May 2025 Market Review: Recovery Continues Despite Credit Rating Concerns

May 2025 Market Review: Recovery Continues Despite Credit Rating Concerns

May brought renewed optimism to financial markets as the S&P 500 erased its year-to-date decline and returned to positive territory. The month's gains unfolded amid evolving trade discussions, varied economic indicators, and persistent questions about America's fiscal trajectory. Although economic data continued reflecting underlying strength, consumer confidence remained subdued regarding future prospects. Interest rates on government bonds experienced volatility throughout the period as investors weighed federal budget concerns and spending priorities. For investors with long-term horizons, May demonstrated how markets can navigate through periods of policy uncertainty and adapt to shifting circumstances.

Key Market and Economic Drivers1

- The S&P 500 advanced 6.2% in May, marking its strongest monthly performance since 2023, while the Dow Jones Industrial Average climbed 3.9%, and the Nasdaq surged 9.6%. For the year through May, the S&P 500 stands at +0.5%, the Dow at -0.6%, and the Nasdaq at -1.0%.

- The Bloomberg U.S. Aggregate Bond index dropped 0.7% during May but maintains a 2.4% year-to-date gain. The 10-year Treasury yield concluded May at 4.4%.

- Global equities also delivered solid returns, with both the MSCI EAFE index for developed markets and the MSCI EM index for emerging markets advancing 4.0%.

