Estate Tax Reduction Strategies: Top 5 Tips for 2024

Estate Tax Reduction Strategies: Top 5 Tips for 2024

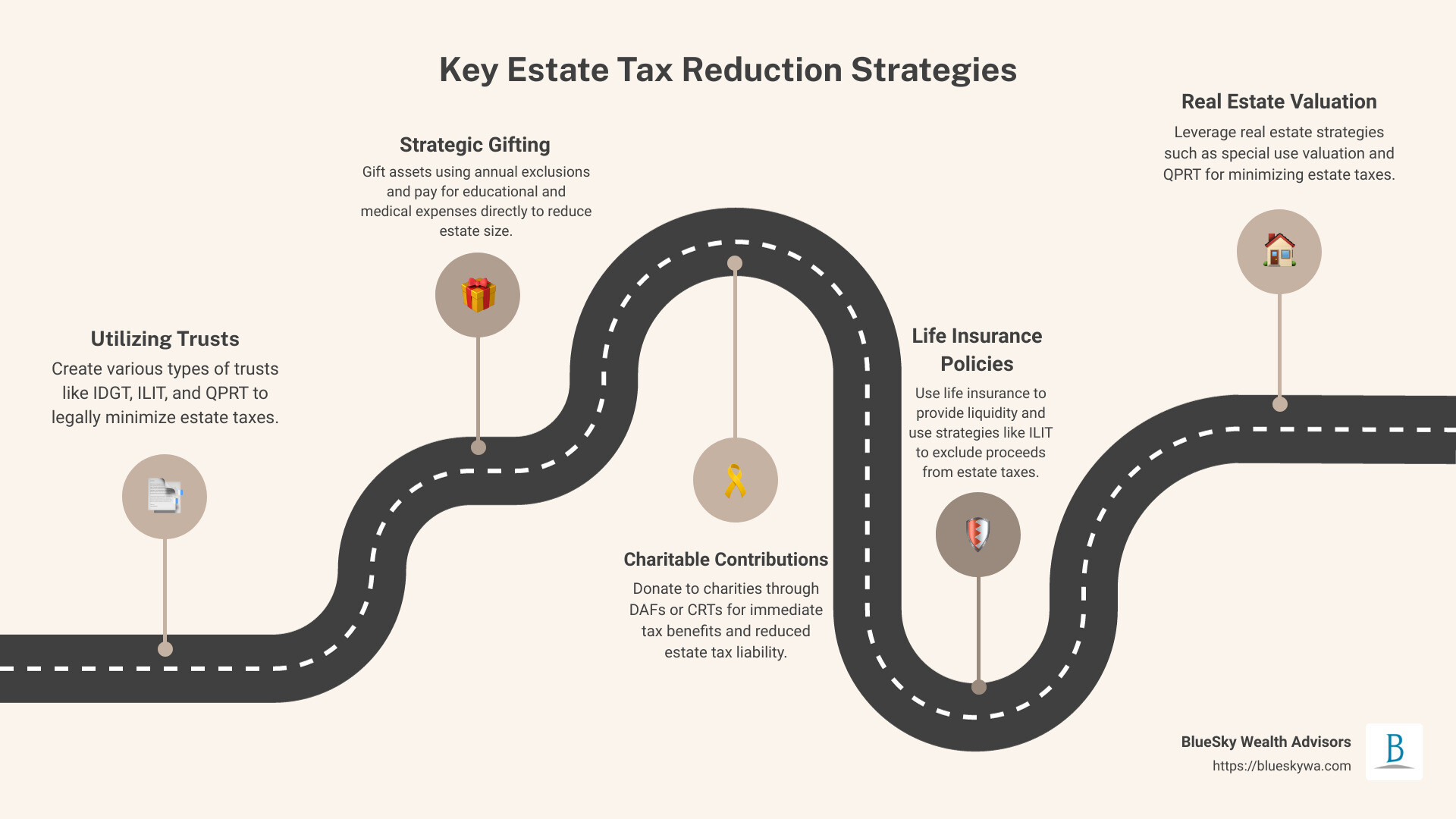

Estate tax reduction strategies are essential for anyone looking to safeguard their wealth for future generations while minimizing their tax burden. Here you’ll find straightforward tips like utilizing trusts, strategic gifting, and leveraging charitable donations—all designed to keep more in the family and less with the taxman.

Estate taxes can significantly impact the wealth you intend to pass on to your heirs. Understanding and implementing effective estate tax reduction strategies is crucial, whether you’re just starting to build wealth or already have a substantial estate. These strategies aren’t just about saving money; they’re about ensuring your legacy and supporting the financial health of future generations.

