Digital Gold: Discovering Assets That Generate Income Online

Digital Gold: Discovering Assets That Generate Income Online

In today’s digital world, the concept of income-producing digital assets, often referred to as Digital Gold, is an exciting avenue for securing financial independence and nurturing a lasting legacy. These assets, ranging from cryptocurrencies like Bitcoin to innovative platforms hosting e-books or online courses, offer a gateway to passive income—a highly sought goal for many.

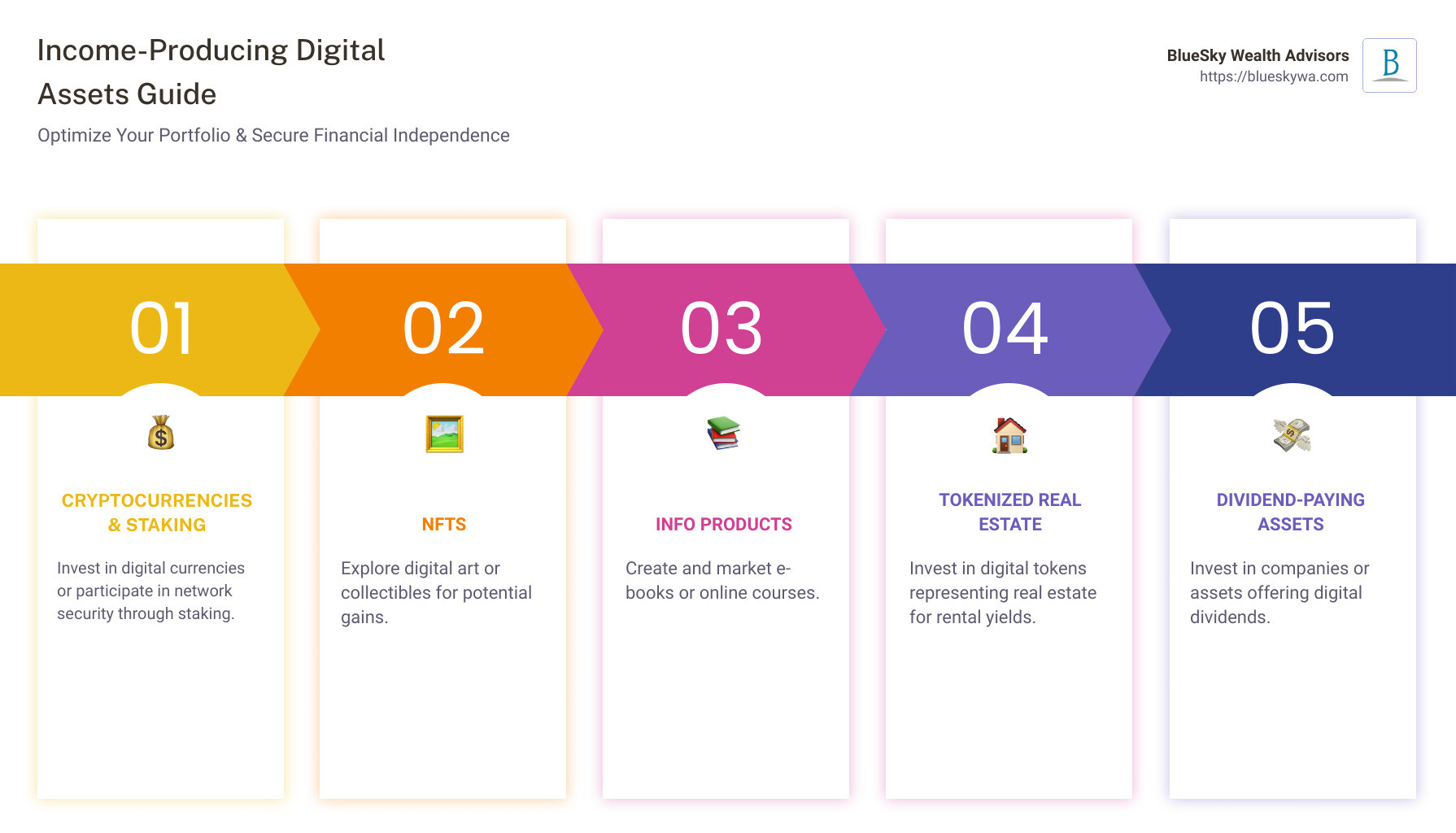

For those of you exploring digital options for generating income, here’s a quick guide to set you on the right path:

– Cryptocurrencies & Staking: Invest in digital currencies or participate in staking on Proof-of-Stake networks.

– NFTs: Venture into digital art or collectibles for potential capital gains.

