Investing for Income: The Ultimate 5-Step Guide for Consistent Earnings & Financial Security

Investing for Income: The Ultimate 5-Step Guide for Consistent Earnings & Financial Security

Investing for income is a strategic approach to building your financial portfolio in a way that generates a steady stream of cash. This method is perfect if you’re looking to secure financial independence, optimize your tax situation, and ensure a lasting legacy without having to delve into the nitty-gritty of financial management.

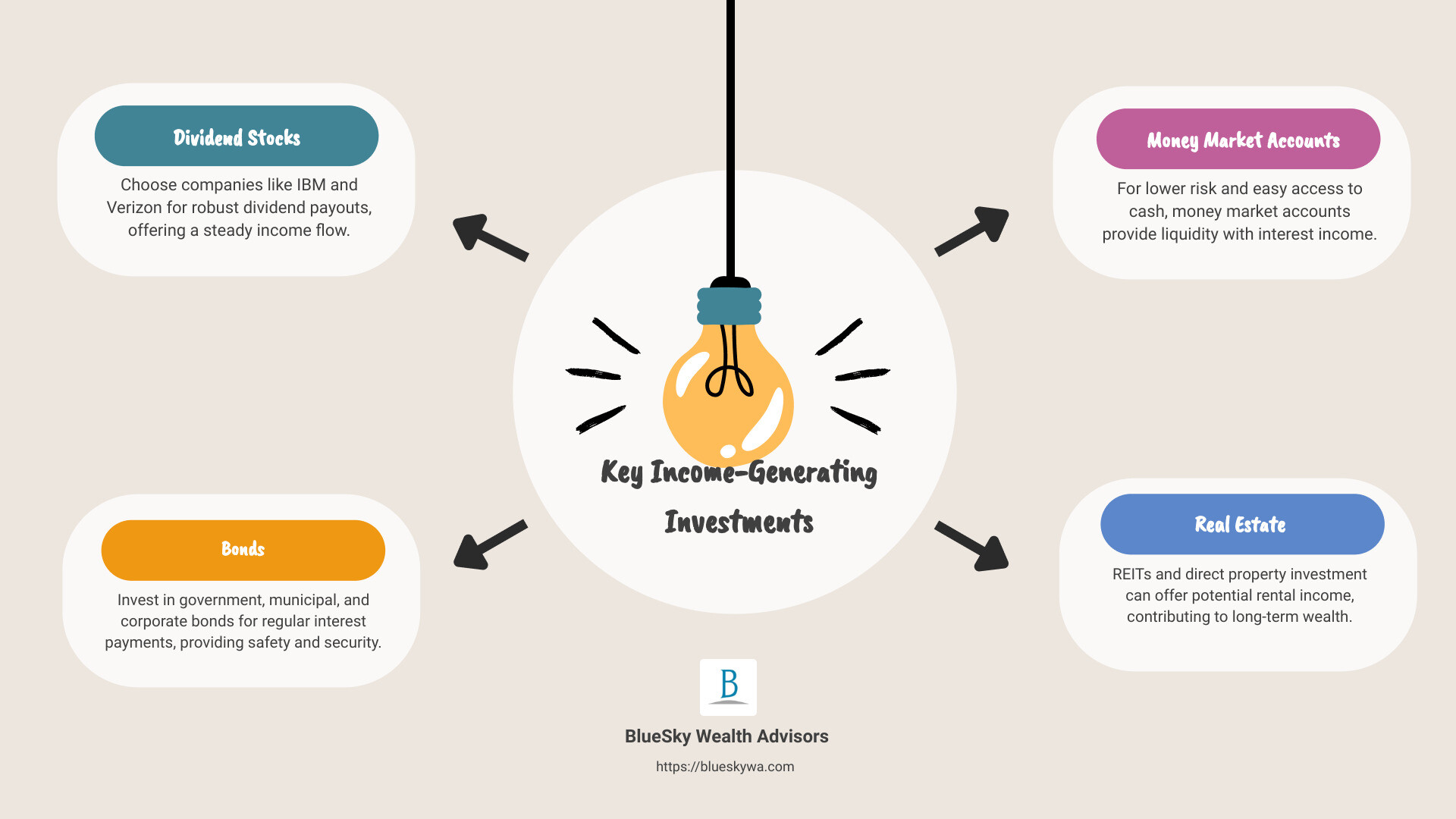

Here’s a quick overview:

– Focus on Dividend Stocks: Choose companies known for their robust dividend payouts.

