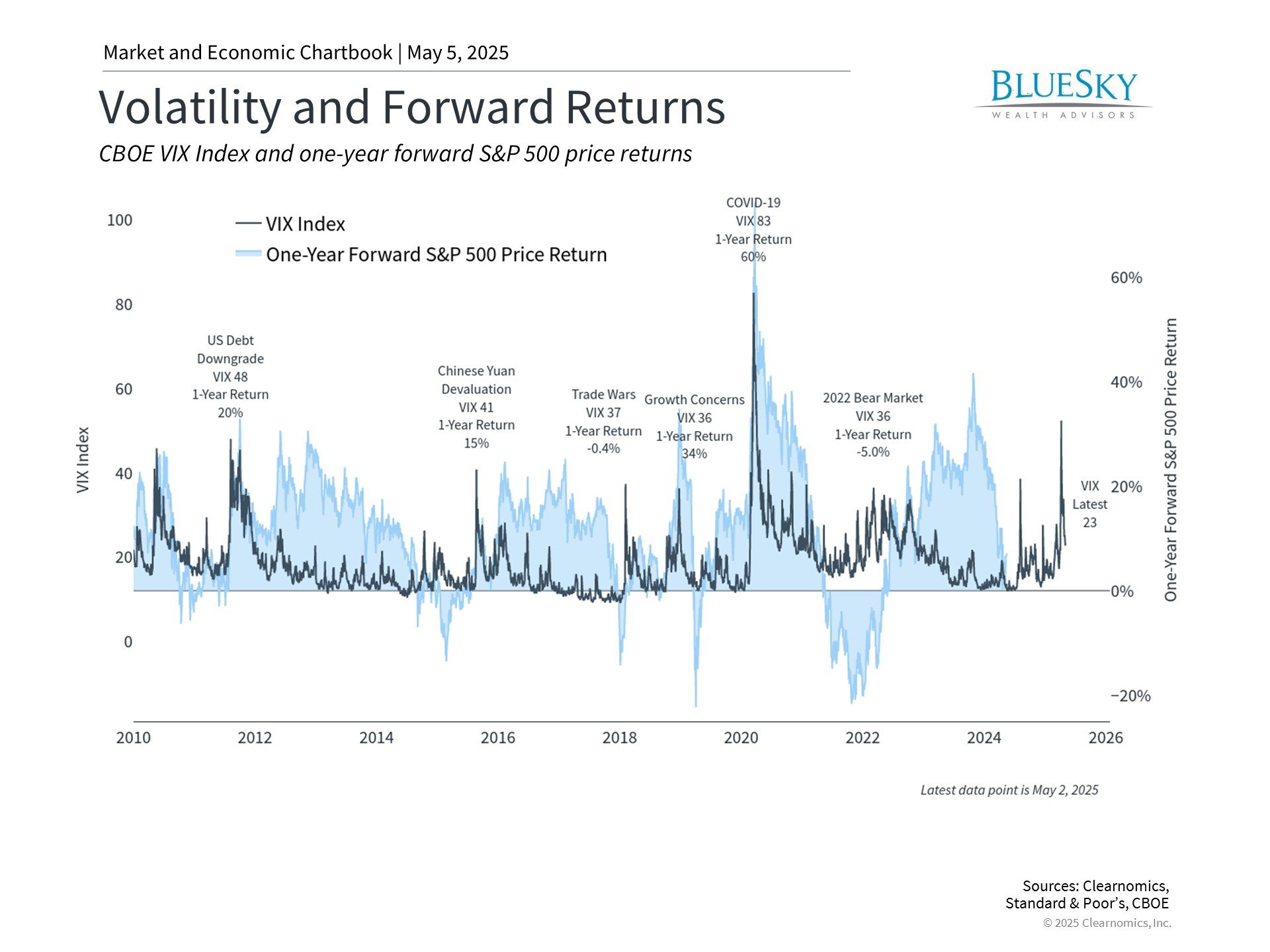

Financial markets typically react most negatively to uncertainty and unexpected developments. This occurs because markets often price in worst-case scenarios immediately, then adjust as additional information becomes clear. While the unexpected magnitude and breadth of the April 2 tariff announcements triggered a sharp market decline, we've also witnessed a quick recovery over recent weeks.

