14 Proven Corporate Tax Reduction Strategies for 2024

14 Proven Corporate Tax Reduction Strategies for 2024

Corporate tax reduction strategies are essential for any business seeking to optimize financial performance and sustain growth. By understanding and implementing effective tax planning techniques, businesses can significantly reduce their tax liabilities, reinvest in their operations, and enhance shareholder value.

Tax planning is more than just an annual task; it’s a strategic approach that influences every aspect of business operations and long-term planning. Effective tax strategies not only preserve capital but also position a business for competitive advantage and robust growth. This involves a wide range of actions from maximizing deductions and credits to timing income and expenditures wisely.

In the following sections, we will dissect various actionable strategies that can aid in reducing your corporate tax. This includes understanding legal structures, leveraging tax-friendly investments, and taking advantage of government incentives. Each strategy will be explained in simple terms to ensure you can implement these approaches confidently and compliantly. Let’s embark on this journey to unlock significant tax savings and foster a thriving business environment.

Understanding Corporate Tax Reduction Strategies

Definitions

Corporate tax reduction strategies are legal methods used by businesses to minimize their tax liabilities. These strategies can range from simple deductions and credits to more complex maneuvers like income shifting and strategic depreciation.

Legal Aspects

It’s crucial to remember that while reducing taxes is perfectly legal, it must be done within the boundaries of the law. Corporate tax evasion—deliberately misrepresenting or concealing information to reduce taxes—is illegal and carries severe penalties. Always ensure that your tax strategies comply with IRS regulations and other applicable laws.

IRS Guidelines

The IRS provides specific guidelines on what is and isn’t acceptable in corporate tax planning. For example, they clearly outline how depreciation should be handled, the proper treatment of business expenses, and the criteria for offshore profit reporting. Familiarizing yourself with these guidelines is essential. You can find detailed information on the IRS website.

Key Points from IRS Guidelines:

- Income Reporting: All income, domestic or international, must be reported accurately.

- Deductions and Credits: Only legitimate business expenses can be deducted; personal expenses cannot be disguised as business costs.

- Documentation: Maintain thorough records of all transactions, deductions, and credits to substantiate your tax filings.

Understanding these aspects of corporate tax reduction is foundational to developing effective strategies that align with federal and state laws while optimizing your tax position. We’ll explore specific strategies that utilize these principles to reduce your corporate tax burden effectively.

Key Strategies to Reduce Your Corporate Tax

Reducing corporate tax liability is crucial for enhancing profitability and ensuring the financial health of your business. Here, we delve into some effective strategies, including accelerated depreciation, offshoring profits, tax credits, and employee stock options, that can help minimize your corporate tax.

Accelerated Depreciation

Accelerated depreciation is a potent tax-saving tool that allows businesses to write off the cost of capital assets, such as machinery and equipment, much faster than the asset’s normal depreciation schedule would allow. Under the Tax Cuts and Jobs Act (TCJA), businesses can deduct the full cost of qualifying assets in the year they are placed in service. This provision is set to phase down starting in 2023, decreasing annually until it expires in 2027.

For example, if a company purchases new manufacturing equipment for $100,000, it can deduct the entire amount in the year of purchase rather than spreading the deduction over several years. This immediate expense recognition can significantly reduce taxable income in the year of purchase, leading to substantial tax savings.

Offshoring Profits

Offshoring profits involves transferring a portion of a company’s earnings to subsidiaries in lower-tax jurisdictions. This strategy was slightly curtailed by the TCJA but remains a viable option for reducing U.S. tax liability. By reallocating profits to countries with more favorable tax rates, companies can substantially lower their overall tax burden.

For instance, shifting intellectual property to a subsidiary in a tax haven allows a company to charge its U.S. operations higher fees for using this IP, shifting profits to a lower-tax area. It’s important to navigate these strategies within the bounds of new regulations like the Global Intangible Low-Taxed Income (GILTI) and the Base Erosion and Anti-Abuse Tax (BEAT) to ensure compliance.