– Invest in Bonds: Government, municipal, and corporate bonds offer regular interest payments.

– Explore Money Market Accounts: For lower risk and easy access to your cash.

– Consider Real Estate: Through REITs or direct property investment for potential rental income.

Investing for income aligns well with a variety of financial goals, from saving for retirement to establishing a fund for future generations. The beauty of this strategy lies in its ability to provide both security and growth potential.

In short, income investing is a powerful tool for anyone looking to enhance their financial well-being, offering a path to achieve financial goals through a steady stream of passive income.

Understanding Income Investing

Income investing is a strategy focused on generating a steady stream of income from your investments. This income usually comes from dividends, interest payments, or rental income. It’s like planting a garden where the plants regularly produce fruits or vegetables you can harvest without having to replant each season.

Passive Income: The Key to Financial Freedom

Passive income is money you earn without actively working for it at the moment of receiving it. Imagine owning a machine that makes money while you sleep, spend time with family, or enjoy hobbies. That’s what passive income does. It provides financial support without requiring daily effort, creating opportunities for financial freedom and stability.

Cash Flow: The Lifeblood of Income Investing

Cash flow is the amount of money moving in and out of your pocket. In income investing, we aim to increase the money coming in without significantly increasing the money going out. Positive cash flow means you’re earning more from your investments than what you’re spending to maintain them. It’s crucial for managing living expenses, especially during retirement, or for reinvesting to grow your wealth further.

Why Income Investing?

- Stability: Regular income streams can offer financial stability in uncertain markets.

- Growth Potential: Reinvesting the income can lead to compound growth over time.

- Flexibility: You can adjust your portfolio based on changing financial needs and goals.

How to Get Started

- Dividend Stocks: Companies like IBM and Verizon Communications offer dividends, which are shares of their profit paid to shareholders. These can provide a regular income.

- Bonds: Lending money to governments or corporations through bonds can earn you interest payments.

- Real Estate: Investments in REITs or rental properties can generate rental income.

Challenges and Considerations

While attractive, income investing requires careful planning and consideration of risks like interest rate changes, market volatility, and the financial health of dividend-paying companies. Diversification, or spreading your investments across different assets, can help manage these risks.

In Summary

Income investing is about building a portfolio that brings in regular income. It’s a way to achieve financial stability and growth, offering a path to financial independence. With the right strategy, you can enjoy the fruits of your investments without constant hands-on effort. Whether you’re planning for retirement or looking to supplement your current income, understanding the principles of income investing is a crucial first step.

Types of Income-Generating Investments

Investing for income is like planting a garden. You want a variety of plants that will bloom at different times, so you have a steady supply of fruits and vegetables. Similarly, a diverse investment portfolio can provide you with a consistent income stream. Let’s dig into the types of investments that can help you achieve this.

Dividend Stocks

Think of dividend stocks as the perennial plants in your garden. They provide you with regular “harvests” in the form of dividends. Companies like IBM, Exxon Mobil, Verizon Communications, AT&T, and Walgreens Boots Alliance are known for their consistent dividend payouts. The SPDR® S&P 500 ETF Trust is another option, offering exposure to the broader market’s dividends.

When picking dividend stocks, look for companies with a history of stable and increasing dividends. This indicates financial health and a commitment to returning value to shareholders.

Bonds

Bonds are the garden beds of your investment garden, providing structure and stability. They come in various types, including government bonds, municipal bonds, corporate bonds, as well as ETFs and bond funds. Bonds are essentially loans you give to the issuer in exchange for regular interest payments, making them a cornerstone of income investing.

Government and municipal bonds are generally considered safer but offer lower returns. Corporate bonds can yield more but carry a higher risk. Diversifying across different types of bonds can help balance risk and reward.

Money Market Accounts

Money market accounts are like the watering system for your garden, providing liquidity and stability. They offer higher interest rates than traditional savings accounts, making them a safe place to park your cash. The interest rates, liquidity, and low risk associated with money market accounts make them an essential part of an income-focused portfolio.