Currently, markets are trading near their year-opening levels and slightly higher than their positions before the April 2 tariff announcement. This pattern aligns with numerous historical examples where recoveries happen once greater clarity emerges. These recent events serve as another reminder of why maintaining a long-term investment perspective remains crucial during uncertain periods.

The agreement between the U.S. and China signals potential for a comprehensive deal

The new tariff arrangement between the United States and China represents positive progress by eliminating a major source of market uncertainty. It establishes the U.S. reciprocal tariff on Chinese products at 10% while preserving the 20% tariff related to the fentanyl crisis implemented earlier this year. Although the situation continues to develop, this agreement creates a pathway toward a more comprehensive trade deal between the world's two largest economies and reduces tensions. Therefore, while tariff rates remain higher than previous levels, the probability of worst-case outcomes has diminished.

Looking back, current events mirror the trade tensions experienced during 2018 and 2019 in the first Trump administration. In both instances, the administration has employed tariffs as negotiating leverage to secure new trade agreements, with the declared objective of reducing the U.S. trade deficit with major trading partners. Five years ago, this approach resulted in the "Phase One" trade agreement with China, the USMCA (United States-Mexico-Canada Agreement), and several other arrangements.

These trade policies encompass multiple interconnected objectives, including boosting manufacturing employment, safeguarding intellectual property, managing immigration, and additional priorities. The key distinction today is that the administration has escalated tariff threats beyond what many investors and economists had anticipated. Nevertheless, the recently announced trade agreement between the U.S. and the U.K. suggests similar patterns may be emerging. This agreement establishes a baseline 10% tariff rate on British goods, with specific provisions allowing importation of up to 100,000 vehicles at this rate plus exemptions for steel and aluminum products.