Tax Credits

Tax credits are another strategic way to reduce tax liabilities directly. Unlike deductions, which reduce the amount of income subject to tax, credits reduce the tax owed, dollar-for-dollar. Businesses can take advantage of numerous credits, including the Research and Development (R&D) Tax Credit, which incentivizes companies to invest in innovation within the United States.

For example, if a tech company spends $200,000 on R&D, it might qualify for a tax credit that directly reduces its tax bill by a percentage of those expenses, leading to significant savings and encouraging further investment in innovation.

Employee Stock Options

Employee stock options (ESOs) are not only tools for compensation but also strategic tax planning instruments. Companies can offer stock options to employees, which are not taxed at the time of grant but at the time of exercise. This strategy can be beneficial for employees and employers in terms of tax timing and planning.

For instance, if employees exercise their options when the company’s stock price is high, they achieve a greater benefit, and the company gets a tax deduction based on the difference between the exercise price and the market price at the time of exercise. This can result in a lower corporate tax bill.

By understanding and implementing these strategies — accelerated depreciation, offshoring profits, tax credits, and employee stock options — businesses can effectively reduce their tax liabilities. Each strategy has its nuances and must be used in accordance with IRS regulations and ethical guidelines. It’s advisable to consult with tax professionals to tailor these strategies to your specific business circumstances and ensure compliance with all tax laws.

We will explore how timing income and expenses can further benefit your tax strategy, ensuring you make the most of your fiscal opportunities.

Timing Income and Expenses for Optimal Tax Benefits

Timing is everything, especially when it comes to managing your business’s taxes. By strategically planning when to recognize income and when to incur expenses, you can significantly influence your company’s tax bill. Here’s how to leverage timing for tax benefits:

Income Deferral

Why defer income? If you expect to be in a lower tax bracket next year, deferring income to the following year could reduce the taxes you owe. This strategy is particularly useful if you anticipate a decrease in revenue or qualifying for additional deductions in the future.

How to defer income:

– Delay Invoicing: Consider waiting until the end of December to invoice clients, which can push the recognition of that income to the next year.

– Deferred Compensation Plans: Utilize plans that allow employees to defer compensation to future years. This not only helps in reducing current taxable income but also benefits employees planning their tax liabilities.

Expense Acceleration

Why accelerate expenses? Accelerating expenses can be a smart move if you’re currently in a higher tax bracket. By recognizing expenses sooner, you can lower your taxable income and, consequently, your tax bill.

How to accelerate expenses:

– Prepay Expenses: Pay for next year’s expenses like rent, insurance, or subscriptions in advance.

– Purchase Equipment: If you’re considering new equipment, purchasing it before the end of the tax year allows you to deduct the expense in the current fiscal year.

Strategic Purchasing

Capitalizing on purchases: Timing significant purchases can influence your tax situation. For example, under the Tax Cuts and Jobs Act, businesses can benefit from bonus depreciation. This provision allows businesses to deduct a substantial portion of the purchase price of eligible business assets in the year they are placed in service.

Planning big purchases: If your business needs substantial equipment or software, consider the timing of these purchases to maximize tax benefits. Buying at the end of the year can accelerate deductions, potentially offsetting taxable income.

Real-world application: For instance, if a company buys and starts using new manufacturing equipment in December instead of January, it can deduct the cost from that year’s income, reducing the overall tax burden for the year significantly.

These strategies of deferring income and accelerating expenses require careful planning and a good understanding of your business’s financial health and projections. Always consider consulting with a tax professional to tailor these strategies to your specific circumstances. This ensures compliance with tax laws and maximizes your tax benefits.

Let’s delve into how maximizing deductions and credits can further reduce your corporate tax liabilities, ensuring that every dollar spent works harder for your business.

Maximizing Deductions and Credits

Business Expense Deductions

One of the most straightforward ways to reduce your tax liability is by maximizing business expense deductions. These are costs directly associated with the running of your business. Common deductible expenses include:

- Office supplies and equipment: Everything from computers to furniture.