– Info Products: Create and sell e-books, online courses, or other educational materials.

– Tokenized Real Estate & Dividend-Paying Assets: Invest in digital tokens representing real estate or companies offering digital dividends.

With these assets, you can diversify your portfolio beyond traditional stocks and bonds, often benefitting from global trends and technological advancements.

As we delve deeper into understanding these digital options, we’ll explore how they not only serve as income streams but also offer novel ways to optimize your tax situation and establish a meaningful financial legacy.

Understanding Digital Assets

In the realm of income-producing digital assets, there’s a whole world beyond the traditional stock market that can help you grow your wealth. Let’s break down some of these digital options: cryptocurrencies, NFTs, eBooks, and online courses.

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are the digital gold of the internet era. They’re not just digital money; they’re platforms for building applications, contracts, and other digital assets. Bitcoin, for instance, has been a rollercoaster ride for investors, showing significant gains in 2023. Ethereum, on the other hand, powers a vast ecosystem of decentralized applications.

Cryptocurrencies offer a way to earn through methods like staking in Proof-of-Stake networks, where you can earn additional tokens for holding and supporting the network. This is akin to earning interest in a savings account but in the digital world.

NFTs

NFTs, or Non-Fungible Tokens, represent ownership of unique digital items like digital art or collectibles. They’ve exploded in popularity, turning digital art into a significant income source for artists and collectors alike. NFTs can include anything from a tweet to a piece of digital art, and their uniqueness comes from blockchain technology, ensuring the item’s ownership and originality are always verifiable.

Creators can earn through NFT royalties, meaning every time the NFT changes hands on the secondary market, the original creator gets a percentage of the sales price. This has opened up new revenue streams for digital artists and content creators.

eBooks and Online Courses

The rise of self-publishing platforms and e-learning platforms has made it easier than ever to create and sell digital products like eBooks and online courses. These platforms allow creators to reach a global audience, share their knowledge, and generate income.

Creating an eBook or online course can be a lucrative way to earn passive income. Once the initial effort of creating the product is completed, it can be sold repeatedly without much additional work. Platforms like Amazon for eBooks and Udemy or Coursera for online courses have made it simple for creators to get their products to market and start earning.

The beauty of these digital assets is their potential for passive income. Whether it’s earning through staking cryptocurrencies, selling NFT art, or creating educational content, these assets can generate revenue around the clock without the creator having to actively manage them.

The next section will dive into the top income-producing digital assets in more detail, exploring how you can leverage these digital options to build and grow your wealth.

The digital world is vast and ever-changing, offering numerous opportunities to those willing to explore and innovate.

Top Income-Producing Digital Assets

In the journey towards financial independence, understanding and leveraging income-producing digital assets can be a game-changer. Let’s explore some of the most promising avenues.

Staking in PoS Networks

Proof-of-Stake (PoS) networks offer a unique way to earn passive income. By staking your digital assets, you essentially lock up your cryptocurrencies to support network security and operations. In return, you receive new tokens as rewards, akin to earning interest in a savings account. It’s a win-win; you help maintain the network’s integrity while growing your digital wallet.

DeFi Yield Farming

Decentralized Finance (DeFi) has revolutionized how we think about financial services. Yield farming, a core component of DeFi, allows you to provide liquidity to a platform and earn rewards in the form of governance tokens or interest. Think of it as planting seeds (your digital assets) in a field (the DeFi platform) and harvesting crops (rewards). It requires a bit more active management but can be significantly rewarding.

Cryptocurrency Lending

Similar to traditional lending but in the digital realm, cryptocurrency lending involves lending your digital assets to others through a platform. In return, you earn interest on these loans. Platforms facilitate these transactions and ensure security for both lenders and borrowers. It’s a straightforward way to earn passive income with your digital assets without selling them.

Tokenized Real Estate Investments

Real estate has always been a staple in investment portfolios, but it’s traditionally been a high barrier-to-entry market. Tokenized real estate breaks down these barriers, allowing you to buy tokens representing shares of real-world properties. You earn rental yields and benefit from property value appreciation, all without the headaches of being a landlord.

Dividend-Paying Cryptocurrencies

Some cryptocurrencies offer dividends or additional tokens just for holding them. These dividend-paying cryptocurrencies operate much like stocks that pay dividends. By holding these tokens, you receive a share of the project’s profits, providing a steady income stream. It’s an attractive option for those looking to benefit from the success of a particular project or platform.

Each of these income-producing digital assets offers a unique set of opportunities and risks. Staking and yield farming can provide significant returns but require active management and understanding of the platforms. Cryptocurrency lending and tokenized real estate offer more passive income streams, with real estate bringing the additional benefit of a tangible asset. Dividend-paying cryptocurrencies, while potentially lucrative, depend heavily on the success of the underlying project.

