Trump vs. Harris: How the Upcoming Election Impacts Financial Plans

Trump vs. Harris: How the Upcoming Election Impacts Financial Plans

With just days to go until the presidential election on November 5, polls suggest it will be a close race between former President Donald Trump and Vice President Kamala Harris. Both candidates are campaigning hard in swing states, and investors may be worried about how either outcome might affect their portfolios.

Given the intense political divisions in recent years, it’s not surprising that emotions surrounding this election are running hot. In this environment, it’s important for investors to prevent politics from derailing their long-term financial plans.

Tax policy is uncertain, especially relating to estate planning

As citizens, voters, and taxpayers, the result of this election could have important implications for our everyday lives. However, putting political preferences aside, this is not necessarily true when it comes to your portfolio. In fact, history shows that the markets and economy tend to impact the result of elections, and not the other way around. Thus, it’s important to vote at the ballot box and not with our hard-earned savings. How can investors maintain perspective in the weeks to come?

Perhaps the most complex area when it comes to the outcome of the election is tax policy. The Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025, leaving the future of individual and corporate taxes unclear and creating a so-called “tax cliff.” The candidates differ in their approaches to corporate taxes, individual rates, capital gains, tax credits, and more.

It’s important to maintain perspective around tax policy since these issues can be politically heated. While taxes have a direct impact on households and companies, they do not always have a straightforward effect on the overall economy and stock market. This is because taxes are only one of the factors that influence growth and returns, and there are many deductions, credits, and strategies that can reduce the statutory tax rate.

Taxes are also quite low by historical standards. This will be true whether the top marginal tax rate is 37% or 39.6%. With the growing federal debt, it’s prudent for investors to expect tax rates to eventually rise, whether they do so after this election or not. Planning for this possibility, ideally with the help of a trusted advisor, is only growing in importance.

One area where taxes are historically low is estate taxes, a tax imposed on the transfer of assets to heirs after death. The TCJA doubled the estate tax exemption amount, and after inflation adjustments, the level has risen to $13.6 million for 2024. Without additional action, this would revert to the pre-TCJA level, adjusted for inflation, which economists believe would be approximately $6.8 million per individual in 2026.

Although estate taxes constitute only a small portion of government revenue, and the percentage of people who are subject to estate tax is small, this has become a challenging political issue. The future of estate taxes will very much depend on the results of this election, including the results of Congressional races. For many wealthier households, this could have a significant impact on tax and estate planning.

Global trade and tariffs will depend on the election

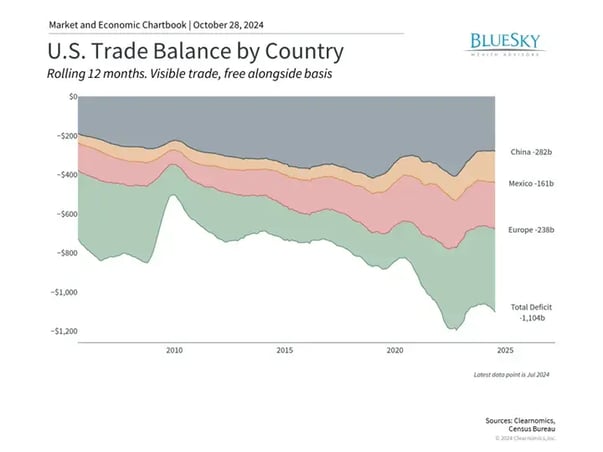

The candidates also differ on their potential trade policies, especially when it comes to tariffs. While the wave of deglobalization and the reshoring of manufacturing is likely to continue, how tariffs are used to increase U.S. competitiveness and generate revenue could depend on the outcome of the election. That said, President Trump’s administration enacted a number of tariffs during his time in office, most of which were continued by the Biden administration.