- Travel expenses: Costs for business trips, including airfare and hotels.

- Utilities: Electricity, internet, and water services used in business operations.

To make the most of these deductions, keep meticulous records of all business-related expenses. This not only supports your claims during tax season but also helps in monitoring your business’s financial health.

Government Subsidies

Exploring government subsidies can also lead to significant tax savings. These subsidies often come in the form of grants, loans, or rebates that support specific industries or initiatives. For example, businesses involved in renewable energy projects may be eligible for government incentives that not only reduce initial project costs but also lower tax liabilities through various credits and rebates.

Tax Loopholes

While the term ‘loophole’ may carry a negative connotation, these are simply legal ways to use the tax code to your advantage. For instance, the depreciation of assets can be accelerated, allowing for a greater deduction in the early years of an asset’s life. This strategy is particularly beneficial for businesses that invest heavily in equipment or infrastructure.

Common Credits

Tax credits are a dollar-for-dollar reduction in your actual tax bill, and they can be extremely valuable. Here are a few credits that can benefit your business:

- Research and Development (R&D) Credit: For businesses investing in new technologies or improving existing products.

- Work Opportunity Tax Credit (WOTC): If you hire from certain groups that have significant barriers to employment.

- Energy Credits: Available to companies that implement energy-saving improvements to their business operations.

Each of these credits has specific qualifications, and it’s crucial to understand the details to ensure your business complies and benefits fully.

Case Study: Utilizing Section 179

A practical example of maximizing deductions is through Section 179 of the IRS tax code which allows businesses to deduct the full purchase price of qualifying equipment. In 2023, the deduction limit is $1,080,000, which can substantially lower your taxable income. A manufacturing firm, for instance, purchased new machinery totaling $800,000 in one year and deducted the entire amount under Section 179, significantly reducing their taxable income for that year.

By understanding and applying these strategies effectively, businesses can significantly reduce their tax burden. Always consider working with a tax professional to navigate the complexities of deductions and credits. This ensures you’re not only compliant with the IRS but also making the most financially sound decisions for your company.

Moving forward, let’s explore innovative tax reduction techniques specifically tailored for C Corporations, which can offer further opportunities to minimize tax liabilities.

Innovative Tax Reduction Techniques for C Corporations

C Corporations have unique opportunities to manage their tax liabilities. Here are some innovative strategies tailored specifically for C Corporations to help reduce their tax burden:

Withhold Dividends

One straightforward approach is to withhold dividends. This means profits are retained within the corporation rather than distributed to shareholders as dividends. Retained earnings are taxed at the corporate level, which is currently a flat rate of 21%, and not at the individual level, which might be higher. This strategy avoids the double taxation typically associated with dividends (taxed at both corporate and personal levels). However, it’s important to balance shareholder expectations, as they might prefer receiving dividends.

Pay Salaries, Not Dividends

Paying salaries instead of dividends can be a smart move. By paying shareholders who work in the company a salary, those payments become deductible expenses for the corporation. Salaries are taxed at the recipient’s individual tax rate but avoid the double taxation on dividends. The IRS requires salaries to be reasonable for the work performed, so this strategy must be used judiciously to avoid scrutiny.

Reimburse Shareholder Expenses

Reimbursing shareholder expenses is another effective method. If shareholders incur expenses on behalf of the corporation, the corporation can reimburse these expenses. These reimbursements are deductible by the corporation and are not taxable income to the shareholder, as long as they are documented and necessary business expenses. This not only reduces the corporation’s taxable income but also avoids any expense duplication on personal tax returns.

Maximize Deductions

Lastly, maximizing deductions is crucial for reducing taxable income. C Corporations should ensure they are taking advantage of all permissible deductions such as employee benefits, travel, and entertainment expenses, depreciation, and more. For instance, under current tax law, businesses can deduct the full cost of qualifying property under certain conditions, notably through the bonus depreciation rules or Section 179 deductions.