Economic indicators remain strong despite trade uncertainties

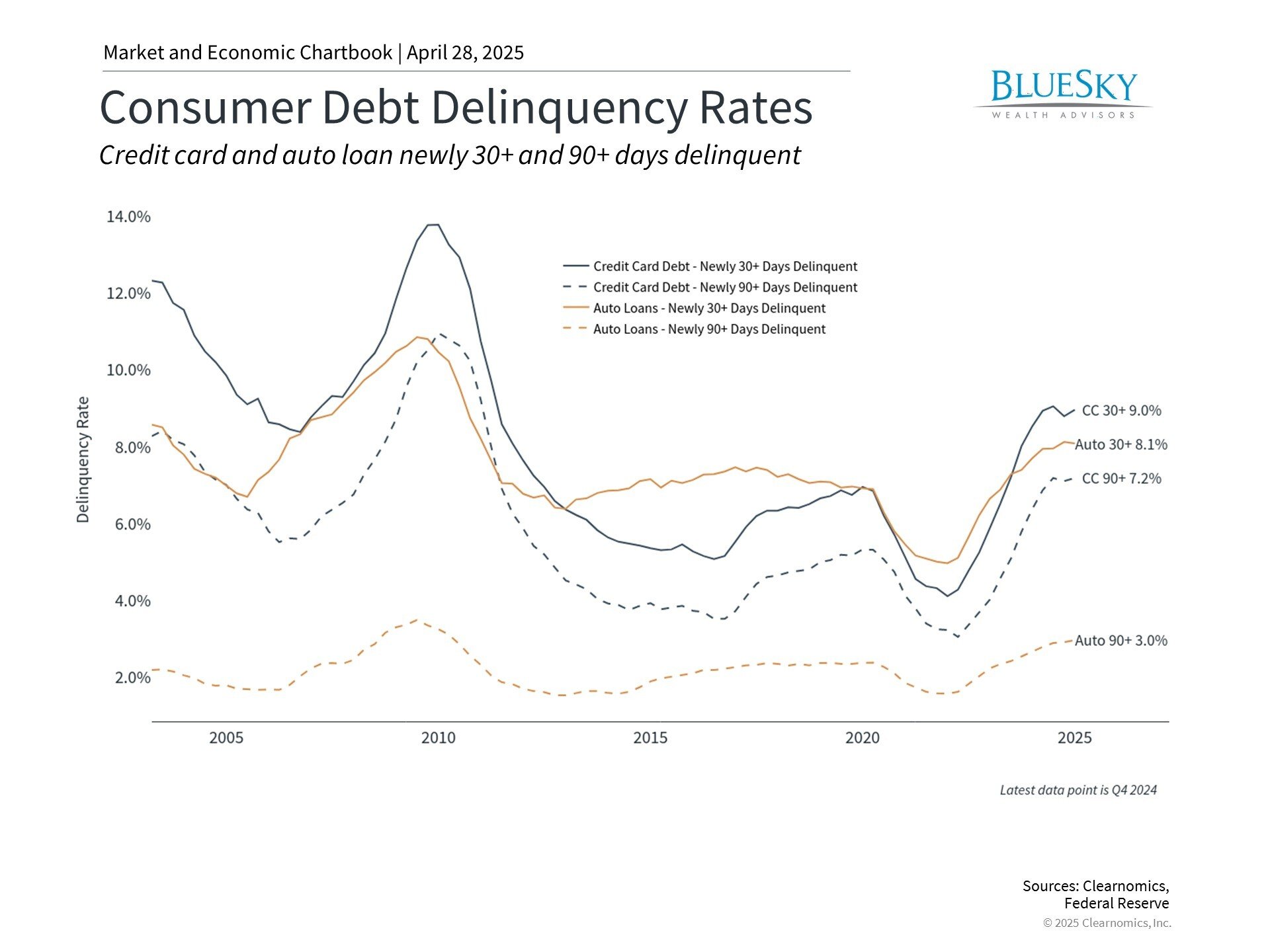

Certainly, final trade agreements with China and numerous other countries have not yet been completed, and daily headlines could continue driving market fluctuations, particularly if existing tariff pauses expire. A significant reason markets have focused intensely on tariffs stems from their impact on inflation and economic growth. This was evident in the first quarter's GDP figure showing a slight economic contraction as businesses accumulated imported goods ahead of tariff implementation dates. Increased clarity will likely benefit both consumers and businesses.

In this environment, what positive developments might emerge? First, many economic indicators continue showing strength. The most recent employment report revealed the economy added 177,000 positions in April, exceeding expectations of 138,000. The unemployment rate remained steady at 4.2%, continuing a period of stability that began last May. This robust job market helps counterbalance concerns that tariffs and uncertainty might impact consumer spending.

Meanwhile, inflation continues its gradual movement toward the Fed's 2% target, with the latest Consumer Price Index reading at 2.4% year-over-year. This deceleration has been supported by declining oil prices, which recently reached four-year lows. Lower oil prices, partly influenced by tariff-related volatility, help reduce costs for consumers and can stimulate economic activity, all else being equal.