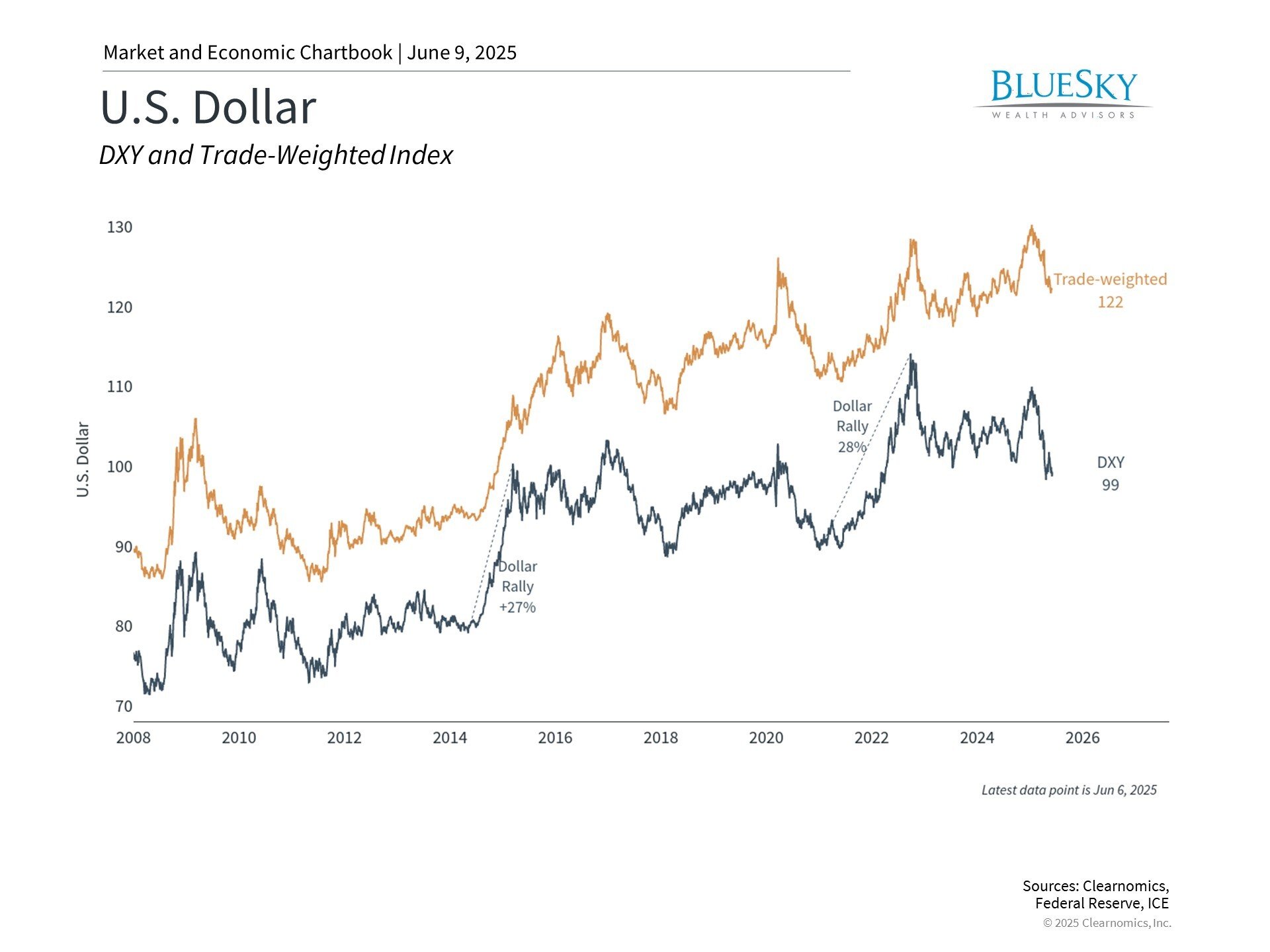

- The U.S. dollar index continued its decline, finishing May at 99.3, approaching three-year lows.

- Bitcoin reached a fresh all-time high of $111,092 before settling at $104,834 by month-end.

- Gold similarly established a new peak at $3,422 before closing May at $3,288, representing a 24% year-to-date increase.

- May's Consumer Price Index data revealed that consumer prices increased 2.3% year-over-year in April, marking the smallest 12-month gain since February 2021.

- Employment growth remained steady with 177,000 jobs added in April, while unemployment held at a low 4.2%.

Market resilience emerges amid ongoing uncertainties

May's strong market performance highlights the value of maintaining investment discipline during volatile periods. Following April's market stress, equity markets showed their capacity to rebound quickly and regain lost ground when conditions improve. This recovery pattern reflects how rapidly investor sentiment can shift as uncertainties begin to resolve, a dynamic witnessed repeatedly over recent years. However, past performance cannot predict future results, and markets will likely continue grappling with trade developments, fiscal concerns, and economic health in upcoming months.