Real Estate

Investing in real estate is akin to having a greenhouse. It requires more upfront work and maintenance but can yield substantial rewards. REITs (Real Estate Investment Trusts) and Real Estate Limited Partnerships (RELPs) allow investors to earn rental income without having to buy property directly. These investments can provide both regular income and the potential for capital appreciation.

REITs, in particular, are required to distribute at least 90% of their taxable income to shareholders, often resulting in higher dividend yields. Investing in real estate through these vehicles offers a way to diversify your income streams further.

Just as a well-tended garden offers a variety of produce throughout the season, a well-constructed portfolio can provide a steady income stream over time. By incorporating dividend stocks, bonds, money market accounts, and real estate into your investment strategy, you can build a diversified portfolio tailored to your financial goals and risk tolerance. The key to successful income investing is not just in choosing the right assets, but in how you combine them to work together harmoniously.

Pros and Cons of Income Investing

When it comes to investing for income, it’s like picking a path through a forest. Some trails might be smooth and easy, offering a peaceful walk with little to no obstacles. Others might be rocky, requiring careful steps and a keen eye to avoid stumbling. Let’s explore the ups and downs of this journey.

Supplemental Income

The beauty of income investing is that it can act like a river, steadily flowing cash into your pocket. Imagine having a small stream in your backyard that you could dip into whenever you needed a bit of extra money. That’s what income investing can offer. It’s a way to build a financial reservoir to draw from, whether for daily expenses, saving up for a vacation, or padding your retirement fund.

Capital Stock Growth

Not only does income investing offer the chance of regular cash flow, but there’s also the potential for your investments to grow in value over time. Think of it as planting a tree. Initially, you enjoy the shade, but as it grows, it adds more value to your property. Similarly, stocks or real estate investments might increase in value, providing you with a nice profit if you decide to sell down the line.

Income Fluctuation

However, not every day is sunny in income investing. Just like weather patterns, income from investments can fluctuate. Dividend payments from stocks can vary based on company profits, and interest rates on bonds can change, affecting what you earn. It’s like relying on a stream that might run bountifully in the rainy season but dries up a bit in the drought. This unpredictability is something to be prepared for.

Investment Risks

Here’s where the path gets a bit rocky. Every investment carries some level of risk. The stock market can be as unpredictable as a sudden storm, and real estate markets have their ups and downs too. Investing in a single company or property can be like putting all your eggs in one basket and hoping it doesn’t fall. That’s why it’s crucial to wear a sturdy pair of boots — in the investment world, this means diversifying your portfolio to spread out the risk.

In Summary

Income investing offers a world of opportunities to generate a steady stream of cash, which can act as a supplementary source of income or even lead to capital growth. However, it’s not without its challenges, such as income fluctuation and the inherent risks associated with any investment. By carefully navigating these paths, with an eye on both the sunny days and potential storms, you can work towards building a portfolio that not only sustains but also grows over time.

Next, we’ll delve into strategies for successful income investing, focusing on how to create a balanced portfolio that aligns with your financial goals and risk tolerance. Stay tuned as we continue to explore the forest of investment opportunities together.

Strategies for Successful Income Investing

Investing for income is like planning a journey where the destination is financial stability and peace of mind. To navigate this path successfully, understanding and applying certain strategies are crucial. Let’s break these down into manageable steps.

Creating a Balanced Portfolio

A balanced portfolio is your financial safety net. It’s about not putting all your eggs in one basket, but rather spreading them across several baskets to minimize risk. Here’s how you can do it:

Diversify Across Asset Classes: Mix different types of investments like stocks, bonds, and real estate. Each behaves differently over time, balancing out the ups and downs in your portfolio.

Equity and Bonds: Include a mix of equity (for growth potential) and bonds (for income). Investment-grade bonds offer lower risk, while high-yield bonds can offer higher income but come with increased risk.

Consider Your Risk Tolerance: Not everyone can handle the same level of risk. Your mix should reflect how much volatility you can stomach. Can you sleep at night if your investments dip 10% in a week?

Investment Horizon Matters: Your time frame affects your strategy. If you’re investing for income in retirement, you might lean more towards bonds. If you’re younger, you might take on more equities for growth.

Regular Reviews and Adjustments: The market changes, and so will your life circumstances. Regularly reviewing and adjusting your portfolio ensures it stays aligned with your goals.