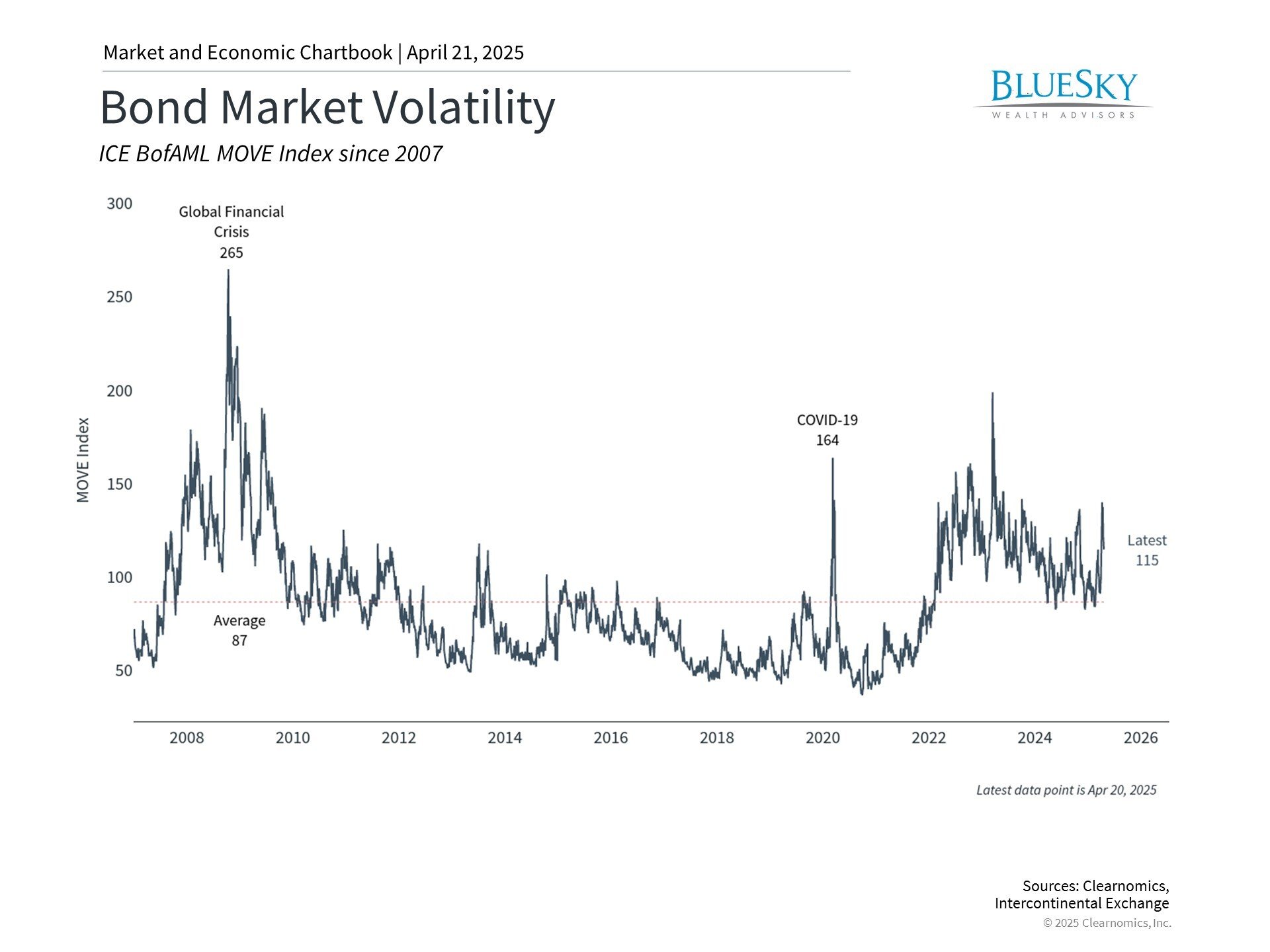

The recent U.S.-China agreement also diminishes pressure for immediate Federal Reserve policy adjustments. Market-based measures still anticipate further rate cuts this year, but expectations have moderated to just two or three reductions, possibly beginning in July or September. The Fed, which recently maintained rates between 4.25% and 4.5%, appears to be adopting a cautious approach rather than reacting to short-term trade, market, and economic developments.

Markets often rebound when least anticipated

While numerous market risks persist, the past several weeks demonstrate how rapidly narratives can shift. By their nature, markets tend to anticipate worst-case scenarios. During periods of negative headlines and market declines, imagining an eventual recovery becomes challenging. While understanding potential risks remains prudent, this shouldn't compromise long-term portfolio positioning.

The accompanying chart illustrates how market corrections have behaved since World War II. While the average correction experiences a 14% decline, recovery often occurs in as little as four months. Most significantly, markets frequently rebound when least expected, as we've witnessed following recent progress in trade negotiations. Investors who overreact to early signs of volatility may find themselves inappropriately positioned relative to their financial objectives.

The bottom line? The most recent U.S.-China trade announcement has reduced market uncertainty and alleviated recession concerns. For long-term investors, this reinforces the importance of maintaining perspective during market turbulence rather than reacting to short-term volatility.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.