Estate planning can seem complex, but with focused strategies you can navigate it easily. By the end of this guide, you’ll be better equipped to make informed decisions that reflect your financial goals and family values.

Understanding Estate Taxes

When it comes to estate planning, understanding the different types of taxes that can affect your estate is crucial. Let’s break down the key concepts: Federal Exemption, State Taxes, the Tax Cuts and Jobs Act (TCJA), and the differences between Inheritance and Estate Tax.

Federal Exemption

The federal estate tax is only applied to estates that exceed a certain value, which is set by the federal exemption amount. For 2023, this exemption is $12.92 million for individuals and $25.84 million for married couples. This means if your estate is valued below these amounts, it won’t owe any federal estate taxes at your death.

State Taxes

While most states follow the federal estate tax system, some have their own estate taxes, and the exemption amounts can be much lower. For example, states like New York and Massachusetts impose their own estate taxes, which can affect estates valued at just over $1 million. It’s important to know not only the federal rules but also the state-specific rules that might impact your estate.

Tax Cuts and Jobs Act (TCJA)

Enacted in 2017, the TCJA significantly increased the federal estate tax exemption amounts. These changes are temporary and are set to expire after 2025, potentially reducing the exemption amounts unless new legislation is passed. This makes current planning even more critical as strategies might need adjustments in the future.

Inheritance vs. Estate Tax

It’s easy to confuse these two, but they are quite different. Estate taxes are charged against the estate itself before the assets are distributed to the heirs. Inheritance taxes, on the other hand, are paid by the beneficiaries who receive the assets. Not all states have inheritance taxes, but for those that do, rates can vary greatly depending on the relationship to the deceased and the value of the inheritance.

Understanding these elements is foundational in employing effective estate tax reduction strategies. Each component influences how you should plan your estate to minimize the taxes your estate might face. This knowledge not only helps in safeguarding your assets but ensures that you can pass on your legacy with as few deductions as possible.

Moving forward, we’ll explore specific strategies that can help reduce your estate’s tax burden, such as using trusts, making strategic gifts, and leveraging charitable contributions.

Estate Tax Reduction Strategies

Utilizing Trusts for Tax Reduction

Trusts are powerful tools in estate planning, offering the dual benefits of asset protection and estate tax reduction. Here are some key trusts:

- Intentionally Defective Grantor Trust (IDGT): This trust allows you to move assets out of your estate while still paying income taxes on them, reducing your estate’s size for tax purposes.

- Irrevocable Life Insurance Trust (ILIT): By placing a life insurance policy within an ILIT, the death benefit is not included in your estate, thus avoiding estate taxes.

- Qualified Personal Residence Trust (QPRT): This trust can remove your home from your estate at a reduced tax cost, provided you outlive the term of the trust.

- AB Trusts and QTIP Trusts: These help married couples maximize their estate tax exemptions, protecting more of their wealth from taxes.

Strategic Gifting to Reduce Estate Size

Gifting is a straightforward strategy to reduce your estate’s size:

- Annual Exclusion: You can give up to $17,000 (as of 2023) to as many people as you like each year without these gifts counting against your lifetime exemption.

- Direct Payments: Paying for someone else’s medical expenses or tuition directly to the institution is not considered part of your gift tax exemption.

- UTMA/UGMA Accounts: These allow minors to own assets without needing a trust, with gifts to these accounts qualifying for the annual exclusion.

- 529 Plans: Contributions to these education savings plans can be front-loaded for up to five years, offering a significant reduction in your taxable estate.

Leveraging Charitable Contributions

Charitable giving can significantly reduce your estate size while supporting causes you care about:

- Donor-Advised Funds (DAFs): These allow you to make a charitable contribution, receive an immediate tax deduction, and recommend grants from the fund over time.

- Charitable Remainder Trusts (CRTs): You can place assets in a CRT, receive income for a term of years, and the remainder goes to charity, reducing your taxable estate.

- Immediate Tax Benefits: Gifts to charity are deductible in the year made, which can also provide immediate income tax relief.

Life Insurance as an Estate Planning Tool

Life insurance can be used strategically in estate planning:

- Irrevocable Life Insurance Trust (ILIT): Again, an ILIT can help keep the death benefits of your life insurance out of your estate, free from estate taxes.

- Term Policies and Whole Life Policies: Ownership and beneficiary designations are key to ensuring these policies serve your estate planning goals without increasing your estate tax liability.

Real Estate Strategies in Estate Planning

Real estate often represents a significant portion of an estate and requires careful planning:

- Special Use Valuation: This can apply to real estate used for farming or business, potentially lowering its value for estate tax purposes.