Utilizing Financial Tools and Platforms

Several tools and platforms can help you manage your income investing strategy more effectively. Here are a few worth considering:

TradeStation: A platform for those who want to take a hands-on approach to manage their investments. It offers robust analysis tools to help you make informed decisions.

WiserAdvisor: If you prefer a guided approach, WiserAdvisor matches you with financial advisors tailored to your needs, helping you craft a personalized income investing strategy.

Realty Mogul: Interested in real estate? Realty Mogul offers a way to invest in high-quality real estate projects without needing to buy a whole property yourself.

M1 Finance: For those who like customization and automation, M1 Finance allows you to build a portfolio of stocks and ETFs and automatically maintains the balance for you.

J.P. Morgan Self-Directed Investing: A great option for those who want to manage their investments directly, with the backing of a trusted financial institution.

By combining a thoughtful, balanced portfolio approach with the right tools and platforms, you’re setting a strong foundation for your income investing journey. The goal is not just to reach your destination but to enjoy the journey without losing sleep over market swings.

We’ll answer some frequently asked questions about investing for income, helping to clear any clouds of doubt and make your investment journey as smooth as possible.

Frequently Asked Questions about Investing for Income

When it comes to investing for income, many questions arise. Let’s dive into some of the most common queries to help you navigate your investment journey more confidently.

What is the best type of investment for steady income?

The best type of investment for a steady income often includes dividend stocks, bonds, money market accounts, and real estate investments. Each of these options has its own set of benefits:

Dividend Stocks: Companies like IBM and Verizon Communications offer dividends, which are regular payments made to shareholders out of the company’s profits. These can provide a consistent income stream.

Bonds: Whether it’s government, municipal, or corporate bonds, they pay interest over a fixed period, offering a predictable income.

Money Market Accounts: These accounts offer interest on your deposits and are known for their high liquidity and low risk.

Real Estate: Investing in REITs or rental properties can generate regular rental income, making it a solid choice for steady income.

How can I minimize risks in income investing?

Minimizing risk is crucial in any investment strategy. Here are a few ways to do so:

Diversification: Don’t put all your eggs in one basket. Spread your investments across different types of assets.

Research: Understand what you’re investing in. Look into the company’s or bond’s financial health and the real estate market trends.

Consult a Financial Advisor: Working with professionals like those at BlueSky Wealth Advisors can provide tailored advice based on your financial situation and goals.

Risk Tolerance: Be honest about your risk tolerance. It will help you choose investments that won’t keep you up at night.

What role does diversification play in income investing?

Diversification is key in reducing risk and achieving a more stable income. By investing in a mix of asset types, you can protect yourself against significant losses if one investment underperforms. For example, while dividend stocks offer growth potential, bonds can provide a cushion during market volatility. Real estate and money market accounts add another layer of diversification, each with unique benefits and risks.

The idea is to create a portfolio that can withstand market fluctuations, ensuring a steady income stream without putting your capital at undue risk.

By addressing these frequently asked questions, we hope to have shed light on how to approach investing for income effectively. With a clear understanding and the right strategies, you can work towards building a portfolio that not only meets your income needs but also aligns with your long-term financial goals.

Conclusion

Investing for income is a journey, not a sprint. It’s about finding the right balance between risk and reward, and ensuring your investments align with your long-term financial goals. At BlueSky Wealth Advisors, we understand that each investor’s journey is unique. That’s why we’re committed to providing personalized advice and strategies tailored to your specific situation.

We believe that a well-structured income-generating portfolio can offer you the financial stability and peace of mind you seek. Whether you’re drawn to dividend stocks, bonds, real estate, or a mix of various assets, our team is here to guide you through the complexities of income investing. Our approach is rooted in understanding your needs, assessing your risk tolerance, and crafting a diversified portfolio designed to provide a steady income stream.

The key to successful income investing lies in diversification, informed decision-making, and continuous portfolio evaluation. By partnering with us, you gain access to our expertise and resources, helping you navigate the ever-changing financial landscape with confidence.

As we conclude this guide, we invite you to explore further how BlueSky Wealth Advisors can assist you in achieving your income investing goals. Whether you’re just starting out or looking to refine your existing portfolio, we’re here to help every step of the way.

Discover how we can help you build a robust income-generating portfolio.

Investing for income is more than just a strategy; it’s a path to financial freedom and security. Let us be your guide on this journey, helping you unlock the potential of your investments and achieve the financial future you envision.