Each of these strategies requires careful consideration and compliance with IRS rules and regulations. It’s advisable to consult with tax professionals to implement these strategies effectively and ensure that they align with the overall business goals and shareholder expectations.

By employing these innovative tax reduction techniques, C Corporations can significantly lower their tax liabilities, retaining more capital for reinvestment or distribution under more favorable tax conditions. Moving forward, we will delve into frequently asked questions about corporate tax reduction to clarify common concerns and provide deeper insights.

Frequently Asked Questions about Corporate Tax Reduction

How can timing income and expenses reduce tax liability?

Timing when you earn income and when you pay expenses can have a big impact on your tax bill. Here’s how:

Deferring Income: If you expect to be in a lower tax bracket next year, you might consider delaying some income until then. For example, if you’re closing a big deal, you might arrange to receive payment in January instead of December.

Accelerating Expenses: Paying for business expenses before the year ends can increase your deductions for the current year. This might include buying office supplies, paying for repairs, or making advance payments on upcoming expenses.

This strategy requires good timing and understanding of your business’s financial outlook and tax situation.

What are the most effective deductions for lowering corporate tax?

Several deductions can significantly reduce your corporate tax:

Business Expense Deductions: Almost all ordinary and necessary expenses you incur to run your business can be deducted. This includes rent, utilities, salaries, and marketing costs.

Depreciation: This allows you to spread the cost of an asset over its useful life and deduct it over several years. For instance, if you buy machinery for your manufacturing business, you can deduct part of its cost each year through depreciation.

Employee Benefits: Costs for health plans, retirement plan contributions, and other employee benefits are not only good for your team but are also deductible.

Utilizing these deductions effectively can lower your taxable income substantially.

How does hiring family members affect corporate tax?

Hiring family members can offer tax benefits:

Lower Payroll Taxes: If your children are under 18 and you’re operating as a sole proprietorship or partnership, their wages might not be subject to Social Security and Medicare taxes.

Income Shifting: By employing a family member who is in a lower tax bracket, you can shift income from higher tax rates to lower ones, reducing the overall family tax burden.

Deductible Wages: Salaries paid to family members must be reasonable for the work performed, but they are as deductible as any other employee’s wages.

However, it’s crucial these hires are legitimate, and the compensation is justifiable to avoid any issues with the IRS.

Moving on, we will explore how businesses can leverage losses and depreciation to further reduce their tax liabilities, ensuring a strategic approach to fiscal management.

Leveraging Losses and Depreciation

In the realm of corporate tax reduction strategies, understanding how to effectively leverage losses and depreciation can significantly decrease tax liabilities. Here, we’ll break down the essentials of net operating losses, carryover provisions, and the various depreciation options available.

Net Operating Losses (NOL)

A net operating loss occurs when a company’s allowable tax deductions exceed its taxable income within a tax year. This can be a powerful tool in tax planning. For corporations, particularly C corporations, NOLs can be carried forward indefinitely to offset taxable income in future years. However, it’s important to note that for losses arising after 2017, the amount of NOLs that can be used in any one year is limited to 80% of taxable income.

Carryover Provisions

Carryover provisions allow businesses to apply a tax attribute, such as a net operating loss or a capital loss, from one tax year to another. This is essential for managing years with high profits and high taxes. For instance, if your business had a down year but expects higher revenue in the future, carrying over a net operating loss could substantially reduce your future tax bill.

Depreciation Options

Depreciation is a method of allocating the cost of a tangible asset over its useful life. For businesses, understanding the various depreciation options can lead to significant tax savings:

Section 179 Deduction: This allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. In 2023, the deduction limit is $1,080,000, phasing out dollar-for-dollar after $2,700,000 in purchases.

Bonus Depreciation: Under this provision, businesses can deduct a substantial portion of the purchase price of eligible business assets in the first year they are placed in service. Currently, you can deduct 100% of the cost of qualifying assets.