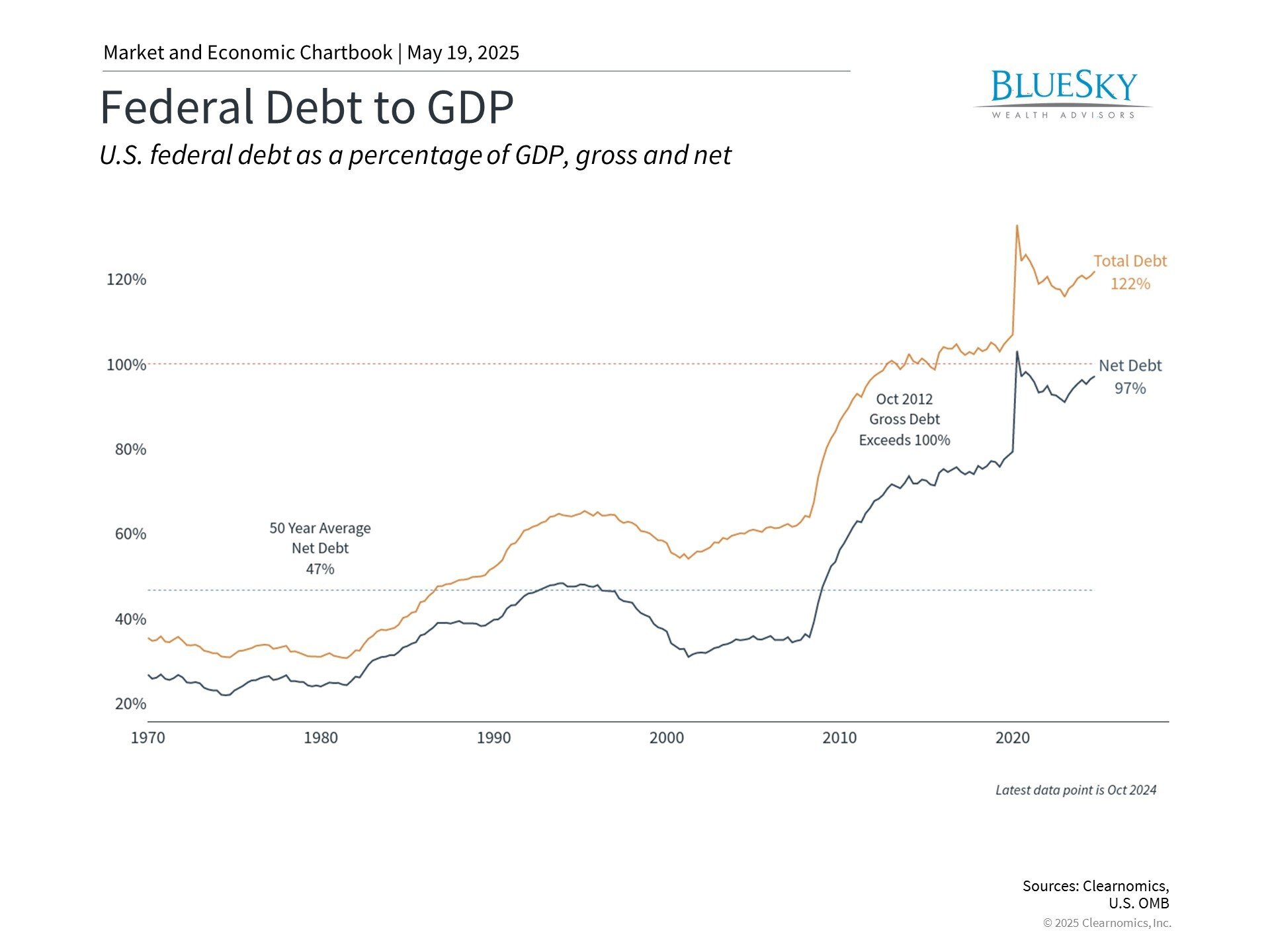

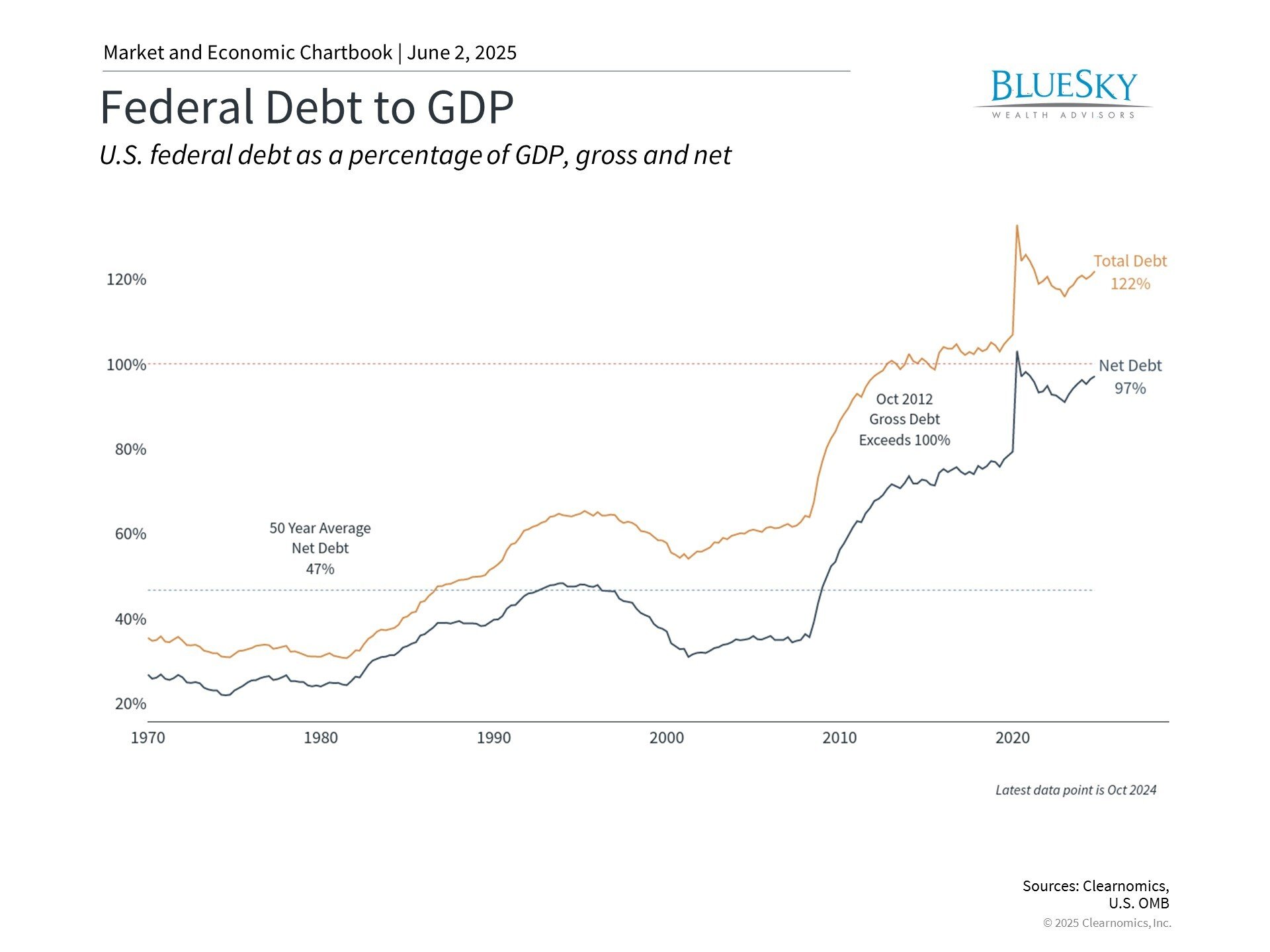

Credit agency reduces U.S. government rating

May delivered an unexpected development when Moody's reduced the U.S. credit rating from Aaa to Aa1. This action joins earlier downgrades by Fitch in 2023 and Standard & Poor's in 2011, all citing worries about escalating debt levels and government expenditures. The chart demonstrates how U.S. total debt reached 122% of GDP in 2024, while net debt, excluding intragovernment holdings, climbed to 97%.

Market reaction to this significant credit downgrade proved remarkably subdued. Investors appeared to view the action as largely reflecting known fiscal challenges rather than introducing new concerns. The limited market response also draws from experience with the 2011 Standard & Poor's downgrade, when Treasury securities maintained their status as preferred safe-haven investments despite the rating change.

The timing coincided with House passage of comprehensive fiscal legislation extending individual tax provisions from the Tax Cuts and Jobs Act. Key elements include maintaining the 37% top tax rate, preserving child tax credits, raising State and Local Tax deduction limits, and creating exemptions for tips and overtime compensation. The Penn Wharton Budget Model estimates this legislation could expand deficits by $2.8 trillion over the coming decade.2 Senate consideration and potential modifications await.

While these fiscal challenges clearly require long-term attention, the U.S. dollar's role as the global reserve currency ensures continued Treasury demand for the foreseeable future.

Commercial negotiations advance positively

May witnessed meaningful advancement in trade discussions, reducing concerns about severe economic disruption. The administration secured agreements with both the U.K. and China while maintaining active negotiations with additional major partners. The U.S.-China arrangement established a 90-day window of reduced American tariffs on Chinese imports.

Trade uncertainty persists despite these achievements. Recent tensions emerged as both nations accused each other of agreement violations, while the administration pursues elevated tariffs on steel and aluminum products. However, European Union discussions generated optimism when the White House postponed planned 50% EU tariffs following constructive dialogue, suggesting diplomatic solutions remain viable even from seemingly entrenched positions.