As we continue to navigate the digital economy, these assets represent innovative ways to generate income and build wealth. However, it’s crucial to conduct thorough research, consider diversification to manage risk, and possibly consult with a financial advisor to tailor these opportunities to your financial goals and risk tolerance.

Next, we’ll delve into how to create and monetize your own digital assets, further expanding your potential for generating passive income in the digital age.

Creating and Monetizing Your Digital Assets

In the digital world, creating and monetizing assets can be a smart way to generate income. Let’s dive into some of the most promising methods.

Automated Trading Bots

Automated trading bots use algorithms to buy and sell cryptocurrencies based on market trends. This can be a hands-off way to potentially profit from the volatile crypto market. By setting parameters that match your risk tolerance and strategy, these bots can work around the clock, capitalizing on opportunities even when you’re asleep. However, it’s important to research and understand the risks involved, as market conditions can change rapidly.

Initial Staking Offerings (ISOs)

Initial Staking Offerings (ISOs) are a newer concept where you can stake your digital assets in early-stage blockchain projects for potential rewards. It’s like getting in on the ground floor, offering both early access and the chance to support projects you believe in. While the rewards can be significant, so can the risks, as not all projects succeed.

Crypto Affiliate Marketing

With crypto affiliate marketing, you can earn commissions by promoting crypto products or platforms. Whether it’s through a blog, social media, or email newsletters, sharing referral links can lead to passive income whenever someone signs up or makes a purchase through your link. The key is to build a trusted presence and audience interested in cryptocurrency.

NFT Royalties

For artists and creators, NFT royalties offer a way to earn income. When you create and sell an NFT (Non-Fungible Token), you can embed royalties so that you receive a percentage of sales whenever your NFT is sold on the secondary market. This means ongoing income from your digital creations, providing a new model for artists to sustain their work.

Masternode Operations

Operating a masternode is another way to earn passive income. Masternodes support the network by performing specific tasks and, in return, receive token rewards. Setting up a masternode requires a significant upfront investment and technical knowledge, but for those who are able, it can be a steady source of income.

In Summary:

- Automated Trading Bots can trade for you based on algorithms.

- ISOs offer a chance to stake in new projects for potential rewards.

- Crypto Affiliate Marketing lets you earn commissions by promoting crypto services.

- NFT Royalties provide ongoing income from secondary sales of your digital art.

- Masternode Operations reward you for supporting a network’s infrastructure.

Creating and monetizing digital assets offers various paths to generating income. Whether you’re a creator, investor, or tech enthusiast, the digital world has opportunities for you. As always, do your homework, understand the risks, and consider how these options fit into your overall financial strategy.

Up next, we’ll explore how to market and sell your digital products effectively, turning your digital gold into tangible rewards.

Marketing and Selling Digital Products

In the journey of turning your digital assets into income, creating them is only the first step. The next crucial phase is marketing and selling these products. This can be done through various channels, but primarily through marketplaces and self-hosted platforms. Additionally, employing effective promotion strategies is key to reaching potential customers.

Selling through Marketplaces

Marketplaces like Amazon, Smashwords, Udemy, and Coursera offer a vast audience ready to discover and purchase digital products. These platforms handle much of the heavy lifting, including payment processing and customer service. However, they also take a percentage of your sales as a fee. While this might seem like a drawback, the exposure and ease of use can make it worth the cost, especially for those new to selling digital products.

- Amazon is a powerhouse for eBooks, with Kindle Direct Publishing (KDP) making it simple for authors to publish and sell their books.

- Smashwords caters to eBook authors who wish to distribute their work across multiple platforms.

- Udemy and Coursera are prime spots for selling online courses, offering a built-in audience specifically looking for educational content.

Self-hosted Platforms

For those seeking more control over their brand and profits, self-hosted platforms such as Shopify, Thinkific, and Disco provide an excellent alternative. These platforms allow you to create a personalized storefront, control pricing, and keep a larger portion of your sales. While they require more effort in terms of setup and marketing, the potential for higher profits and brand building is significant.

- Shopify is ideal for sellers of digital downloads, offering a Digital Downloads app to facilitate sales.

- Thinkific allows creators to build and sell online courses under their brand.

- Disco supports community-driven courses and memberships, offering flexible pricing options.

Promoting Your Digital Products

Regardless of where you choose to sell, promotion is key. Here are three effective strategies:

Social Media Marketing: Platforms like Facebook, Instagram, and Twitter are powerful tools for building an audience and promoting digital products. Engaging content and targeted ads can drive traffic to your marketplace listings or self-hosted store.