MACRS (Modified Accelerated Cost Recovery System): This is the primary method of depreciation for federal income tax purposes, allowing for faster asset expense recovery, potentially accelerating tax deductions.

Each depreciation method has specific rules and eligibility requirements, which can influence the decision-making process for purchasing business assets. For instance, choosing between Section 179 and bonus depreciation often depends on the business’s current taxable income and future earnings expectations.

By strategically employing these depreciation methods, businesses can manage their capital expenditures while optimizing their tax outcomes. This not only aids in immediate fiscal management but also in long-term financial planning.

In the next section, we will delve into various tax-friendly investment opportunities that can further enhance your business’s tax efficiency and overall financial strategy.

Investing in Tax-Friendly Opportunities

Investing wisely not only boosts your business’s growth but can also significantly reduce your tax burden. Let’s explore some tax-friendly investment opportunities that smart businesses use to enhance their financial strategies.

Municipal Bonds

Municipal bonds, or “munis,” are issued by local or state governments to fund public projects like roads and schools. The big advantage? The interest you earn is usually tax-free at the federal level. This can be particularly beneficial if you’re in a high tax bracket. While most munis offer tax-exempt interest, it’s important to check the specific bond as there are exceptions. Investing in munis can lower your taxable income while contributing to community development.

Long-Term Capital Gains

When you hold an investment like stocks or bonds for more than a year before selling, any profit you make is considered a long-term capital gain. These are taxed at lower rates than short-term gains—typically 0%, 15%, or 20%, depending on your income. Planning the sale of assets to qualify for long-term capital gains can substantially decrease your tax liability, making this a smart strategy for reducing corporate taxes.

Real Estate

Investing in real estate offers several tax advantages. Not only can you deduct the costs associated with managing and maintaining properties, but you also benefit from depreciation. This allows you to write off the cost of the property over its useful life, providing annual tax deductions. Furthermore, if you sell the property after holding it for over a year, any gains are taxed at the favorable long-term capital gains rate.

Oil and Gas Investments

Investing in oil and gas can yield significant tax benefits. The Intangible Drilling Costs (IDC), which include everything but the actual drilling equipment—labor, chemicals, mud, grease, and other miscellaneous items—can be 100% deductible in the year they are incurred. Moreover, depending on the setup, you might also qualify for depletion allowances, which allow you to account for the reduction of reserves as a form of depreciation.

By incorporating these tax-friendly investment strategies into your financial planning, you can not only see potential returns on the investments themselves but also significantly reduce your overall corporate tax liability. Each of these options should be considered within the broader context of your company’s financial health and future goals.

In the following sections, we will continue to explore additional corporate tax reduction strategies and how they can be applied to further optimize your tax situation, ensuring that your business maximizes its financial potential.

Benefits of Structuring as a C Corporation

When considering corporate structures, C corporations (C corps) offer unique tax benefits despite the challenge of double taxation. Understanding these can help you leverage tax strategies effectively.

Double Taxation Explained

A key characteristic of C corps is double taxation. This means the corporation itself is taxed on profits, and then shareholders are taxed again on dividends at their individual tax rates. Although this might seem like a disadvantage, the structure provides opportunities for strategic tax planning. For instance, retaining earnings within the company can defer personal taxes for shareholders.

Dividend Distribution Taxes

Dividends distributed by C corps to shareholders attract personal taxes. However, managing how and when dividends are distributed can influence your tax liability. For example, timing these distributions in a year when shareholders expect lower personal income can reduce the overall tax paid. Dividends are taxed at the qualified dividend rate, which is lower than regular income tax rates for most shareholders.