Tariffs were once a major factor in trade and a significant source of revenue for the U.S. government, but in recent decades they’ve played a small role. Over the past century, the formation of organizations and agreements – such as the WTO, NAFTA, the USMCA, and others – helped to ease trade barriers across major partners. Still, the use of tariffs to protect domestic industries and intellectual property, including steel, electronics, semiconductors, agricultural goods, and more, have occurred periodically.

For investors nervous about a possible trade war, it’s important to note that the same fears in 2018 and 2019 did not lead to the worst-case scenarios that some predicted. The economy remained strong during this period, with unemployment near historic lows and inflation non-existent, even though it was quite late in the business cycle. Eventually, ongoing negotiations between key trading partners helped to mitigate some fears. As the accompanying chart shows, throughout different trade regimes, the U.S. has maintained a trade deficit with many countries.

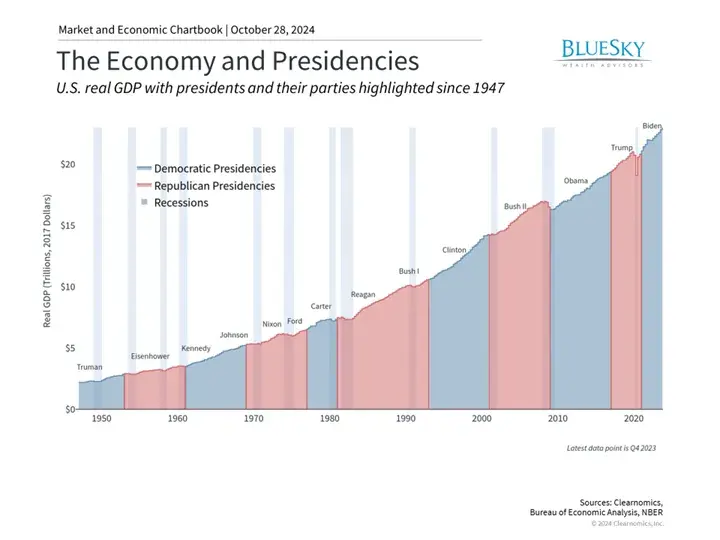

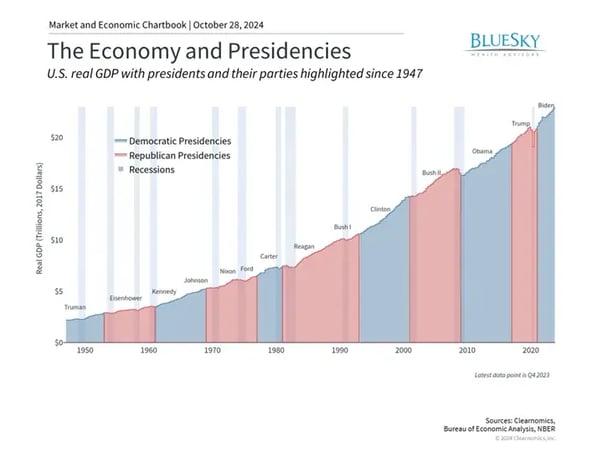

The economy has grown under both major parties

When it comes down to it, history shows that the economy has grown under both political parties and bull markets have occurred regardless of who occupied the White House. Although it may seem counterintuitive, this is because politics often has a small impact on the economy and markets. Specifically, the business cycle and broad trends such as the growth of artificial intelligence and technology advancements, falling inflation, and the strong job market matter far more.

Despite the perceived importance of this election, policy changes also tend to be gradual due to checks and balances in our political system. What candidates promise on the campaign trail can differ from what they can actually enact.

When it comes to taxes, neither candidate is proposing a return to pre-Reagan era tax levels when the top marginal rates reached as high as 94%. When it comes to trade, tariffs may increase but they are unlikely to reach the levels experienced almost a century ago during the Great Depression. It’s important to keep these facts in perspective when planning for the next four years.

The bottom line? The election matters for many reasons, but its long-term impact on the stock market and economy is often overestimated. The economy has grown under Democrats and Republicans alike, and it’s important for investors to maintain perspective this election season.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.