- Qualified Personal Residence Trust (QPRT): Transferring a personal residence to a QPRT can remove it from your estate at a reduced value, provided you outlive the trust’s term.

- Family Home Transfer: Transferring a family home to heirs during your lifetime can reduce your taxable estate, especially if done when property values are lower.

By understanding and utilizing these estate tax reduction strategies, you can significantly decrease the taxes your estate may owe while ensuring your assets are distributed according to your wishes. This proactive approach not only secures your legacy but also maximizes the benefits your heirs will receive.

Moving on, we’ll delve into advanced estate planning techniques such as Family Limited Partnerships and LLCs, which further protect your assets and reduce estate taxes.

Advanced Estate Planning Techniques

Family Limited Partnerships and LLCs

Family Limited Partnerships (FLPs) and Limited Liability Companies (LLCs) offer strategic advantages for estate planning. These entities allow you to maintain control over your assets while also providing tax benefits and asset protection.

- Asset Protection: Both FLPs and LLCs provide a barrier against creditors, ensuring that only the assets within the entity can be targeted, not your personal assets.

- Business Continuity: These entities facilitate the smooth transfer of business interests to the next generation without the disruptions that can come from probate.

- Tax Discounts: Assets transferred through FLPs often qualify for valuation discounts. For example, because FLP interests are not easily sold in the open market, they are often appraised at lower values, reducing the taxable estate.

Utilizing Annuities and Trusts

Grantor Retained Annuity Trusts (GRATs) and Grantor Retained Unitrusts (GRUTs) are effective tools for transferring asset appreciation to the next generation without significant tax liability.

- GRAT: You transfer assets into a trust and retain the right to receive an annuity payment for a set period. Any increase in asset value beyond the annuity payments passes to your beneficiaries tax-free.

- GRUT: Similar to a GRAT, but the annual payment varies based on the trust’s asset value each year. This can be beneficial in a rising market.

Private Annuities can also play a role in estate planning. By selling an asset to a family member in return for a lifetime annuity, you can remove an asset’s value from your estate while securing a steady income stream.

Spousal Lifetime Access Trusts (SLATs) allow one spouse to create a trust that benefits the other spouse but is excluded from both spouses’ estates for tax purposes. This is a powerful tool if you are concerned about future estate taxes but still want to provide for your spouse.

Making the Most of Marital Deductions

Marital deductions are a cornerstone of estate tax planning for married couples, allowing them to pass unlimited assets to each other tax-free. However, leveraging trusts can enhance this benefit:

- Portability Election: Allows a surviving spouse to use any unused federal estate tax exemption from their deceased spouse. This can effectively double the amount the couple can pass tax-free to their heirs.

- AB Trusts and QTIP Trusts: These trusts help ensure that the surviving spouse benefits from the trust during their lifetime, with the remaining assets going to other beneficiaries (like children) after the surviving spouse’s death. They can provide tax advantages and protect the assets from future relationships.

By strategically using these advanced estate planning techniques, you can protect your assets, ensure business continuity, and significantly reduce your estate tax liability. These methods are complex and require careful planning and legal guidance to ensure they align with your overall estate planning goals.

In the next section, we will explore how BlueSky Wealth Advisors can assist you with personalized estate planning solutions that reflect your unique circumstances and aspirations.

Estate Planning with BlueSky Wealth Advisors

When it comes to securing your financial legacy, a one-size-fits-all approach simply doesn’t cut it. At BlueSky Wealth Advisors, we understand that every individual has unique financial goals, family dynamics, and legacy aspirations. That’s why we offer personalized solutions tailored to your specific needs and visions for the future.

Personalized Solutions

Our approach begins with a deep understanding of your personal and financial situation. Whether you’re looking to minimize tax impacts, ensure your assets are distributed according to your wishes, or create a lasting legacy that reflects your values, we craft bespoke plans to meet these goals. We utilize a variety of tools, including revocable living trusts, durable powers of attorney, and charitable giving strategies, to provide a customized plan that aligns with your life’s work and aspirations.

Proactive Strategies

Estate planning is not a one-time event but an ongoing process that needs to adapt as your life changes. BlueSky Wealth Advisors is committed to proactive strategies that anticipate changes in tax laws and personal circumstances. Our team stays ahead of the curve, ensuring that your estate plan not only complies with current laws but also takes advantage of all available tax-saving opportunities. This forward-thinking approach is crucial for maximizing the impact of your estate plan and ensuring that your legacy is preserved for future generations.

Client Care

At the heart of our service is a dedication to client care. Building lasting relationships based on trust, transparency, and mutual respect is paramount. Our team is dedicated to understanding your vision and working closely with you to achieve it. This personalized approach ensures that our services are comprehensive and deeply aligned with your personal and business aspirations.

