Will There Be A Soft Landing in 2024?

Will There Be A Soft Landing in 2024?

Stock and bond markets struggled during the first trading week of 2024 as investors questioned the probability of a “soft landing” and what it may mean for the timing and size of Fed rate cuts later this year. The S&P 500 and Nasdaq fell 1.5% and 3.2%, respectively, driven by a decline in large cap tech stocks, while the 10-year Treasury yield climbed to 4.05%. Market-based measures still suggest that the Fed could cut rates by 25 basis points five or six times this year, beginning in May and possibly as early as March. So, while investors might prefer to start the year off on a positive note, it’s important to not overreact to a single week of activity, especially in the context of the strong trends of the past twelve months. What should investors consider today to maintain a longer-term perspective on markets and the economy?

The economy added 2.7 million new jobs last year

First, it’s important to define what a soft landing entails. The Federal Reserve’s Congressional mandates since 1977 have been to maintain stable prices (i.e., keep inflation low) and achieve maximum employment (i.e., keep the economy strong). From 2008 following the global financial crisis to early 2020, inflation was exceptionally low, allowing the Fed to keep policy rates near zero for much of that decade. The inflation spike of the past few years reversed this trend for the first time since the early 1980s, resulting in one of the fastest rate hike cycles in history. Since rising rates tend to slow the economy, the Fed’s challenge has been to tighten policy in a way that slows inflation without causing a deep recession.

The probability of a soft landing increased last year as the economy remained robust even as inflation fell. The Fed has traditionally maintained a 2% inflation target on the Personal Consumption Expenditures Price Index, a measure of inflation, and these figures have now decelerated to 2.6% and 3.2% on the headline and core measures, respectively. Absent any major shocks to the economy, energy prices, or rents, these figures could be on track to reach 2% on a year-over-year basis later this year. Recent month-over-month numbers have been significantly lower with the latest figures showing a decline in prices.

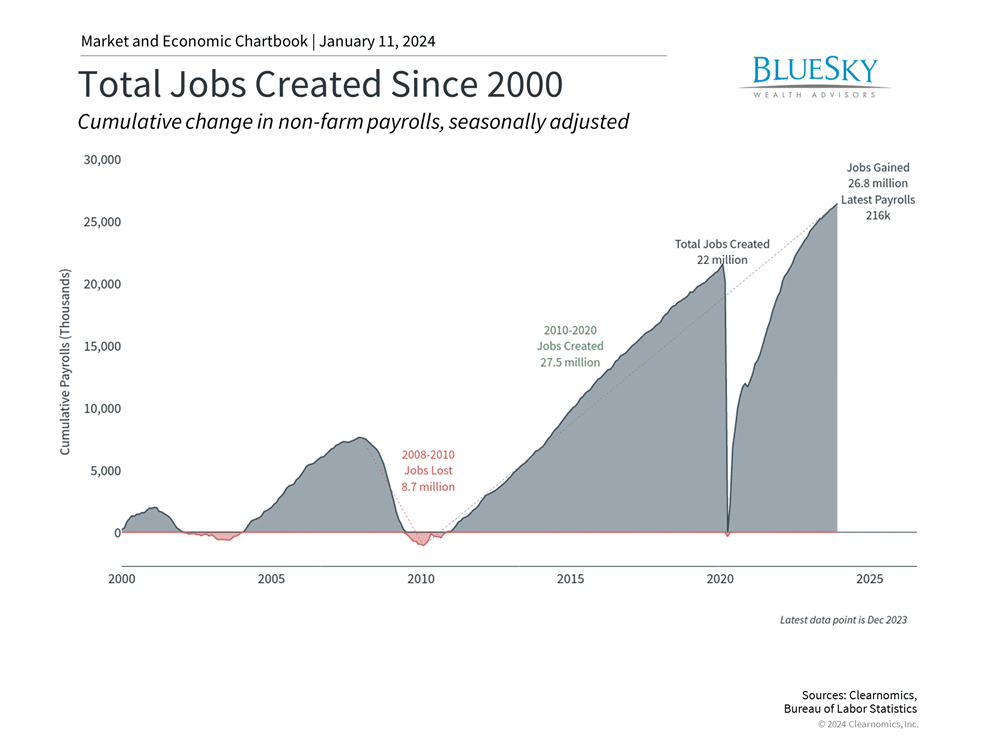

Last week’s jobs data also showed that the labor market has slowed but remains historically strong. Unemployment was steady at only 3.7% and 216,000 new jobs were added in December, although there were also 71,000 in downward revisions to the prior two months. Still, this means that 2.7 million new jobs were created in 2023, an exceptional pace that adds to the cumulative job gains shown in the accompanying chart.

The economy is expected to slow but few expect a deep recession this year

These improvements in inflation and the strength of the economy are the opposite of what most economists anticipated just a year ago, serving as a reminder to take forecasts with a grain of salt and a dose of humility. This upside surprise allowed markets to not only rebound but also for the Fed to pause its rate hikes and pave the way for rate cuts. Just as the bear market in 2022 was defined by the spike in inflation and rapid rate increases, markets are anticipating that the next couple of years could be defined by a reversal in these trends.

Of course, things never go as smoothly as investors would like. One possibility is that the economy could slow in 2024 after avoiding a recession last year. The accompanying chart shows that economists anticipate a deceleration in GDP growth during the first three quarters of the year. This could happen as consumers tighten their belts and the impact of high rates continues to filter through the economy. Of course, the irony is that a slowing economy would further justify Fed rate cuts which is generally positive for both stocks and bonds. Another possibility is that the last mile of inflation is difficult to navigate, especially among categories that are “sticky.” This could be the case if wage growth remains strong which, while positive for households, could keep price pressures higher than the Fed would prefer.

Valuations have risen as stock prices have priced in positive trends

All of this matters to investors not because small changes in inflation or the difference between one or two rate cuts will dramatically alter the path of the economy or monetary policy. Instead, it’s because markets have “priced in” quite a lot over the past few months since, after all, the job of financial markets is to incorporate all available information. The S&P 500 price-to-earnings ratio, for instance, has climbed to 19.8x, well above recent lows and the historical average. Much of last year’s market gains were in anticipation of positive events, pushing valuations higher until fundamentals such as corporate profits can eventually catch up.

Thus, investors need to maintain perspective in this environment. When professional investors and portfolio managers debate whether inflation will be stuck at 3% on a year-over-year basis or whether the Fed will begin cutting rates in March or May, this can cause short-term market swings. However, for long-term investors, this amounts to splitting hairs since they don’t affect the overall trajectory of the market and economic trends. While investors should always expect the unexpected, debating on a daily basis whether or not the Fed will cut three, five or seven times this year loses sight of the bigger picture.

The bottom line? Investors should continue to focus on the trends that began last year as the economic and market situation unfolds in 2024. Staying diversified across stocks and bonds is still the best way to achieve long-term financial goals.