Legal complications also emerged regarding tariff authority. The U.S. Court of International Trade invalidated numerous recently implemented tariffs in May, determining they exceeded presidential authority under the International Economic Emergency Powers Act. Although a federal appeals court suspended this ruling temporarily, maintaining current tariffs, the legal challenge introduces additional uncertainty to trade policy.

Trade policy development typically requires months or years rather than immediate resolution. May's market recovery reminds investors to avoid overreacting to trade-related news, particularly as extreme negative scenarios appear less probable.

Corporate earnings provide market foundation

First quarter corporate results offered additional encouragement for market participants. S&P 500 companies exceeded earnings per share expectations while 64% surpassed revenue projections, according to FactSet data.3 This robust earnings performance demonstrated corporate profitability's fundamental strength, with technology sector companies displaying particular resilience amid trade policy uncertainties.

Consumer sentiment contrasted with corporate performance, remaining pessimistic throughout the year due to tariff and inflation worries. Nevertheless, recent sentiment measures began indicating improvement that better aligns with positive earnings and economic fundamentals. The University of Michigan's May survey reflected slightly lower inflation expectations and stabilizing sentiment levels. While single-month data requires cautious interpretation, this improvement represents a constructive development that could support market performance alongside strong economic conditions.

The bottom line? May delivered encouraging results for market participants despite new fiscal challenges from the U.S. credit downgrade. Trade agreement progress helped drive market gains, reminding long-term investors to maintain perspective and focus on fundamental economic trends rather than temporary policy developments.

- Standard & Poor's, Nasdaq, Bloomberg. All month end figures are as of May 30, 2025.

- https://budgetmodel.wharton.upenn.edu/issues/2025/5/23/house-reconciliation-bill-budget-economic-and-distributional-effects-may-22-2025

- FactSet Earnings Insight May 30, 2025

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.