Market Outlook 2025: Finding Balance in an Era of Change

Market Outlook 2025: Finding Balance in an Era of Change

French novelist Balzac's observation that "our worst misfortunes never happen, and most miseries lie in anticipation" aptly describes the market environment of 2024. Despite widespread fears about recession risks, market declines, and electoral uncertainty, many of these concerns proved unfounded.

As we close out the year, markets have demonstrated remarkable resilience. The S&P 500 has reached historic highs, inflation continues to moderate, economic growth remains robust, and monetary policy has shifted toward easing. These developments highlight how excessive caution can potentially compromise long-term investment success.

While recent years have been characterized by extremes - from the market downturns of 2020 and 2022 to the strong recoveries of 2021, 2023, and 2024 - the coming year presents an opportunity to restore equilibrium, both in terms of market dynamics and investor sentiment.

Moving forward, maintaining investment discipline becomes increasingly crucial. Current market valuations exceed historical averages, monetary policy remains in flux, questions surround technological advances, and global tensions persist. Unexpected developments will likely continue to test investor resolve.

The experience of the past year offers valuable guidance for navigating 2025 and beyond. Here are five key insights to help investors maintain perspective during periods of uncertainty.

1. Economic resilience has buoyed financial markets

Contrary to widespread concerns about a severe economic downturn amid tight monetary policy, the economy has demonstrated remarkable strength. Inflation has retreated toward normal levels, employment remains robust, and growth has exceeded expectations - outcomes few anticipated at the start of 2024.

Current economic indicators paint an encouraging picture: inflation has moderated to 2.6% annually, unemployment stands at just 4.2%, and the economy has added 2.3 million jobs over twelve months. Third-quarter GDP growth reached 2.8%, surpassing most forecasts.

This economic vigor has supported broad-based asset appreciation. Domestic equities have achieved new peaks, international stocks continue to advance, and bonds have rallied as rates stabilize. Gold has reached record levels, while Bitcoin has surged following the presidential election.

However, challenges remain on the horizon. Consumer spending may moderate as savings decrease, while debt levels pose concerns for both consumers and businesses. Recent sharp price appreciation in certain assets may lead to increased volatility. During such periods, emphasis on fundamental analysis becomes essential.

Corporate performance has helped drive market gains, with earnings growing 8.6% over twelve months to reach $236 per share for the S&P 500.

However, stock prices have advanced more rapidly than earnings, pushing valuations higher. The market's price-to-earnings ratio now stands at 22.3, significantly above the 15.7 historical average and approaching the 24.5 peak seen during the dot-com era.

These elevated valuations carry important implications. First, they emphasize the need for balanced portfolio construction incorporating bonds and international investments. Second, they suggest potential opportunities in market segments trading at more reasonable levels.

While technology and AI-related stocks have led recent gains, market strength has broadened considerably. All eleven sectors have posted positive returns this year. Given the difficulty in predicting sector leadership, broad diversification can help provide portfolio stability.

The Federal Reserve initiated rate cuts in September, lowering rates by 75 basis points thus far. Markets anticipate three to four additional reductions through 2025.

While the precise timing and scale of future cuts remain uncertain, the shift from monetary tightening to easing marks an important transition. Just as higher rates created headwinds, lower rates may help support economic activity and potentially benefit investment returns over time.

The evolving policy environment may particularly benefit fixed income investments as inflation and growth normalize. Lower short-term rates combined with stable longer-term yields could support bond prices while maintaining attractive income levels. This environment may create opportunities for balanced investors seeking both growth and income.

Rather than attempting to predict specific policy moves, investors should focus on the broader trajectory of monetary policy. As Fed policy becomes clearer, market attention may increasingly turn to the incoming administration's agenda.

4. From electoral uncertainty to policy implementation

Markets have responded positively to reduced electoral uncertainty and expectations of business-friendly policies. However, the nation remains politically divided, making it crucial to separate personal views from investment decisions.

Historical evidence shows that markets and the economy have performed well under both major parties. Economic cycles, which depend on numerous factors beyond politics, typically exert greater influence on investment outcomes than presidential administrations.

The post-election environment provides greater clarity on tax policy, with key provisions of the Tax Cuts and Jobs Act likely to be extended. This affects various tax considerations from individual rates to estate planning. Professional guidance remains valuable for navigating these implications.

Policy challenges persist, particularly regarding trade relations and fiscal deficits. While new tariffs may be implemented, previous experience suggests worst-case scenarios often don't materialize. Similarly, while the $36 trillion national debt presents long-term challenges, markets have historically demonstrated resilience despite deficit concerns.