SEO: Optimizing your product pages for search engines can significantly increase visibility. Use relevant keywords in your product titles and descriptions to improve your rankings in search results.

Email Marketing: Building an email list allows you to communicate directly with potential customers. Use it to announce new products, offer discounts, and keep your audience engaged with valuable content.

Influencer Partnerships: Collaborating with influencers can help you reach a broader audience. Look for influencers whose followers match your target market and explore partnerships that can promote your digital products effectively.

By leveraging these strategies, you can increase your digital products’ visibility and attract more customers. Each product and audience is unique, so experiment and find what works best for you. Keep refining your approach, and you’ll find success in the digital marketplace.

We’ll dive into some frequently asked questions about income-producing digital assets, providing you with the knowledge you need to make informed decisions in this exciting space.

Frequently Asked Questions about Income-Producing Digital Assets

As we delve into digital wealth, questions abound. Let’s tackle some of the most common queries related to income-producing digital assets, simplifying the complex in the process.

What are digital assets?

In the simplest terms, digital assets are any form of content or media in digital format that you own or have the right to use. This broad category includes everything from photos, videos, and music to more complex items like eBooks, online courses, cryptocurrencies, and NFTs (non-fungible tokens). Essentially, if it exists in digital form and holds value, it’s a digital asset.

How can I make money from digital assets?

Making money from digital assets can be approached in several ways, depending on the type of asset you’re dealing with. Here are a few methods:

- Selling or licensing your digital creations, such as eBooks, music, or digital art.

- Investing in cryptocurrencies like Bitcoin or Ethereum and benefiting from their value appreciation.

- Earning dividends from dividend-paying cryptocurrencies or tokens.

- Staking in Proof-of-Stake (PoS) networks to earn additional tokens as rewards for participating in the network’s security.

- Yield farming in DeFi (Decentralized Finance) platforms by providing liquidity to earn interest or governance tokens.

- Lending your cryptocurrencies on platforms to earn interest from borrowers.

- Collecting royalties from NFTs you’ve created whenever they’re sold in the secondary market.

What are some proven strategies for making money from digital assets?

Success in the digital asset space often requires a mix of knowledge, timing, and strategy. Here are some proven strategies:

- Diversification: Just like with traditional investments, spreading your assets across various digital assets can help manage risk.

- Research and Education: Stay informed about the latest trends and technologies in the digital asset space to make knowledgeable decisions.

- Utilize Platforms and Marketplaces: Platforms like Gumroad for digital products or OpenSea for NFTs can significantly expand your reach.

- Engage in Communities: Whether it’s cryptocurrency forums or NFT artist collectives, being part of a community can provide invaluable insights and opportunities.

- Marketing: Use social media, SEO, and email marketing to promote your digital assets effectively.

- Monitor and Manage: Keep an eye on the performance of your digital assets and adjust your strategies as needed.

By understanding the basics of what digital assets are, how you can make money from them, and applying proven strategies to your efforts, you’re well on your way to tapping into this modern goldmine. The digital asset landscape is changing, so continuous learning and adaptation are key to success.

to experiment and find what works best for you. Keep refining your approach, and you’ll find success in the digital marketplace.

Conclusion

In our journey through the realm of income-producing digital assets, we’ve explored a variety of avenues that can lead to financial independence and growth. From staking in PoS networks to the innovative world of NFT royalties, the digital landscape offers numerous opportunities for those willing to dive in and explore. However, venturing into this digital goldmine requires more than just knowledge of the assets themselves; it necessitates a strategic approach to managing and growing your digital wealth.

This is where BlueSky Wealth Advisors steps in. Our team is dedicated to providing personalized financial solutions tailored to meet the unique needs of each client. We understand that digital assets can be complex and overwhelming, which is why we’re here to guide you through every step of your financial journey.

With a focus on tax reduction strategies, we aim to maximize your returns and minimize your liabilities. By leveraging our expertise in both traditional and digital assets, we can help you craft a comprehensive financial plan that incorporates income-producing digital assets into your broader investment strategy.

At BlueSky Wealth Advisors, we’re not just advisors; we’re partners in your quest for financial independence. Whether you’re new to digital assets or looking to optimize your existing portfolio, we’re here to provide the insights and support you need to achieve your financial goals.

Discover how we can help you navigate the digital finance landscape and unlock the full potential of your investments. Explore our personalized financial solutions and learn more about our tax reduction strategies at BlueSky Wealth Advisors. Let’s embark on this journey together, turning digital possibilities into tangible outcomes.