Capital Gains Strategy

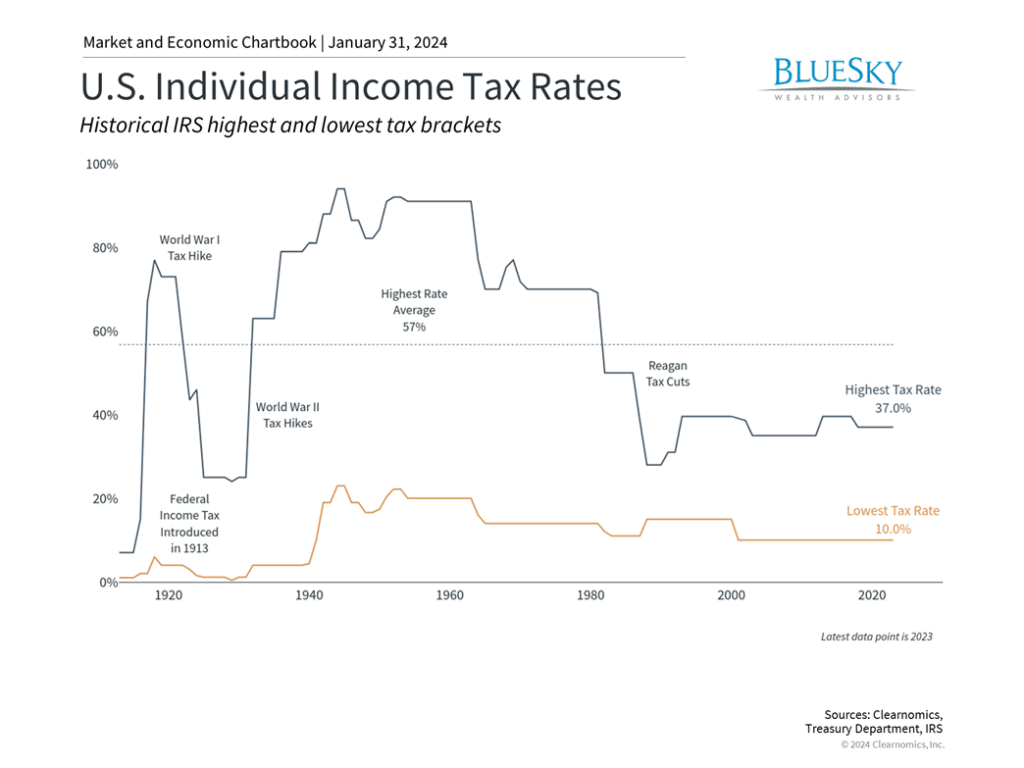

C corps also benefit from a unique approach to capital gains. Profits from the sale of assets held for more than a year are subject to corporate tax at a flat rate of 21%. This is notably lower than some individual tax rates, which can be as high as 37%. Planning the sale of assets to align with strategic tax planning can result in significant savings.

By understanding these elements of C corporation taxation, businesses can better navigate the complexities of corporate taxes. The ability to retain earnings, time dividend distributions, and manage capital gains strategically are powerful tools for minimizing tax liabilities.

In the next section, we’ll delve into how leveraging specific tax credits can further reduce your corporate tax obligations, ensuring that every available benefit is utilized to support your business’s growth and sustainability.

Utilizing Tax Credits to Lower Liabilities

Tax credits are a direct way to reduce your corporate tax bill, dollar for dollar. Here, we’ll explore some key credits that can significantly benefit your business.

General Business Credit

This is an umbrella term that includes various tax credits designed to encourage businesses to engage in certain behaviors, such as improving facilities or increasing research activities. Utilizing the general business credit can lower your tax liabilities by allowing you to claim a credit for a percentage of your qualifying expenses. For example, if your business has enhanced its accessibility for disabled individuals, you might be eligible for the Disabled Access Credit.

Investment Credit

The investment credit includes several incentives aimed at encouraging businesses to invest in specific assets. Key components include the Rehabilitation Credit and the Energy Credit, which are designed to support investments in historic buildings and energy-efficient improvements, respectively. If your company has recently upgraded its facilities to green technologies, such as solar panels, you could benefit from the Energy Credit, reducing your tax liability while contributing to environmental sustainability.