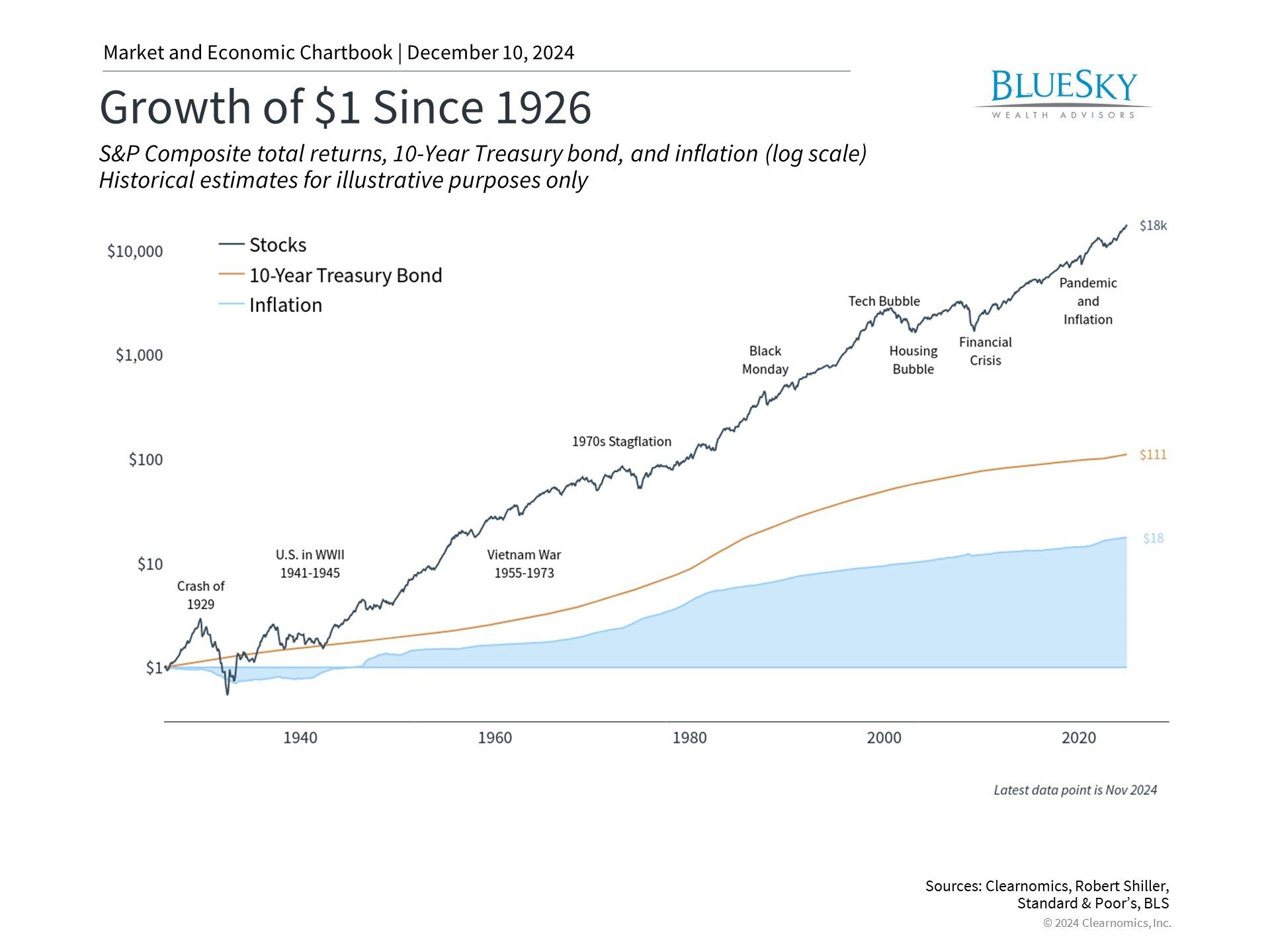

The past year reinforces that markets can thrive despite prevalent concerns. Brief pullbacks in April and August tested investor resolve, but maintaining course proved rewarding. Market resilience has been supported by economic growth, innovation, and broad-based strength across asset classes.

Historical perspective demonstrates that sustainable wealth creation occurs over extended timeframes. Even for retirees, maintaining a long-term outlook helps provide context for near-term events and supports better decision-making.

The bottom line? While we can celebrate strong market performance in 2024, the focus for 2025 should be on portfolio balance. Historical evidence suggests this approach best positions investors to weather uncertainty while pursuing long-term objectives.

BlueSky Disclosures

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.