How Fed Policy Affects Investment Strategy in an Uncertain Economy

How Fed Policy Affects Investment Strategy in an Uncertain Economy

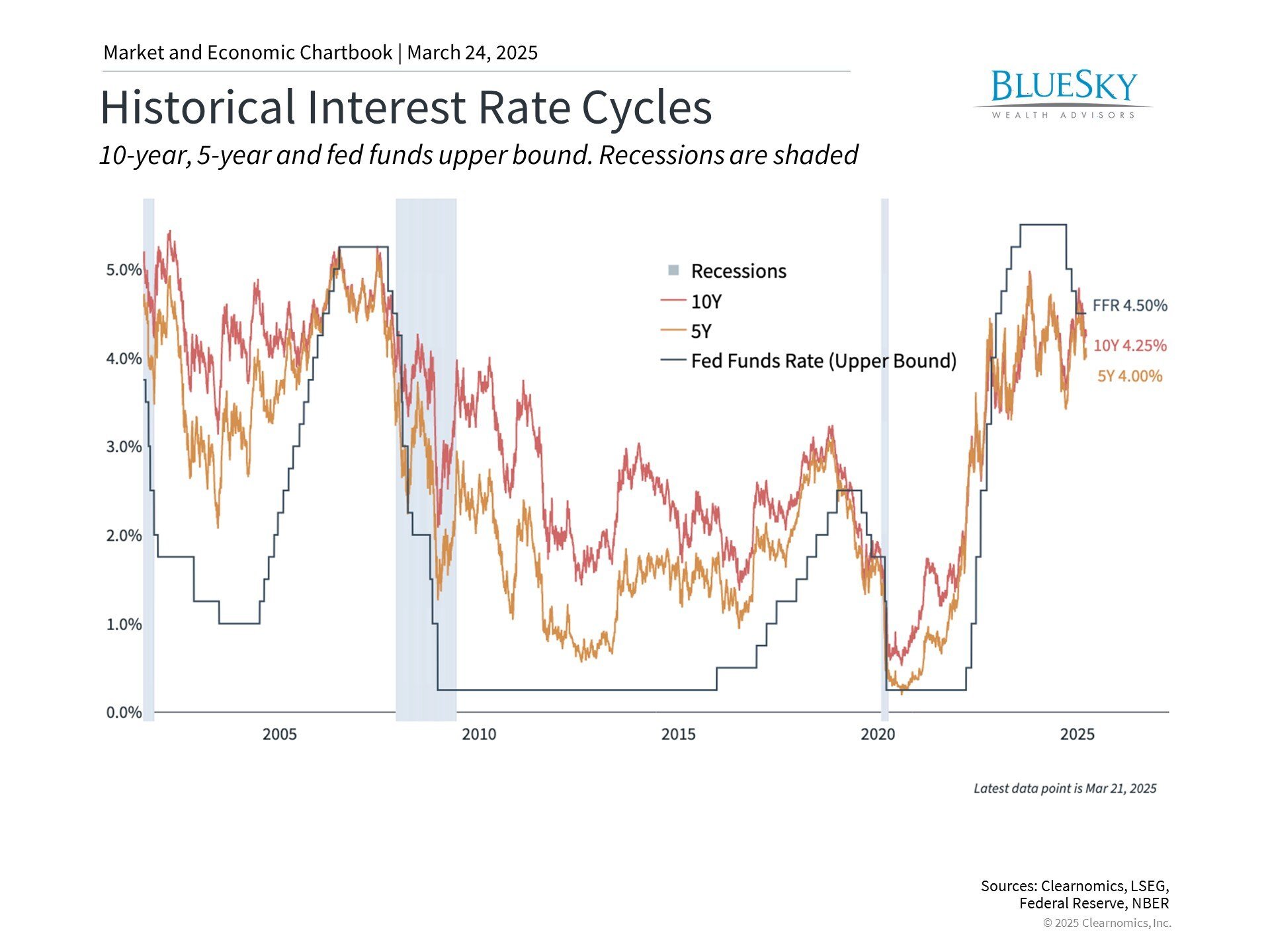

As we move through 2025, the Federal Reserve's monetary policy continues to shape market dynamics. Following rate hikes in 2022 and cuts in 2024, the Fed has now adopted a wait-and-see approach despite various economic challenges. Understanding the Fed's current stance and its implications is crucial for investors navigating today's market environment.

The Fed maintains rates as it balances economic risks

The Federal Reserve operates under a Congressional mandate to maintain price stability and maximum employment. This dual objective guided its aggressive rate increases in 2022 to combat inflation, followed by rate reductions in 2024 as price pressures moderated. The feared economic slowdown that many anticipated at the start of 2024 did not materialize.

Recent economic projections from the Fed's March meeting indicate a potential slowdown, with GDP growth forecasted at 1.7% for 2025, down from 2.4% in 2024 according to the Bureau of Economic Analysis. The last time growth fell below 2% was during the high-inflation period of 2022.

Despite rising concerns about inflation and unemployment, the Fed has maintained its rate guidance. This reflects a measured approach to managing economic risks, even as markets have shown increased volatility.

The Fed's current stance is influenced by several factors, particularly the potential impact of tariffs on consumer prices. It's essential to differentiate between temporary price increases affecting specific products and broader inflationary pressures across the economy. For example, while tariffs in 2018 caused a spike in washing machine prices, the effect was temporary and localized.

The Fed aims to look beyond short-term disruptions, though widespread, long-lasting tariffs could lead to broader price increases. Currently, the three main inflation measures remain above the Fed's 2.0% target, contributing to market anxiety.

Chair Jerome Powell has highlighted positive economic indicators, including robust employment figures and steady wage growth. He noted the disconnect between consumer sentiment and actual spending patterns, with retail sales remaining resilient despite low confidence levels.

The Fed also acknowledges data interpretation challenges. For instance, consumers might increase purchases ahead of expected tariffs, creating counterintuitive economic signals. Powell emphasized that while rising food costs impact Americans significantly, they are lagging indicators of inflation.

Rate cuts still anticipated for 2025

Despite maintaining current rates, the Fed projects two rate cuts in 2025. Market forecasts align with this view, suggesting two to three reductions this year, reflecting optimism about inflation progress despite tariff uncertainties.

Rate expectations can shift dramatically. Last year began with predictions of seven to eight cuts before settling at three actual reductions. Even the Fed's own projections undergo significant quarterly revisions.

The Fed has announced plans to slow its balance sheet reduction, effectively providing economic support through increased Treasury security purchases. This modification to its quantitative tightening program may impact interest rates independently of direct rate actions.

For long-term investors, the overall direction of monetary policy matters more than individual rate decisions. Historically, declining rates have supported economic growth by reducing borrowing costs for businesses and consumers.

The risks of excessive cash holdings

While high rates may tempt investors to hold cash, maintaining excessive cash positions can be detrimental to long-term financial success. Markets often rebound unexpectedly, and missing these recoveries can significantly impact investment returns.

Despite attractive nominal yields, many cash instruments offer negative real returns after accounting for inflation. The purchasing power of cash gradually erodes, even when account balances appear stable.

While higher-yielding cash options exist, cash holdings are not an effective long-term strategy for generating income or growing wealth. Despite ongoing uncertainties around recession risks, tariffs, and monetary policy, maintaining a long-term perspective remains crucial.

The bottom line? The Fed's balanced approach to current economic challenges provides a model for investors. Taking a long-term view and avoiding reactive decisions based on short-term news remains the most effective path to achieving financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.