R&D Credit

The Research and Development (R&D) Credit rewards businesses that invest in innovation, particularly in developing new products or processes. This credit is calculated based on a percentage of your research expenditures. If your company has been involved in developing new software or improving manufacturing processes, claiming the R&D credit can provide substantial tax savings. This credit was made permanent by the Consolidated Appropriations Act, 2016, reflecting the government’s commitment to fostering innovation.

Energy Credits

With a growing emphasis on sustainable practices, energy credits are particularly lucrative. These include credits for producing clean hydrogen, clean electricity, and clean fuels. The recent legislation under the Inflation Reduction Act has added new dimensions to these credits, allowing businesses to receive direct payments for certain credits, which is beneficial for startups and other businesses with low initial taxable income.

By strategically using these tax credits, businesses not only reduce their tax liabilities but also align their operations with broader economic and environmental goals. For instance, transitioning to clean energy not only leverages the Clean Energy Investment Credit but also positions your company as a responsible leader in sustainability.

In conclusion, leveraging tax credits is a powerful strategy for reducing corporate tax liabilities. These credits not only lower taxes but also encourage businesses to invest in their growth, innovation, and sustainability. In the next section, we will explore advanced strategies for high-income businesses to further optimize tax savings.

Advanced Strategies for High-Income Businesses

High-income businesses often need more sophisticated tax strategies to optimize their tax savings. Here we’ll explore some advanced techniques including changing tax status, leveraging the Qualified Business Income (QBI) deduction, utilizing the home office deduction, and maximizing available tax credits.

Change Tax Status

For businesses that have grown or evolved, changing your tax status can lead to substantial tax savings. For instance, if your business is currently structured as an LLC, you might consider electing to be taxed as a C corporation. This change can be beneficial because C corporations enjoy a flat tax rate of 21%, potentially lower than the individual rates that pass-through entities like LLCs are subject to, which can go up to 37%.

Before making any changes, it’s crucial to consult with a tax professional. They can provide a detailed cost-benefit analysis to determine if changing your tax status makes sense for your specific business situation.

Example: An LLC with high earnings elects to be taxed as a C corporation to capitalize on the lower corporate tax rate, thus saving on taxes that would have been higher under the individual rates of its members.

Leverage the QBI Deduction

The QBI deduction allows eligible pass-through entities to deduct up to 20% of their business income. However, it’s subject to complex rules, especially for specified service trades or businesses (SSTBs), where high earners may see phased-out benefits.

If your business qualifies and your income is below the threshold ($182,100 for single filers and $364,200 for joint filers in 2023), you can take full advantage of this deduction. For those above these limits, strategies such as deferring income or accelerating expenses to reduce taxable income can help in remaining eligible for the QBI deduction.

Fact: Utilizing the QBI deduction effectively can significantly reduce the taxable income of high-income business owners, potentially saving thousands in taxes.

Claim a Home Office Deduction

If you use a part of your home exclusively for business, the home office deduction can be a valuable tax-saving tool. This deduction allows you to write off a portion of your home expenses, proportional to the space used for business activities.

Criteria: The space must be used regularly and exclusively for conducting business. For example, if your home office makes up 10% of your house’s total square footage, you can deduct 10% of your home-related expenses, such as rent, utilities, and maintenance.

Case Study: A consultant uses a dedicated room in their house as an office. By claiming the home office deduction, they save on their overall tax liabilities by deducting a portion of their mortgage and utility costs.

Leverage Tax Credits

Tax credits are direct reductions in tax liability, offering another layer of tax savings for businesses. High-income businesses should explore credits such as the R&D tax credit, which rewards companies for investing in research and development.

Strategy: Evaluate your business activities to identify qualifying R&D projects. Document all expenditures related to these projects meticulously to claim the credit accurately.

Impact: By leveraging the R&D tax credit, businesses can reduce their tax burden while reinvesting in innovation, enhancing competitiveness and long-term viability.