By partnering with BlueSky Wealth Advisors, you engage with a team that is committed to your success. We navigate the complexities of estate planning with confidence and ease, allowing you to focus on what you do best—enjoying your life and preparing for the future. Together, we can ensure that your legacy is preserved and cherished for generations to come.

In the next section, we will address some frequently asked questions about estate tax reduction strategies to further clarify how you can benefit from planning ahead with BlueSky Wealth Advisors.

Frequently Asked Questions about Estate Tax Reduction

How can I use trusts to reduce estate taxes?

Trusts are powerful tools in estate tax reduction strategies. Here’s how they work:

- Intentionally Defective Grantor Trust (IDGT): You transfer assets into the trust but still pay income taxes on any earnings those assets generate. This allows the assets to grow without additional gift tax, reducing your estate’s size.

- Irrevocable Life Insurance Trust (ILIT): This type of trust owns your life insurance policy, meaning the death benefit is not included in your estate, potentially saving your heirs from a hefty tax bill.

- Qualified Personal Residence Trust (QPRT): You transfer your home into the trust and retain the right to live there for a certain number of years, reducing the value of your estate.

- AB and QTIP Trusts: These help manage and protect assets for the benefit of a surviving spouse while also specifying how the assets are distributed after the spouse’s death.

By placing assets in these trusts, you can significantly lower the value of your taxable estate, ensuring more of your wealth goes to your loved ones.

What are the benefits of lifetime gifting?

Lifetime gifting can help reduce your estate’s size and the corresponding tax liability. Here are the key benefits:

- Annual Exclusion: In 2023, you can give up to $17,000 per recipient without incurring any gift tax. For married couples, this amount doubles to $34,000 per recipient.

- Direct Payments for Education or Medical Expenses: Payments made directly to an educational institution or healthcare provider are not considered part of your taxable estate.

- UTMA/UGMA Accounts: These allow gifts to minors that can be used for education, reducing your taxable estate.

- 529 Plans: Contributions to these education savings plans are removed from your estate but you retain control over the funds.

Strategic gifting reduces your taxable estate while fulfilling your family’s needs and aspirations.

How does charitable giving impact estate taxes?

Charitable giving not only supports worthy causes but also provides significant estate tax benefits:

- Immediate Tax Deductions: Gifts to charity provide an income tax deduction in the year of the gift.

- Reduced Estate Size: Charitable gifts reduce the size of your estate, which can lower or even eliminate estate taxes.

- Donor-Advised Funds (DAFs): These allow you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund over time.

- Charitable Remainder Trusts (CRTs): These enable you to receive income for a period of time, with the remaining assets going to charity, reducing your taxable estate.

Incorporating charitable strategies into your estate plan can significantly reduce your tax liability while supporting your philanthropic goals.

By understanding and utilizing these strategies, you can ensure a more efficient and beneficial transfer of your assets. For personalized guidance, consider consulting with a professional at BlueSky Wealth Advisors to tailor a plan that fits your unique situation and goals.

Conclusion

As we wrap up our discussion on estate tax reduction strategies, it’s clear that effective estate planning is not a one-time task but a long-term commitment. This approach ensures that your financial legacy is preserved and passed on according to your wishes with minimal tax implications.

Long-term Planning

Estate planning is a dynamic process that adapts to changes in laws, your financial situation, and personal goals. Engaging in long-term planning means continuously evaluating and adjusting your strategies to safeguard your assets against future uncertainties. This proactive approach helps in maintaining the relevance and effectiveness of your estate plan over time.

Review Annually

We recommend an annual review of your estate plan. This isn’t just about checking boxes; it’s a critical evaluation to align your estate with any new tax laws, changes in your financial status, or shifts in your personal life, such as marriages, births, or divorces. Regular reviews ensure that your estate plan remains robust and reflective of your current intentions and circumstances.

Professional Advice

Navigating the complexities of estate taxes and planning strategies can be daunting. That’s why it’s crucial to seek professional advice. At BlueSky Wealth Advisors, our team of experts is dedicated to crafting personalized solutions that align with your unique needs and goals. By partnering with us, you gain access to knowledgeable professionals who are committed to optimizing your estate plan for tax efficiency and long-term growth.

In conclusion, your journey to a well-structured estate plan is ongoing. With the right mix of long-term planning, annual reviews, and expert guidance, you can achieve a legacy that reflects your values and maximizes benefits for your loved ones. In estate planning, being proactive is key to navigating the complexities of taxes and ensuring your legacy endures through generations.