In conclusion, high-income businesses have several advanced strategies at their disposal to reduce tax liabilities. By carefully planning and consulting with tax professionals, businesses can significantly enhance their savings and reinvest in their growth and development. Next, we will look into the best practices for planning and record keeping to maintain compliance and avoid audits.

Planning and Record Keeping to Avoid Audits

Proper planning and meticulous record keeping are essential to avoid the costly and time-consuming process of tax audits. Implementing robust systems for tracking expenses, using high-quality software, and seeking professional tax advice can safeguard your business from potential issues with the IRS.

Expense Tracking Apps

Utilizing expense tracking apps is a game-changer for any business aiming to streamline its financial records. These apps allow you to:

- Capture receipts on the go: Snap a photo of your receipt and upload it directly to the app. This means no more lost receipts or piles of paper to sort through.

- Categorize expenses easily: Automatically sort expenses into categories, making it simpler to file taxes and monitor spending.

- Sync with accounting software: Many apps integrate directly with accounting systems, updating your books in real time.

Popular apps like Expensify or QuickBooks offer these functionalities, ensuring that even on-the-go expenses are recorded accurately.

High-Quality Software

Investing in high-quality accounting software is crucial for maintaining accurate books and ensuring compliance. Software like Xero, QuickBooks, and Sage provide comprehensive solutions that:

- Automate bookkeeping tasks: Reduce errors associated with manual data entry.

- Generate detailed reports: Quickly produce financial reports that are essential for strategic planning and tax preparation.

- Ensure data security: Protect sensitive financial information with advanced security measures.

These tools not only help in organizing financial data but also play a critical role during tax season by simplifying the preparation and filing process.

Professional Tax Advice

Consulting with a tax professional can never be overstated in its importance. Certified Public Accountants (CPAs) or tax advisors provide expert advice tailored to your business needs. They help you:

- Stay updated on tax laws: Tax regulations change frequently, and professionals can provide updates that might affect your business.

- Identify deductions and credits: Experts can spot opportunities to save on taxes that you might not be aware of.

- Plan for the future: Proactive tax planning can prevent surprises during tax season and help in long-term financial planning.

For instance, a tax professional might advise you on the best methods of depreciation or how to leverage new tax credits.

In summary, robust expense tracking, reliable accounting software, and expert tax advice are pillars of effective tax planning and audit prevention. By integrating these elements into your daily operations, you can ensure that your business maintains compliance and is prepared for any inquiries from tax authorities. Next, we will explore how leveraging losses and depreciation can further enhance your tax strategies.

Conclusion

In the realm of corporate tax planning, the journey towards minimizing liabilities and maximizing growth is ongoing and dynamic. At BlueSky Wealth Advisors, we understand that effective tax strategies are not just about compliance but about leveraging opportunities that align with your business goals and financial health.

Long-term planning is the cornerstone of sustainable tax management. We encourage our clients to look beyond the annual tax cycle and consider the broader implications of their financial decisions. By adopting a forward-thinking approach, we can help you anticipate changes in tax legislation, adapt to evolving business environments, and secure a competitive advantage.

Our commitment at BlueSky Wealth Advisors is to provide you with proactive strategies that are tailored to your unique circumstances. Whether it’s exploring new deductions, optimizing your entity structure, or implementing innovative accounting techniques, our goal is to ensure that every aspect of your tax planning is proactive rather than reactive.

Client care is at the heart of everything we do. We believe in building lasting relationships with our clients, based on trust, transparency, and mutual respect. Our team is dedicated to understanding your vision and working closely with you to achieve it. This personalized approach ensures that our tax planning services are not only comprehensive but also deeply aligned with your personal and business aspirations.

In conclusion, partnering with BlueSky Wealth Advisors means engaging with a team that is committed to your success. We are here to help you navigate the complexities of corporate tax reduction strategies with confidence and ease, ensuring that your business not only complies with the law but thrives under it. Let us take care of the details, so you can focus on what you do best—running your business.